Budgeting | Financial Planning | Personal Finance | Article

What You Should Know Before Buying A Car in Malaysia

by Ooi May Sim | 23 Jun 2022 | 9 mins read

Buying a car is a necessity for many Malaysians, to get us to and from our office, and to ferry us around while we carry out errands.

A car loan is also often the first loan we take, as not all of us can afford to pay the full price of a car upfront.

But before you book your new set of wheels, there are a few things you should know before committing to it:

New vs Used

The first question you should ask yourself is whether you want to buy a new or second-hand car. Each has its own pros and cons.

New cars come with a full manufacturer warranty so if there are any problems with the car, you can always send it back to the dealer, and they will fix it for you for free (until the warranty period is up). Many dealers also throw in complimentary servicing for a certain timeframe

However, a new car’s value drops the minute it leaves the showroom, so if you plan to sell it later on, you would be getting much less than what you paid for it. It is estimated that a car’s value drops by about 9% to 11% after it is driven out of the sales gallery. That means, if you bought your car for RM50,000, it would be worth RM5,500 less within five minutes. And its value depreciates with time.

This is why financial advisors claim that buying a new car is not a financially sound decision. You can overcome this by buying a second-hand car. A used car is also much cheaper than a new one, plus, there is no wait time. But buying second-hand comes with its own set of problems.

The condition of a used car depends on how well its previous owner took care of it, how old it is, and its mileage. There may be many unseen issues such as gearbox problems or an air-conditioning leak that may come from wear and tear. And as there isn’t a warranty to fall back on, paying for these repairs lies on your shoulders, and can easily skyrocket.

One way to reduce the chance of buying a ‘problematic’ car is to buy from a reputable car dealer and to check the car thoroughly before buying it. You can even bring a mechanic to view the car with you as they would be able to assess the condition of the car better.

Related

Local vs Foreign car

If you are looking at buying a new car, there are three options available: a locally manufactured, Completely Knocked Down (CKD) or Completely Built Up (CBU) vehicle.

Locally manufactured vehicles are assembled in the country using parts and components that are mostly made in Malaysia. Proton and Perodua vehicles fall into this category.

CKD vehicles are made up of mostly imported parts that are assembled locally instead of in its country of origin. The assembled vehicles also include a certain percentage of locally made components. CBU vehicles, on the other hand, are assembled in a foreign country and then imported into Malaysia as fully operating vehicles.

The biggest difference between the three options is in their prices. As locally manufactured vehicles are made in the country, they are often the cheapest option as you avoid having to pay for high import duties.

CKD vehicles come in second as imported parts are imposed with import duties and excise tax. The taxes on CBU vehicles are the highest among the three: import duties can be 30%, and excise duties can range from 75% to 105%. In fact, Kuala Lumpur is ranked as the fifth most expensive city in the world to buy a foreign-made car because of these taxes.

Types of loans

Ideally, buying a car with cash is the most financially sound route as we wouldn’t have to take on any debt. But, since the majority of us don’t have huge amounts of cash sitting in our bank accounts, most people take out a bank loan to help pay for their car.

Banks typically offer hire purchase car loans, which means that although you are using and maintaining the car, the bank is the legal owner of the car, until the loan has been fully paid off. This also means that if you fail to pay your monthly instalments on time, the bank can repossess your car. Only after all the instalments have been paid will the bank transfer legal ownership of the car to you.

Under hire purchase, there are two loans you can opt for:

1. Fixed rate loan

The interest rate and monthly instalments stay the same throughout the loan period and is calculated based on the amount borrowed and the length of the loan period.

The good thing about fixed rate loans is that payments are pre-calculated, so you won’t get caught off guard. The downside to this is that as payments have been set, paying higher monthly instalments (than the fixed amount) would not reduce the total interest you have to pay, and thus, does not reduce your loan amount. Any extra money you put in each month would just be brought forward to the following month. The only way to get more savings is if you settle the loan early as some banks will give you a rebate.

2. Variable loan

Interest rates depend on the Base Lending Rate (BLR) set by banks. As the BLR fluctuates throughout the year, you may get better interest rates, but this is based on global economy, and a bit of luck.

And unlike a fixed rate loan, as interest is calculated based on the reducing balance method, you might be able to reduce your interest on your principal amount when you pay more than the required monthly instalment.

Down payment

When you take a loan for a car, there is usually an upfront payment that you’ll need to make, which covers part of the cost. Generally, you would have to place 10% of the car’s price as the down payment for a new car and 20% if you are buying a secondhand car.

