Financial Planning | Personal Finance | Article

Setting Midterm Goals

by The Simple Sum | 8 Mar 2021 | 4 mins read

Everyone’s caught up in the rush of setting lofty resolutions. But more often than not, our biggest resolutions are never realised. From a financial standpoint, a huge resolution or goal would be to retire. But retirement is big – so big that we might not have a concept of it, or how to get there.

Goals are tough. And between the small and huge goals, there’s something we also neglect: the middle portion of our lives, before we get from A to Z, where our mid-term goals should be.

But what are mid-term goals? These are milestones or goals that take about three to five years to achieve.

In comparison, short-term goals (emergency funds) are more immediate, while long-term goals (retirement funds) take 10 years or more to achieve.

Most of us fixate on short-term and long-term goals and forget about life in between. This creates what some people call a “financial barbell,” where a typical barbell has weights on either end of it. Each end represents a person’s short-term goals and long-term goals, without anything in the middle.

What’s missing there is a person’s mid-term goals. But realistically, life doesn’t go immediately from 0 to 100 in the blink of an eye. Lots of time will pass before you’re ready for retirement, and you will need money to fund life as you live it before it’s time to reap the rewards.

So it’s only natural that we use this time to plan out relevant milestones and steps – or mid-term goals – to get ourselves to retirement.

But how do we decide what these goals are, and how do we plan achievable milestones that bring us closer to the ideal endpoint?

Now vs Later

The best way to figure out your financial mid-term goals is to work backwards. Before retirement, what are your life goals? To get married? To buy your own home, whether or not it’s with a spouse?

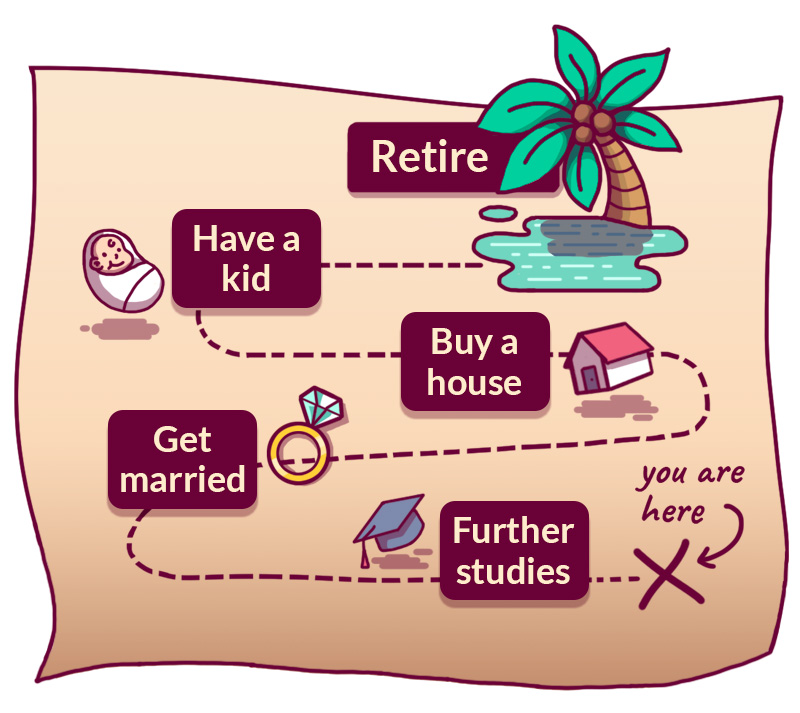

The typical Malaysian would have these life stages or events on the horizon:

- Getting married

- Owning a home

- Having a baby

- Buying a car

- Travels

- Furthering studies

These mid-term goals may be inevitable for some of us, which is why it’s wise to plan for them financially.

Been there, done that with major life events? Don’t throw in the towel just yet – you can also use mid-term goals as stepping stones to achieving your retirement goals! It’s time to work backwards again, this time with a bit more number-crunching.

Using mid-term goals to bridge the gap to retirement

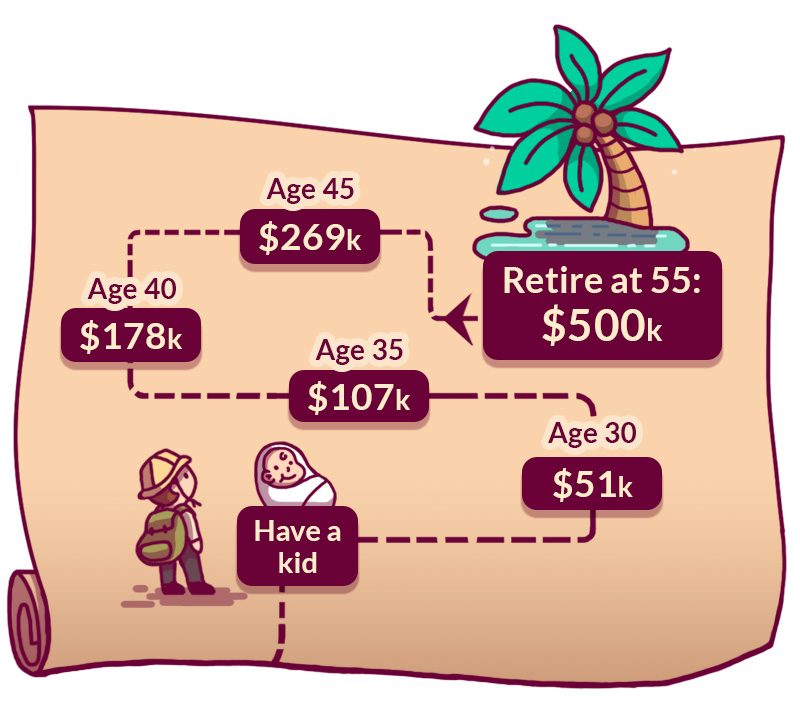

Let’s assume that someone is currently 25 and is aspiring to retire at age 55, with a healthy investment portfolio of RM500,000 that generates 5% in returns.

He or she plans to put in RM650 each month into a 5% yielding investment portfolio to achieve this.

To build up RM500,000 isn’t easy. This person could set mid-term goals by working backwards, and calculating how much they’d need in their portfolio by certain ages before retirement.

Think of it as retirement milestones to stay on track.

For example, to reach a RM500,000 portfolio by 55 (and remember, your figure for retirement may differ from another person’s) would mean needing approximately RM269,000 in investments by age 45.

This person could continue to create milestones for age 40, age 35, and so on — and work towards each mid-term goal before finally reaching their long-term goal of retiring. The plan would look something like this.

Assuming:

A constant RM650 a month contribution till retirement:

A projected rate of return of 5% p.a.

- Age 55: Retire with investments worth RM500,000

- Age 45: Build RM269,000 in investments

- Age 40: Build RM178,000 in investments

- Age 35: Build RM107,000 in investments

- Age 30: Build RM51,200 in investments

So by reverse-engineering large goals into incremental milestones or steps (also known as using the S.M.A.R.T. method), the task of striving becomes more manageable – and to ensure you stay on track for your final goal.

It’s also a useful benchmark to see if your investments are performing at the level you require for your goal.

And for the case of retirement, retiring at 55 is 30 years away from a 25-year-old. That’s a long time to be working away at a goal, so setting mid-term goals will prevent fatigue and discouragement — or worse, giving up completely.

By focusing on one mid-term goal at a time — and breaking it down — you’d be able to achieve a lot more without being overwhelmed by large numbers and seemingly impossible financial targets.

Before you know it, it’s time for a happy retirement, cashing in on all your hard work over the years!