Financial Planning | Life | Personal Finance | Article

What You Need To Do Before Buying Your First House in Malaysia

by Ooi May Sim | 21 Jan 2022

For many of us, the desire to leave the family nest to a place of our own increases the older we get.

The good news is that once we start working and accumulating wealth, this once crazy idea actually becomes achievable.

The bad news? It is easier said than done. This is because buying a property is a major financial decision. It is probably the single biggest purchase many of us will be making in our lifetime.

And as most of us do not have half a million-ringgit lying in our banks, we would have to finance this with a housing loan, which means being tied down by repayments that have to be made for the next three decades.

As it’s a huge decision that involves quite a lot of money, you would need to get some things in order before you start looking for your dream home. Understanding all the financial factors in advance will allow you to make the necessary preparations and give you a firm footing in achieving your dream.

Set a realistic budget

The most crucial part to becoming a homeowner lies in having a good plan. Get this part wrong and you might struggle to pay your mortgage down the line.

For instance, even if you are eligible for a RM1 million loan, it doesn’t necessarily mean you should take up the offer, if you are going to struggle with your other payments.

Hence you need to be realistic about what you can afford based on your income and lifestyle when purchasing a house.

Before looking for a new crib, make an itemised list of your monthly expenses. This includes food, utilities, car payment, credit card bills, insurance, taxes, etc. From there, you will know how much money you have left for your monthly loan repayments or can deliberately make changes to your spending habits to have more money go towards your housing loan.

To calculate your property affordability level, the general rule is that your monthly loan payment should not exceed one third of your income for it to remain affordable and reduce the likelihood that you’ll default on your payments. So, if you are drawing a RM5,000 salary every month, your monthly repayment should not exceed RM1,666.

There are also numerous online loan calculators that can project estimated monthly payments. All you have to do is fill in the property price, loan tenure (number of years) and interest rate.

Loan tenures are from five to 35 years, or up to 70 years of age, whichever is earlier. Interest rates are set by the bank and generally costs upwards of 2.85%.

Related

Have sufficient cash for upfront payments

Although the majority of a house can be paid through a bank loan, you will have to fork out money from your own pocket to first secure your house of choice.

-

Down payment

In Malaysia, most banks offer loans of up to 90% of a property’s price for a buyer’s first two residential properties. This means you need a minimum 10% of the property’s purchase price ready for down payment.

Eg: If a house costs RM500,000, you would need to pay at least RM50,000 upfront.

It is also good to note that although 10% is the minimum requirement for a down payment, you can opt to put a bigger percentage. This will reduce your loan amount, which can either lower your monthly instalments or reduce the length of your loan.

-

Miscellaneous fees

Aside from the down payment, there are a lot of other upfront payments people often forget to budget for. These include the sales and purchase agreement, stamp duties, and the legal, valuation and agent fees.

Many of these fees are calculated as a percentage of the property price and can add up to a pretty hefty sum of money.

A rule of thumb is to set aside an extra 10% of the property price to pay for these costs. This means that in addition to the down payment, you would need to set aside another 10% for these upfront charges.

So, a substantial amount of capital is needed if you want to buy a house. If you do not have a lump sum of money laying around, you might want to start a saving fund for your down payment and miscellaneous fees.

Know your debt service ratio

If you thought that banks would be more than willing to lend you money to buy a house, think again. Applying for a housing loan can be difficult as banks scrutinise a whole bunch of factors before approving a loan. Debt to service ratio (DSR) is one of them.

DSR calculates a person’s debt obligations. This allows banks to determine whether someone can afford the loan they are applying for and how much monthly instalment they can afford to pay.

Every bank has their own DSR limit and calculation method. But the general DSR formula is to divide your total monthly debt payment by your net income (after all the deductions) and multiply that by 100 to get a percentage.

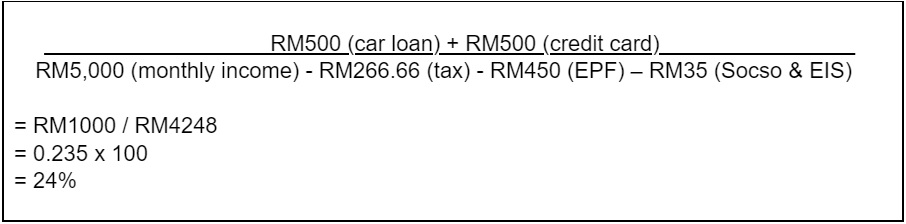

For example, if your monthly salary is RM5,000 and your car loan costs RM500, and you spend about RM500 a month on credit card bills, the calculations are:

This means you spend 24% of your income on debt every month. Having a low DSR is attractive to banks as it indicates a lower risk of defaulting.

