Financial Planning | Personal Finance | Article

Should You Buy a New Car?

by Marcus Lee | 11 Dec 2020 | 5 mins read

Editor’s note: The SST exemption has been extended to June 2021 and the article has been updated to reflect that change.

Though the COVID-19 pandemic has wreaked havoc on our nation, car sales have actually increased year-on-year compared to 2019 from June this year till October. The sales and service tax exemption that was introduced in June 2020 by the government to stimulate car sales has actually worked and people are buying more cars in 2020 compared to 2019! Since everyone is getting a new car, should you buy a new car with the SST exemption?

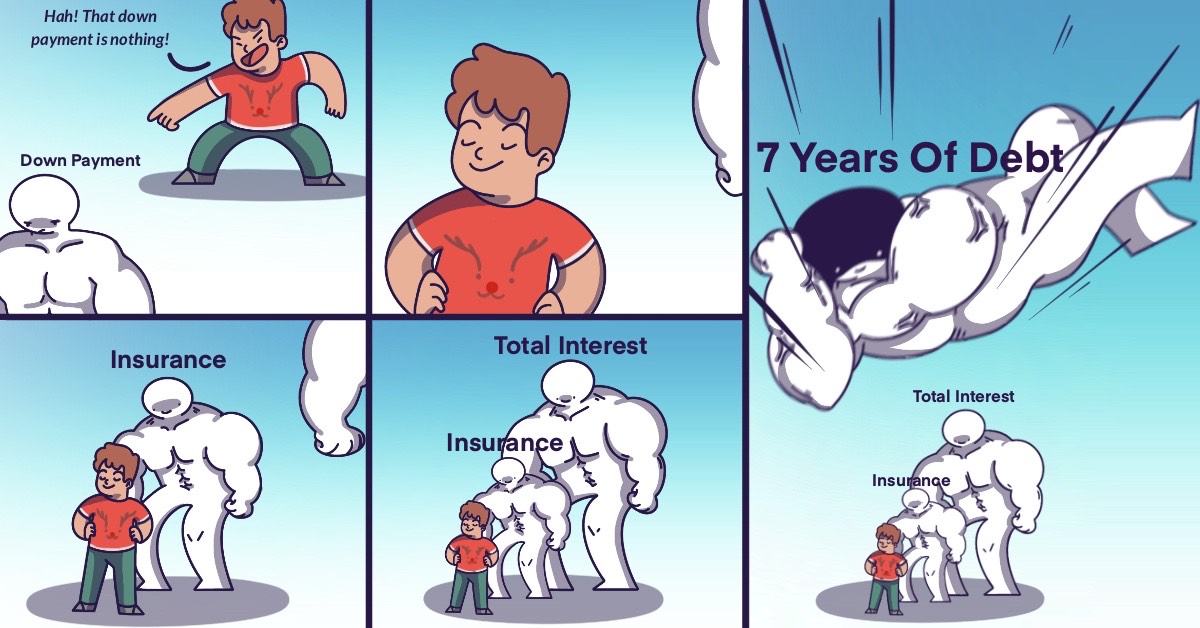

The Many, Many Hidden Costs of Buying a New Car

As an idealistic graduate with a new job and cash to blow, it may be tempting to flex that paycheck with a new car. After all, it’s on discount!

But ask any grizzled member of the workforce about the benefits of owning a car and you’ll begin to see another picture. While the monthly repayment may be just what you can afford at this time, your expenses may begin to add up over your loan period.

Insidious Interest Rates

The most insidious thing about owning a car is the interest payable. Take the oh-so-affordable Proton Saga 1.3MT at RM32,800 as an example:

| 10% Down Payment (No problem lah, save 3 months only) |

RM3,280 |

| Interest Rate 3% Over 7 Years | |

| 1st Monthly Repayment | RM425.23 |

| Total Upfront Cost (without insurance) |

RM3,858 so cheap! |

What’s the total cost of your car with the loan? Take RM425.23 x 12 mths x 7 years = RM35,719.32. On a loan of RM29,520, your interest is an additional RM6199.32. Doesn’t sound like much, does it?

Think About It This Way

If you invested that same amount of RM435.23 every month at 3% interest per annum adding the deposit of RM3,280 as an initial investment, you would have RM43,311.96 by year 7!

Shorten your investment to 5 years and you’d have RM30,874.59 – almost enough to buy that car with cash and no monthly commitments. Nobody thinks about investing first and spending later, but that’s the point we’re trying to make. We need to think differently about how we spend money.

Buying anything on credit takes the pressure off of you in the moment but it does not completely go away. It spreads out that financial pressure over your loan period and sends you gentle reminders of it each month.

Insurance, Road Tax, Petrol, Maintenance

| 1st Year Insurance (No discount) | RM1,100.60 |

| Road Tax | RM70 |

| 1st Year Petrol (RM1.67/l x 25 l x 4 weeks x 12 mths) | RM2,004 |

| 1st Year Maintenance Costs (estimate by Proton) | RM379.04 |

| Total Miscellaneous Cost Year 1 | RM3,553.64 |

| Total cost of owning a car in Year 1 (Downpayment + monthly repayment + misc. costs) |

RM11,936.40 |

Debts or Dividends?

Assuming you earn RM4,000 as a fresh graduate, after deducting EPF and SOCSO, your take home salary is about RM3,540 per month. The car alone accounts for 28% of your income annually.

The total cost of owning your car in year one is RM11,936.40 and that’s a significant amount that could have been saved or invested. If you’re serious about growing your wealth then you cannot avoid investing.

You may not have even thought about investing when you read this article, but you should be thinking about where your money is going and where else it could have gone.

So I Cannot Buy a New Car?

This article might sound like we’re discouraging everyone from buying a car, but far from it. We’re merely teaching you a new way to think about buying a car.

If the car is your main asset for a business that generates more than enough money to pay for the car, then it’s an investment instead of debt. But if your car is only a vehicle to take your money from your hands to pay for a loan, then maybe you need to find better ways to pay for the car.

Though some cars retain their resale value better than others, there is no way you’re getting a return on the money that you’ve spent without a significant downgrade. If owning a certain car make and model is one of your goals in life, that’s fine. But think about how you can make your money work for you to own the car instead of merely affording the car on credit.

Investing 5 years to save for a car to buy it with cash that you’ve earned will feel a lot better than merely making payments every month and narrowly scraping by. If you absolutely need a car solely for transportation then you don’t really need it new one do you? Save some money, get a second hand car with cash (or pay a significant down payment to lower the interest payable) and save the rest for that dream car you can really afford.

Thomas Jefferson once said, “Never spend your money before you have earned it.” He was referring to debt. If you what an example closer to home: In the words of Tun M,

“… I am a person who has who has no debts. I don’t borrow money. If I borrow, I feel burdened that I have to repay it. I don’t want that burden.”

Are you going to buy a new car during the tax holiday? Let us know on Instagram!