Financial Planning | Life | Personal Finance | Relationships & Family | Article

How to Talk About Money with Your Parents

by Ooi May Sim | 24 Mar 2022 | 9 mins read

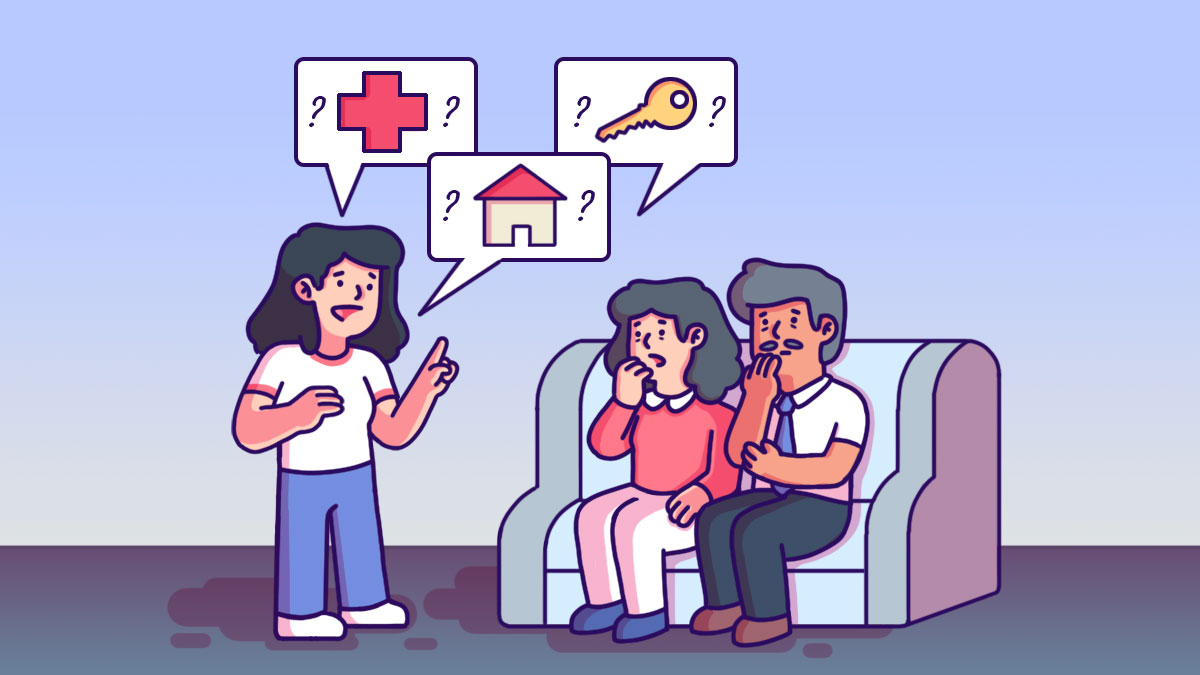

When do you plan to retire? Do you have enough savings or a health insurance plan? Do you have a will?

While these are all important questions that should be discussed as a family, it is easier said than done. Talking about money is often viewed as taboo, especially in this corner of the world.

And money is understandably a sensitive topic. Parents who are used to being in charge may not like that their children are now taking the lead on these kinds of family duties. They could also be embarrassed to reveal their financial situation.

For us as children, we don’t want to come off as enquiring about our future inheritance.

While we may be reluctant to talk about finances, waiting too long to have these conversations may not be ideal. That’s because, having these conversations when your parents are mentally alert and physically stable is way easier than doing it later in life when they may be afflicted with health or financial issues. Then, the challenge would be tenfold.

However, talking about money goes beyond finances. There is a lot at play, from family dynamics to the psychological aspect of it. So, we roped in psychologist Dr Goh Chee Leong to shed some light on how we can approach this delicate topic.

As the former president of the Malaysian Psychological Association who specialises in the application of psychology to change management, conflict mediation, people management and stress management, Dr Goh has facilitated in a fair share of financial conflicts within family units.

“The Asian way is that we feel that is it our responsibility to take care of our parents. Our parents looked after us, so now it is our turn,” explains Dr Goh.

The importance of having “the talk”

“Finances are not the most exciting thing to talk about, but it is a necessary conversation to have,” says Dr Goh, who adds that it comes under family management, which includes other things such as health and infrastructure like your parents’ home.

“(Having the talk) is important because at some point, the children are going to have to take a more active role in ensuring that their parents’ needs are being met. If this conversation (is skipped), a lot of bad things can happen,” he says.

Dr Goh shares that there have been cases where when the father passes away, nobody knows anything about his finances; not even his wife.

“Everyone is scrambling. They are trying to look for pieces of paper and for bank accounts and access codes. They are also trying to answer questions like: ‘Has dad paid off the house loan?’ ‘Does he have any debt?’ or ‘Who holds the keys to the house?’” he says.

This can be avoided if everyone was open about their finances from the beginning. Here is how talking about finances can help:

1. Allows the family to be more prepared when a crisis occurs

When a medical emergency happens, a child may not have enough money to afford his parent’s hospital bills. This is especially true for prolonged illnesses. And, in the case of death, they may not be able to carry out their parents’ final wishes because these topics were never discussed prior to the crisis.

