Career & Education | Financial Planning | Life | Personal Finance | Article

Getting an Education Loan Could Do You More Harm Than Good

by Ooi May Sim | 21 Dec 2023 | 5 mins read

Having a degree is something that is undeniably helpful for your career, especially in this competitive climate where high paying jobs are hard to come by.

But getting a degree does not come cheap. A course at a local public university cost upwards of RM5,000 and a degree at a local private university cost even more.

To fund their education, many people seek financial help by taking loans. And whilst the interest rates for study loans tend to be lower than a personal loan, it is still a loan that needs to be managed and paid off. Not doing so could lead to serious consequences.

What happens if you don’t repay your PTPTN loan

While there are multiple options for education loans out there, the most popular and most accessible study loan in Malaysia is the National Higher Education Fund Corporation (Perbadanan Tabung Pendidikan Tinggi Nasional; PTPTN), under the Ministry of Education.

Up until 30 September 2022, as many as 3.7 million students have borrowed a total of RM67.69 billion from PTPTN to finance their education. Their popularity stems from their low interest rate, which is only 1% as it is heavily subsidised by the government. Plus, if a student graduates with First Class Honours, their PTPTN loan will be waived.

However, an article by The Edge in 2019 showed that more than half of all PTPTN borrowers are defaulting on their loans. And from the 51% who are not paying back their debt, 19% have not even made a single payment.

Defaulting on the loan can also affect you in these ways:

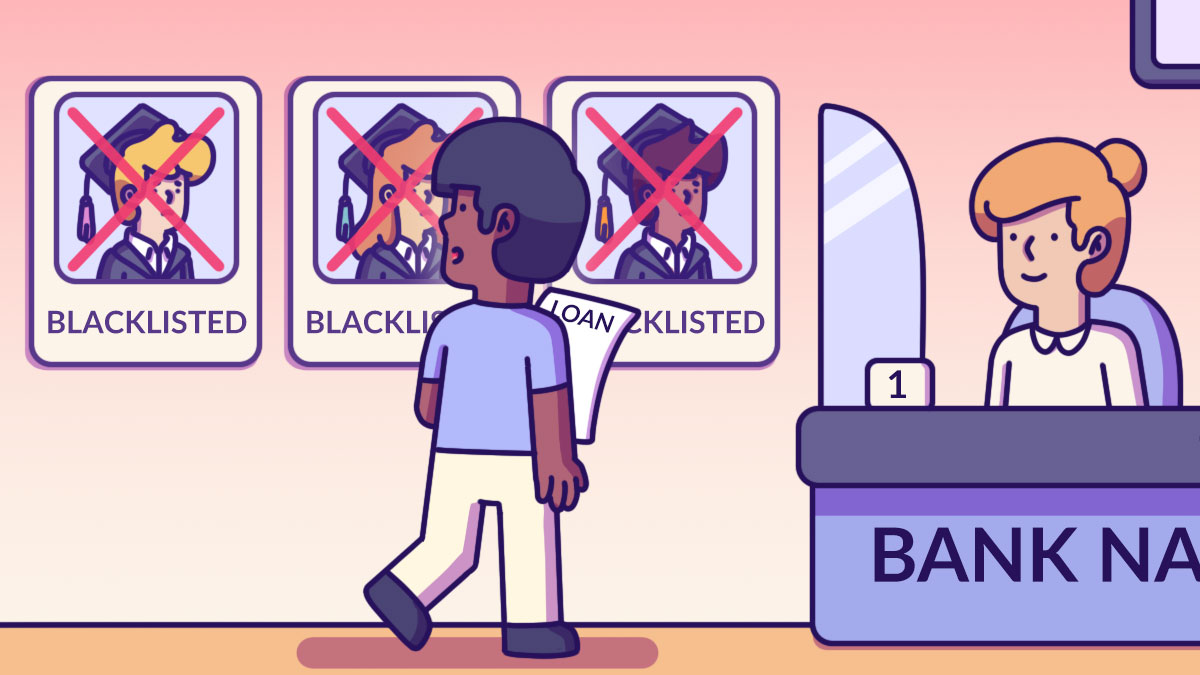

Blacklisted on CCRIS so you’ll have a bad credit rating

PTPTN borrowers who do not repay their loans will be blacklisted in the Central Credit Reference Information System (CCRIS). This will affect your credit score. And as the CCRIS system is used to store financial information on borrowers that is used by banks and financial institutions to determine if you are a good borrower, being blacklisted here could mean that you will likely be rejected for any future loans and even credit cards.

Have legal action taken against you

Loan defaulters will be issued reminder notices, and if payment is still not made, PTPTN can charge you in court.

Related

Steps to follow before taking an education loan

To ensure that you don’t end up defaulting on your education loan, be sure to consider the following factors before you apply for one.

Determine what you want to study and how much it’ll cost

Find out how much your course will cost, in total. Then, calculate all the other costs such as tuition fees, study materials, accommodation and living expenses.

Calculate how much loan you’ll need to take

Now that you know how much your degree will cost, you should assess your financial standing by looking at how much savings you have and all your financial obligations.

If you have started working, you can also look at how much you have in your Employee Provident Fund (EPF), which allows you to use the entire savings in your Account 2 to pay for your education.

However, if you are thinking about using your EPF savings to fund your education, remember that you will be losing out on the annual dividends and compounding interest if you do so. EPF’s average 10-year dividends for conventional savings is at 6% (2013 to 2022).

So, if you withdraw RM10,000 from your EPF Account 2, and if dividends are at 6% annually, you will lose out RM7,908.48 in 10 years and RM22,071.35 in 20 years.

You should also find out if you are eligible for any scholarships or financial aid that can help fund your education. After all these considerations, you can then determine how much you’ll need to borrow.

