Financial Planning | Investing | Personal Finance | Article

Will You… Take A Joint Loan with Me?

by The Simple Sum Team | 25 May 2023 | 4 mins read

You’ve just tied the knot and now you’re thinking about the next step in your relationship journey – buying a home.

Buying a home is a massive financial undertaking that could wipe out your savings if only one of you were footing the expense. So, you may consider getting a joint home loan with your spouse to finance your home purchase.

But although a joint home loan offers shared ownership and the opportunity to fulfil your dreams of homeownership together, there are risks involved that can potentially lead to financial strain. So, to help you make an informed financial decision that suits both your home aspirations and financial well-being, consider these advantages and risks before you start filling out those loan applications.

Related

How can a joint loan benefit you?

Bigger loan amount

One of the biggest advantages of applying for a joint loan is that you will be able to obtain a higher loan amount than if you were taking an individual loan.

Banks use Debt Servicing Ratio to determine whether you can afford the loan you’re applying for, and how capable you are in repaying that loan. Based on your net income and your existing debt obligations, banks assess how big a loan to give you. So, combining two incomes increases the total amount you can borrow.

This can be helpful if you are looking to buy a bigger or more expensive home.

Higher success rate for loan approval

Joint housing loans generally have a higher approval rate because the risk of a loan default is lower when there are two borrowers, compared to one.

Better interest rates

Lenders such as banks may offer more favourable interest rates for joint home loans as the lender’s recovery risk is lower with two parties compared to individual loans.

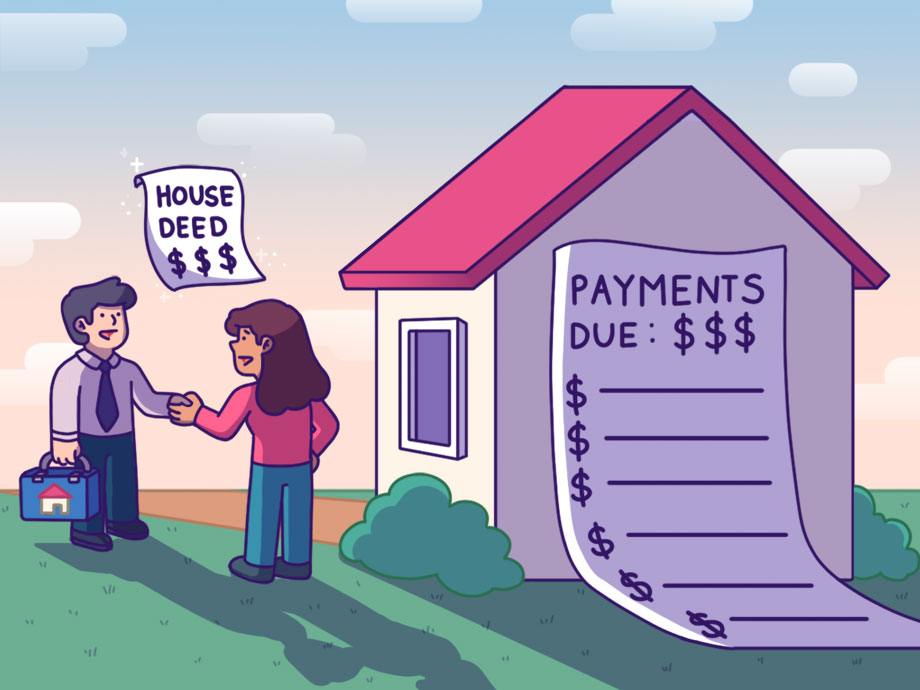

Shared costs

Taking a joint home loan with someone enables co-owners to split costs and fees such as the down payment, legal fees, stamp duty, land tax and maintenance.

As all these costs are shared and not shouldered by just one person, it can help reduce an individual’s financial burden.

Related

Be wary of these factors

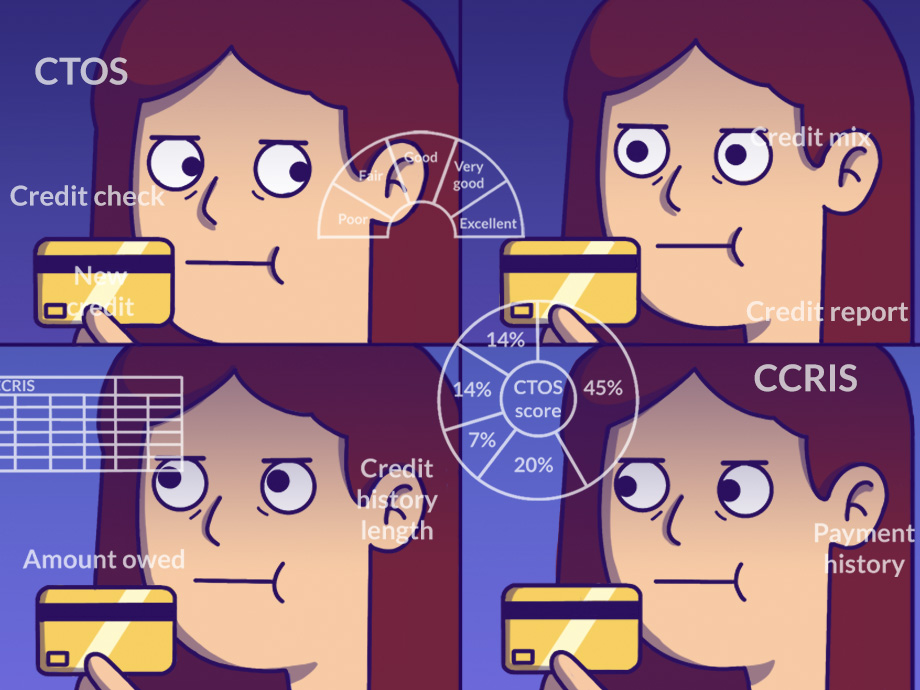

All applicants must have good credit scores

When you apply for a joint home loan, all applicants’ credit scores will be taken into account. If one of the applicants doesn’t have a good credit score, the loan application is likely to get rejected, which is a disadvantage to an individual who has a good credit score.

Miss out on government initiatives

There are numerous housing initiatives to help first-time homeowners in Malaysia. However, if you apply for a joint loan, you might forego any opportunity both of you have to benefit from first-time buyer initiatives. For instance, if you and your spouse are first-time home buyers and are applying for a joint home loan together, only one of you will be able to benefit from the incentives. And if either one of you wants to buy another house down the road, you won’t be eligible for the first-time buyer initiatives anymore.

Future loan considerations

You can get up to 90% financing for your first and second home. If you take a joint loan, you and your spouse can only have two houses with a 90% loan as opposed to four houses if you opted for a personal loan. Your third and subsequent loan will only give you 70% financing.

Everyone has to consent on decisions

As you share ownership of the property, you cannot choose to rent it out or sell it if the other party doesn’t agree to it.

If you want to sell the property and the other party doesn’t want to, you may have to buy out their share of the property, or come to an agreement.

Affected by someone else’s financial mismanagement

While sharing financial responsibility can be a good thing, it also means that you’ll both be responsible for paying back the total amount of the loan, not just your half.

If one borrower doesn’t pay their share of the loan diligently, or if one partner passes away, the other co-borrower will be held responsible to furnish the total instalment on their own.

If borrowers are unable to service the total instalment amount every month, resulting in loan default, the credit history of all parties will take a hit. The property can also be seized by the bank.