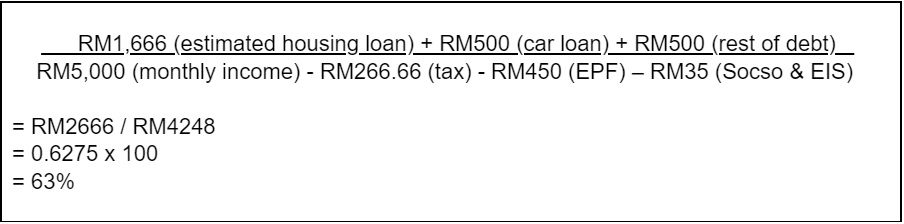

Of course, this number will change the minute you add your estimated housing loan repayment. For example, if the estimated monthly instalment for your housing loan is RM1,666, the calculations would be:

Spending 63% of your income on debt alone is pretty high, especially since other expenditure, such as daily living expenses hasn’t been added into the equation.

Expenses such as food, utilities, entertainment, and petrol do add up. Homeowners who overextend themselves and commit to an extremely tight budget may find it difficult to service their loan down the line. Without any wiggle room, an overspend in one month might lead them to spiral out of budget. Not to mention, it might not be good for your health or sanity to be eating instant noodles continuously for the next 35 years.

So, it is important to be realistic about your expectations and in what you can afford. You might be better off looking for a more affordable property or reducing the loan amount.