Some banks offer 100% loans for new cars, but this offer is often limited to a handful of banks, for certain car models and come with conditions attached to it.

Interest rates

Interest rates for car loans are generally set by two main factors: firstly, whether the car is national or foreign-made and secondly, if the car is new or used. Car loans for national and used cars come with higher interest rates.

Other factors that affect interest rates are the loan amount and tenure, and the borrower’s credit history.

Loan tenure

This is the amount of time given to repay your loan. In Malaysia, loan tenures range from one year to a maximum of nine years. If you are unsure about how many years to opt for, just remember – shorter loan tenures equate to paying less interest in the long run, but it also means higher monthly instalments.

How much should you take out on your car loan?

Financial experts recommend that auto payments should be between 10% and 15% of your monthly income (and should not exceed the 15% mark). If your salary is RM5,000, your monthly instalments should be between RM500 and RM750.

Keep in mind that the purchase price is only a part of your auto expenses. You should also set aside a budget for car maintenance, petrol, insurance, road tax, toll and parking.

Related

Calculate your monthly instalments

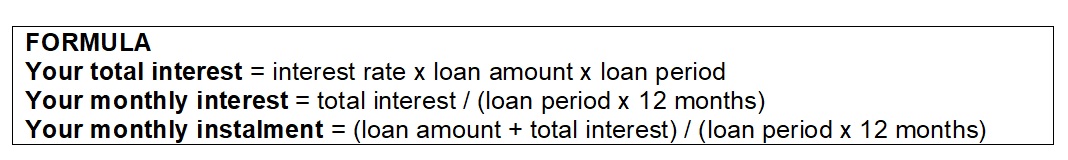

Before taking the plunge, it is vital that you do some calculations to know exactly how much you would need in order to own a set of wheels.

For example, if you buy a RM50,000 car, take a 90% loan at 3.5% interest and a 9-year loan repayment period, this is what you will have to pay monthly:

Car price: RM50,000

Loan amount: RM45,000 (90%)

Interest: 3.5%

Loan tenure: 9 years

Total Interest: 3.5% x RM45,000 x 9 = RM14,175

Monthly Interest = RM14,175/ (9×12) = RM131.25

Monthly Instalment = (RM45,000 + RM14,175) / (9×12) = RM547.90

Remember, the shorter your loan tenure, the higher the monthly instalment. For example, if you want to repay your car in 5 years instead of 9, the calculations are as such:

Total Interest: 3.5% x RM45,000 x 5 = RM7,875

Monthly Interest = RM7,875/ (5×12) = RM131.25

Monthly Instalment = (RM45,000 + RM7,875) / (5×12) = RM881.25

While the monthly instalments are higher when you take a shorter loan, do note that the total interest you pay the bank is also significantly lower – RM7,875 compared to RM14,175 (if you were to take a 9-year loan tenure).

Thus, it is always good to repay debt as fast as you can, but make sure you can afford it. The last thing you want is to miss payments as your vehicle can get repossessed by the bank.

Related

Road tax

Before you take your new car for a spin, you need to pay a road tax. This annual payment is used by the government for road works and maintenance, among other things.

The price of road tax varies according to a vehicle’s engine capacity, geographical location (East Malaysia/West Malaysia), ownership (private/company), and type (sedan/SUV/MPV/Pick-up).

Insurance

It is compulsory to get insurance coverage in Malaysia. Without it, you wouldn’t be able to renew your road tax and are not allowed to drive on the road. Two common insurance coverage that people opt for are third-party and comprehensive coverage.

If you cause an accident, third-party coverage insures that person (that you knocked) from injury or death. They can also claim your insurance for any damage to their vehicle that was caused by the accident. As this only covers third party claim, you would not be able to make a claim for damage or repairs made for your vehicle. Thus, this policy is cheaper than the comprehensive coverage.

Comprehensive coverage protects you and the third-party in the event of an accident, theft or fire. So, if you get into an accident where you are at fault, you, and the third-party would be able to claim for damages and repairs. Vehicles that are still under bank loans are required to get comprehensive insurance coverage. Meaning, if you take a nine-year loan, you can only opt for third-party coverage on the tenth year, after your loan has been paid up.

There are additional add ons that you can also consider, based on your need, such as protection for additional drivers, windshield protection, and special perils that covers natural disasters such as floods and landslides.