Managing Debt | Personal Finance | Article

How To Clear Debts Fast

by The Simple Sum | 22 Mar 2021 | 4 mins read

One moment you’re paying for groceries with a credit card, and the next thing you know – after a few forgotten payments – you’re saddled with a huge debt that you can’t repay all at once.

Sounds extreme? Well, maybe. Debts can easily arise from bad financial habits. But it can even arise when bad luck strikes – from losing a job or falling gravely ill.

To tide over a rough patch, you might be tempted to take out a loan or rely on a credit card. After all, it’s just temporary; things will get better! But sometimes, things don’t improve. Then debt starts compounding. Then it snowballs out of control.

So, the nightmare begins.

The red letters demanding repayments start to pile. By then, it can seem like there is no way out. If you find yourself in this situation, don’t lose hope. Here are some strategies to help manage debts that seem out of control.

Managing your web of multiple credit lines

A common problem faced by debtors is the complexity of juggling multiple payments. Needless to say, the main priority is to clear these debts fast, before the accrued interest gets higher and higher.

There are two common methods to tackle multiple debts:

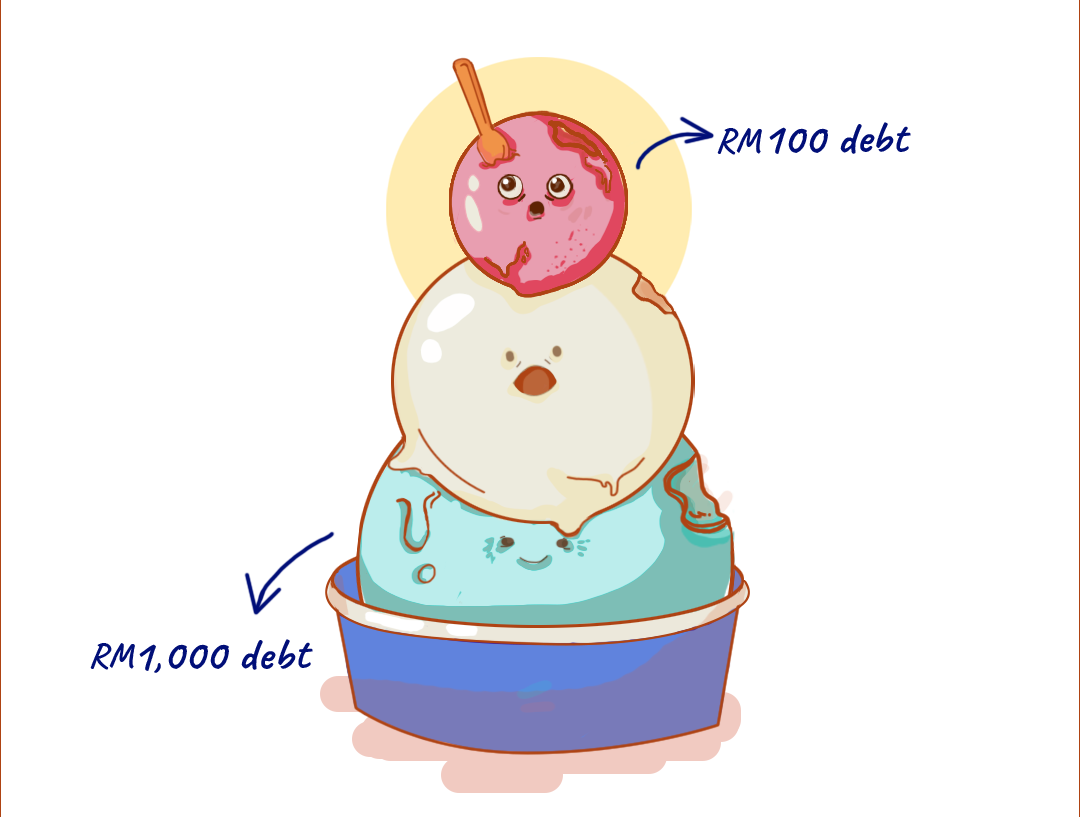

Snowball method

- Pay the minimum sums* for all debts

- List out existing debts in order from smallest to largest

- Put the remainder towards the smallest debt to clear it off, and continue onto the next smallest debt

Avalanche method

- Pay the minimum sums for all debts

- List out existing debts according to interest rates from largest to smallest

- Repay as much as is possible for the debt with the largest interest rate, before moving on to the next one and so on

*minimum amount possible that reduces some debt principal

Both methods place an importance on first paying off the minimum sums for each debt, so some of the principal (original amount loaned) is being chipped away, preventing the debt from growing bigger.

But more importantly the methods help you list and take stock of all of your debts, and provides a simple action plan to keep you focused on clearing them off.

We have some recommendations between these two methods.

- The Avalanche method is better suited for those who are struggling with credit card debt in addition to low-interest or smaller loans. By dealing with the higher interest loans first, no snowballing will occur – and the loan is settled in a shorter period of time, thus incurring lesser interest.

- The Snowball method can be used for low interest or smaller loans, whether it’s a personal loan from family or overdue bills towards telcos or utilities. This is a systematic way of handling loans and bills in an organised way, without neglecting any by accident.

But when it all seems too much

Sometimes, no matter your intentions, your debts can overwhelm you and if you need help to restructure your payments, you may consult the services of an independent third party like the Credit Counselling and Debt Management Agency (AKPK).

AKPK’s consultants will work out a plan for repayment with you in agreement with your financial service providers under AKPK’s Debt Management Program.

On top of that, they also offer financial education and financial advisory services if you need more help taking control of your finances.

In the end, no mountain is insurmountable – even one made out of debt. For borrowers who are beginning to find themselves in trouble, it is not the end. With every step in the right direction (and a whole lot of discipline and transparency), a debt-free life is possible.