Related

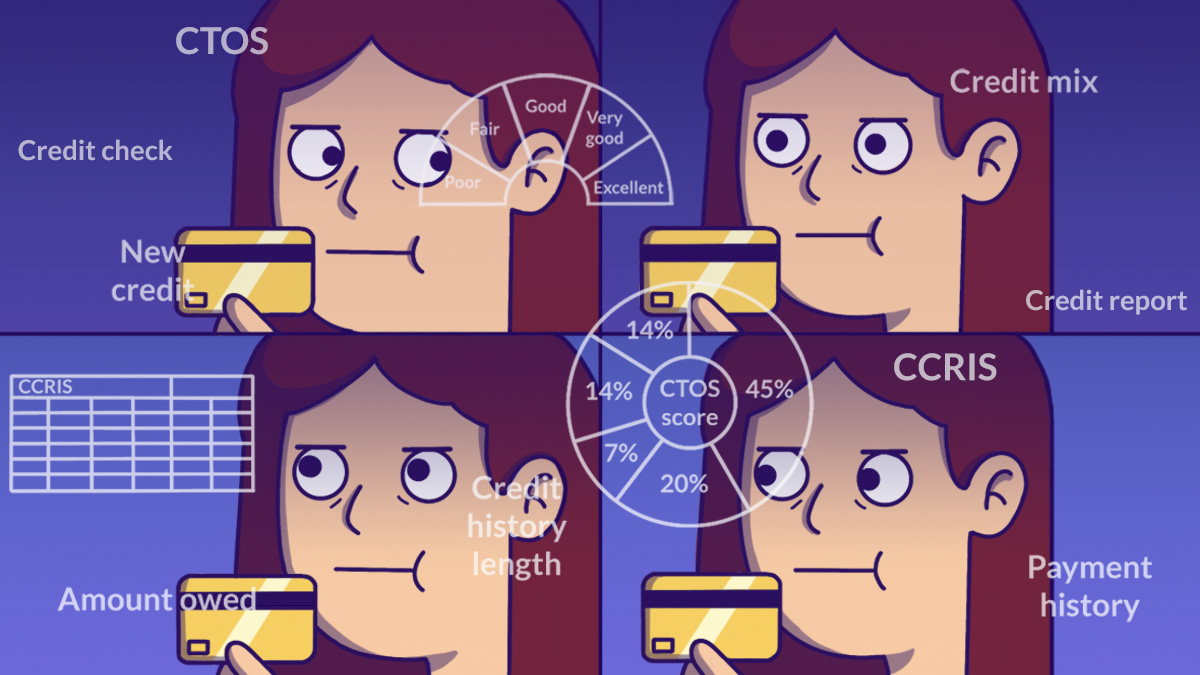

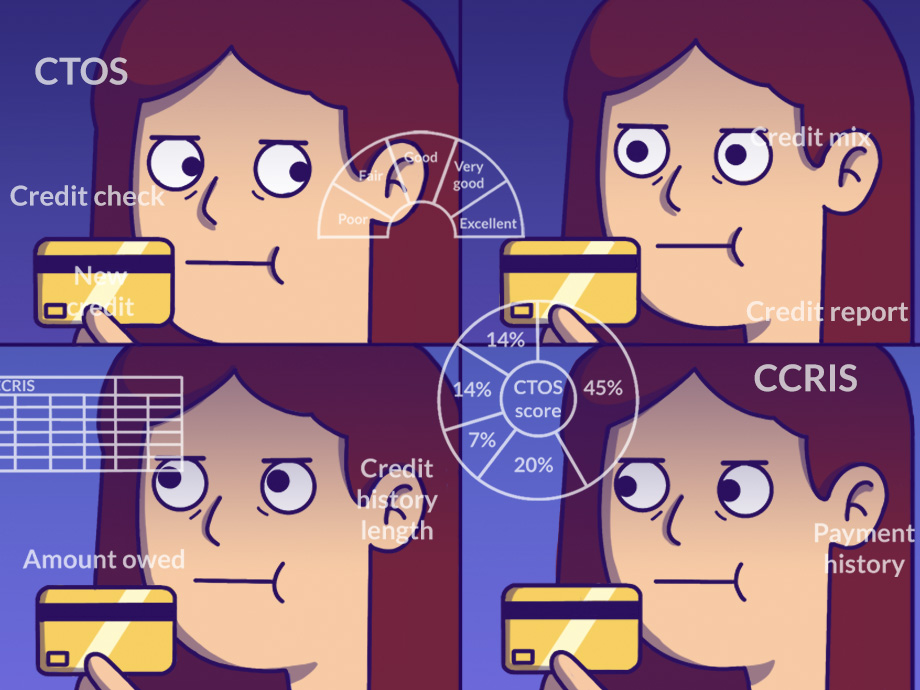

Review your latest credit report

Another thing that banks will be looking at before agreeing to your housing loan request is your credit report.

A credit report contains information about an individual’s outstanding debt, bankruptcy status, legal track record, and payment history. All this is calculated into a score; a higher score indicates better credit management.

There are two main credit reports in Malaysia: Bank Negara’s Central Credit Reference Information System (CCRIS) and privately-owned CTOS.

Every bank and financial institution in the country has to input their customers’ credit information into these centralised systems.

Lenders such as banks use credit reports to assess a person’s financial health and evaluate their finesse as a borrower. If you have a bad credit score, this tells banks you have poor payment behaviour and spending habits. This may lead to banks rejecting your loan or imposing high interest rates.

The Malaysia Consumer Sentiment Study in 2020 reported that 54% of Malaysians faced difficulty obtaining a housing loan due to poor credit history.

As your credit score is the biggest determining factor in getting a bank loan, you should review your current financial credit health by obtaining a credit report.

You can print your CCRIS report for free at Bank Negara or online. Once you’ve gotten your hands on your report, you can try to improve your score if you have a low one.

Payment history plays a huge role in your credit score. Missing just one payment might bring down an otherwise good score and may result in fees and penalties. So, settling missed payments and paying off debt are a few things that can improve your rating.

A healthy credit report improves the chances of getting a loan application approved, and with better interest rates.

But what if you have never owned a credit card or applied for any loan? This means, you won’t have a credit history or a credit score. And because banks cannot gauge your creditworthiness, you will tend to get rejected for a loan

If you are in this category, you might want to look at establishing a credit history. One way to do so is to own and use a credit card. Just make sure payments are made promptly.

Taking the plunge

Purchasing a property is a long-term commitment that should not be rushed into. Before taking the plunge, check your property affordability level, credit report, debt service ratio and do all the necessary calculations.

Crunching the numbers: To purchase a property, you would need to have 20% of the property price upfront (10% for down payment and another 10% for other miscellaneous charges).

Meaning, if you are looking to purchase a RM500,000 home, you would need to have RM100,000 in cash.

Although your head may be spinning from all these numbers, don’t be discouraged. Once you have factored in all the costs, you are one step closer to home ownership.