Budgeting | Life | Personal Finance | Article

Should I Spend More Money To Buy A Warranty For My Item?

by The Simple Sum | 18 Apr 2024 | 3 mins read

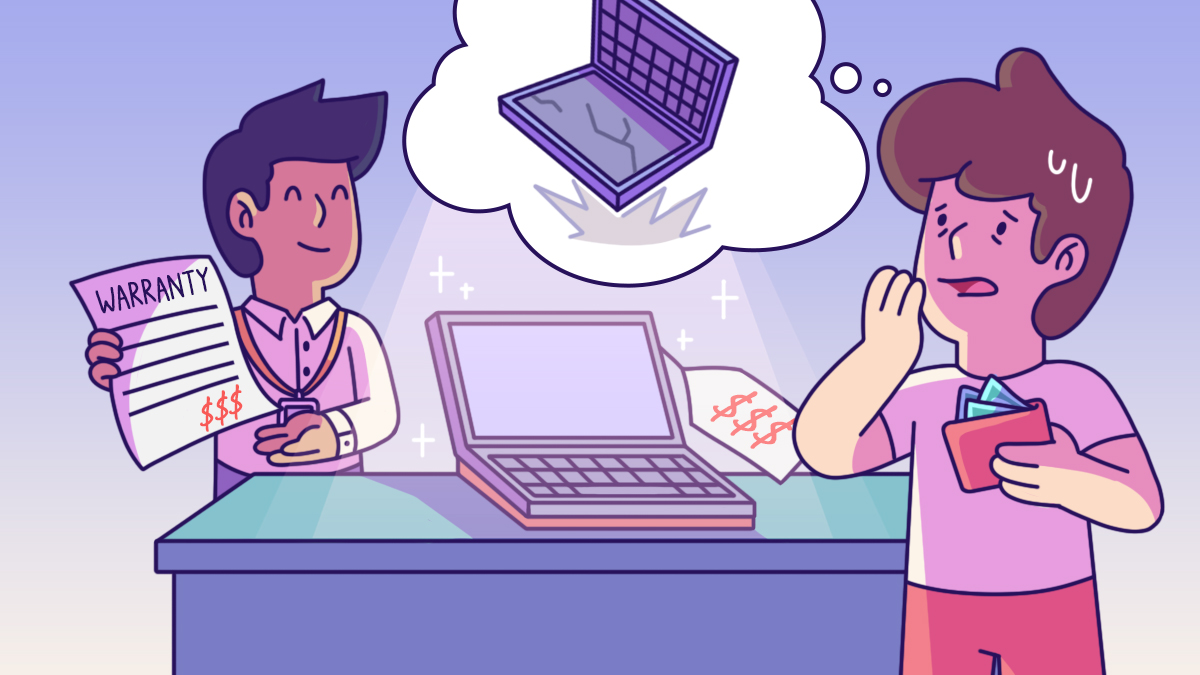

In pursuit of extended protection and peace of mind, many consumers are often presented with the option to pay for an extended warranty. This additional coverage, often marketed as an extra layer of security, raises the question of whether this investment is truly worthwhile.

While extending a warranty can seem appealing, it’s essential to weigh the costs against the potential benefits. In some cases, the additional expense might not align with the actual risks associated with the product.

So, the question remains: Should I spend more money on a warranty?

Weigh the warranty costs against potential savings

Before getting an extended warranty, weigh the cost of the warranty against the potential savings it could bring you in the long run. For instance, if the cost of repairs for a product is very high and exceeds the warranty price, an extended warranty may prove beneficial.

Evaluate the brand’s reputation

One key factor to consider is the reliability of the product. If a product is renowned for its durability, has positive reviews, and comes from a reputable manufacturer, the need for added warranty may be diminished. However, if an item or brand has a history of frequent breakdowns, an extended warranty can act as a safety net.

Related

Scrutinise the terms and conditions

The devil is in the details, and this holds true for warranty agreements. Before deciding to spend more on a warranty, scrutinise the terms and conditions. Understand what is covered and what is not. Pay attention to any limitations, exclusions, or clauses that might void the warranty under certain circumstances. Knowing the ins and outs of the warranty agreement is crucial to making an informed decision.

Consider your risk tolerance

Individuals vary in their risk tolerance, and this plays a significant role in the decision-making process. If you are risk-averse and prefer the security of knowing you’re covered in case of any issues, investing in a warranty might align with your peace of mind. On the other hand, if you’re comfortable taking on potential risk, you may opt to forgo the extended warranty and allocate your funds elsewhere.

Compare prices

Before committing to an extended warranty, explore alternative options. Some credit cards offer extended warranty protection as a cardholder benefit. Additionally, compare the costs of third-party warranty providers with those offered by the manufacturer. Third-party warranties may provide similar coverage at a potentially lower cost, but it’s essential to assess their reputation and customer reviews.

In conclusion, the decision to spend more money on a warranty requires careful consideration. By taking a thoughtful approach, you can make a decision that aligns with your preferences, needs, and budget constraints.