Financial Planning | Personal Finance | Article

What Does It Mean to be B40, M40 or T20?

by Ooi May Sim | 19 Jun 2024 | 4 mins read

You’ve likely come across the terms B40, M40 and T20 before. But do you know which income classification your household belongs to?

These classifications describe the different household income levels in Malaysia and wasn’t created to stigmatise or belittle anyone. Instead, policymakers use them to understand the income distribution and socioeconomic dynamics within a population.

So, on the contrary, they are designed to aid those in the lower income brackets through targeted subsidies and assistance programmes.

Understanding which income category your household falls into will allow you to determine if you qualify for any financial assistance from the government.

So… which classification do you belong to?

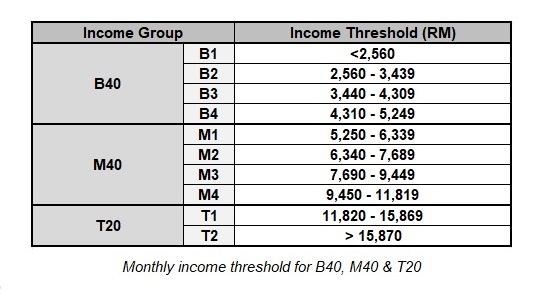

It doesn’t matter how much (or how little) you earn; all Malaysians are divided into three household income groups: B40, M40 and T20.

B40: Representing the bottom 40% of income earners, this typically consists of low-income families who may be facing financial challenges and may require financial aid and social support from the government.

M40: Middle-income earners who generally have enough to cover their essential expenses but still have limited discretionary spending.

T20: The top 20% of earners consists of affluent households who have higher disposable income and greater financial security.

If you’ve noticed, everything is calculated as household income because although people earn individual salaries, they typically live with others as households. So, policymakers conduct the Household Income and Expenditure Survey twice every five years to understand household, rather than individual income.

The chart below shows the income threshold for B40, M40 and the T20 groups.

To tabulate your household income, find out how much money is earned by everyone you live with, including yourself. This includes salary, bonus and other incentives. Add them all up and you’ll get your household’s total income.

Why is it important to know this?

Depending on which income group you are in, you may be eligible for tax reliefs, financial aid, and various health plans. The government provides various incentives targeted towards the B40 and M40 income groups (sorry, T20!).

If you are in the B40 household income group, you can apply for the Sumbangan Tunai Rahmah (formerly known as BR1M), which is a cash assistance programme. The assistance amount varies according to household income and the number of dependents you have.

There is also the Peka B40 initiative that offers free health screenings and treatments to B40 individuals mainly for non-communicable diseases such as diabetes, hypertension and high cholesterol.

M40 households however can enjoy an income tax reduction of 2% beginning this year for those with taxable incomes between RM35,000 and RM100,000. This group can also enjoy stamp duty exemption of up to 100% for first-time home purchase priced at RM500,000 and below.

Knowing where you stand in relation to the general population is also a good way for you to access your financial situation. This can help you make more informed financial decisions and set realistic goals about spending, saving and investing.

There are also government housing schemes such the Program Perumahan Rakyat (PPR) for the B40 community and Madani which provides affordable housing for the B40 and M40 community.

Related

However, these classifications are being phased out

This year, the government plans to phase out the B40, M40 and T20 income classifications as they believe that these do not accurately represent the actual situation on ground.

As the current classification represents fixed income, it is oversimplified and doesn’t capture factors such as demographics, number of children and locality, or the financial circumstances of households such as the especially in their ability to spend or save money after accounting for all their household expenses. Hence, the government believes that changing it in favour of a system that showcases household disposable income will reflect the financial realities of Malaysians more accurately.

For example, a person in the M40 category may seem like they have all their finances in control but prod a little deeper and you might realise that after paying off housing, car and education loans, and after deducting childcare, there may be nothing left at the end of the month.

By eliminating these classifications, the government hopes to reduce errors in subsidy exemptions caused by inaccuracies in classifying individuals based on their income levels. Rather, they aim to streamline subsidy allocation to ensure that benefits reach the intended recipients more effectively.

To achieve this goal, the Central Database Hub (PADU) was launched to digitise existing systems and to optimise subsidy allocation, ensuring that resources are distributed equitably and transparently.