Plus, if a parent does not have insurance or a will, a bank can freeze all their accounts and assets for years!

So, talking about basic financial planning and management such as savings, retirement plans, estate planning and end-of-life-planning like having a will and executor is one way to prepare for financial emergencies and end-of-life wishes.

“Ideally, children should know about their retired parents’ savings, how much do they have in their bank accounts, insurance coverage and what properties they own. So, in case of any emergency, the children can help,” Dr Goh says.

2. Assess whether you need to support either parent

Aside from emergencies, a big part of talking about finances is to find out whether your parents have enough savings to live comfortably after they have retired.

To make that assessment, you would need find out how much savings they have right now, how much money they need every month to live comfortably and whether they have retirement savings or a pension plan.

Calculate how far their money can take them. For example, if you find that your parents would run out of money in eight years, you can start taking steps to rectify this problem.

Getting your parents to put money towards their retirement (if they are still working), moving to a smaller unit and getting all your siblings to contribute financially are some of the ways around this.

Related

But…how do I broach the subject with my parents?

As Dr Goh point out, there is no one way of talking about it because “every family is unique and has different dynamics”.

So rather than describe a modus operandi (because there is no one method that works for everybody), Dr Goh suggests that the better approach would be for you to consider various factors when thinking about broaching the subject with your parents.

The factors to consider are:

1. The motive has to be clear

“I am assuming (and I am making a big assumption here) that you and your parents have a trust relationship.

“This is not a situation where the children are after their parents’ money. If a child has a gambling addiction and is out sourcing for funds, all of this is off the table,” says Dr Goh.

In a situation where a child is genuinely concerned about his parent’s financial situation and has their interest at heart – and his parents know that – it is always good to be upfront with their motive, he adds.

Dr Goh shares, “You can talk to your parents and say, ‘You looked after me when I was young, so now, I just want to make sure that you are well looked after’.”

2. Do it in a respectful manner

You need to understand that for parents, having conversations about their financial wellbeing is awkward and embarrassing.

Some parents may be bad at managing their finances and don’t want their children to know about it and worry about them. Others might not even want to make a will because of ‘pantang’ (it is considered bad luck to talk about death), Dr Goh points out.

“So, talking to them has to be done in a way that is respectful and helps the parents save face. You don’t want to humiliate your parent – that is not the purpose of this exercise,” he says.

Avoid being judgemental and using negative comments that may belittle your parents’ feelings. Don’t say things like, “How come you have so little savings?” or “Why didn’t you get insurance earlier?”

These comments are not helpful as we cannot turn back time. Instead, focus on what you can do right now.

“Too often, the focus in family arguments is always – ‘Last week, you…’; ‘Last year, you…’; or ‘You are always like that’.

“Once you are sucked into blame, everyone becomes defensive and starts fighting each other,” says Dr Goh, who suggests giving feedback that is constructive and forward facing.

He also points out that this principle applies to all aspects of life – “communicating respectfully without judgement or blame is a healthy way to approach any topic in any relationship”.

3. Do it at a neutral, private setting

It goes without saying that you would want your parents to be as comfortable as possible when you bring up this topic. So, noisy restaurants or family reunions are perhaps not the best setting for having financial discussions.

4. Bring in a professional

Speaking from experience, Dr Goh has found that hiring a professional with a background in financial knowledge often helps. These can be financial planners, accountants, will solicitors and even bankers.

“Many times, having a third-party present makes things less awkward. Parents may also be more open and receptive when dealing with a professional rather than dealing with their child, because they may think – ‘Why should I listen to my child? They don’t know anything about finance!’” he shares.

Bringing in a third party also removes the power struggle. “Many times, parents think – ‘I have lived my whole life. Now, I have to take instructions from my 30-year-old child on how to look after myself.’ Not everyone can put aside their ego and accept that,” explains Dr Goh.

Furthermore, as professionals are trained, they know how to build trust and what to say without offending the parents. So, they are much better equipped at broaching the subject than the children are, adds Dr Goh.

Related

It doesn’t all fall on your shoulders

While it is essential for families to talk about finances, it is important to note that a child is not responsible for their parent’s financial position.

“That is not realistic,” says Dr Goh, who adds, “We have to be reasonable with our expectations on what children are expected to do.

“At the end of the day, a parent is an adult who has to control their own finances. Most parents should be intelligent and responsible enough to know about savings and retirement plans.

“If a parent is really irresponsible with their cash and is always living beyond their means, there is really nothing much a child can do, aside from having an intervention.”

In this instance, early intervention is good. It may even help to call some uncles or aunties that can assist with this, Dr Goh suggests.

Communication is key in all relationships

Sometimes, it might take a while for parents to open up about their finances. So, don’t be discouraged. Connect with them and talk about their needs, plans and aspirations (it doesn’t have to be financial). This might even bring you closer as a family.

“At the end of the day, the kind of culture we are trying to encourage, from a psychological point of view that leads to a happy, conducive family environment is openness and transparency,” says Dr Goh.