Remember that taking an education loan is just like taking any other loan so borrow only what you need to prevent going into too much debt.

Research the various loan options

There are many different types of loans you can take to fund your education. Explore all your options and compare the terms, interest rates and repayment structures. Pay close attention to the fees, penalties and consequences that you may incur if you default on the loan.

Have a plan for repaying your loan

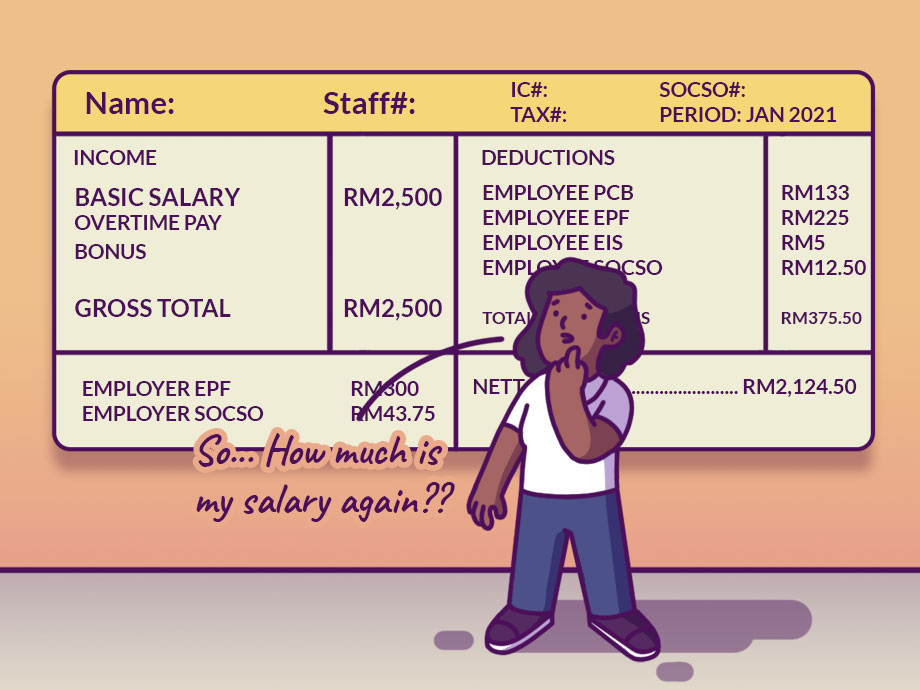

A big part of not defaulting on your loan is being able to pay for the instalments every month. To ensure you can make these payments, look at how much a fresh graduate in your chosen field of study can realistically earn after graduating. Then think about how much you will be able to set aside for your education loan every month because the last thing you want is take a loan then lapse on payments.

You can also begin your loan repayments while you are still studying by looking for part time jobs or side gigs that can bring in an income.

Related

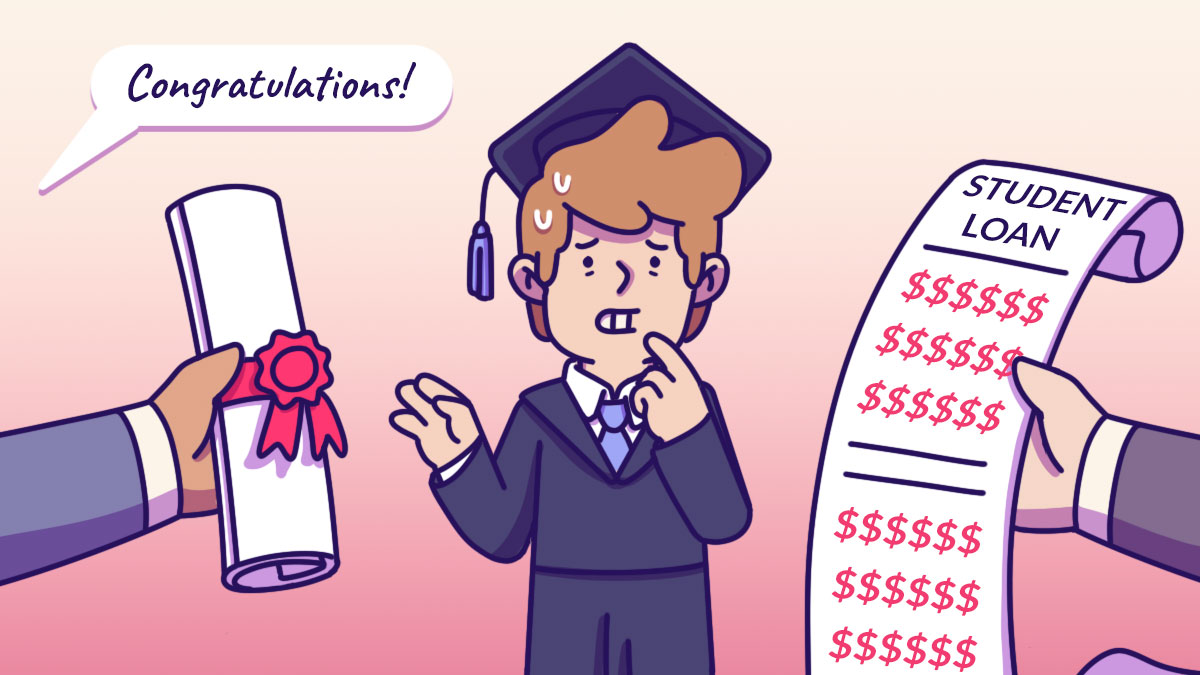

The downsides of an education loan

Although getting a degree can help you snag a higher paying job, it doesn’t come without its drawbacks. One of the biggest downsides of taking an education loan is that you’ll be accumulating debt even before you have started working.

And as you’ll have to make monthly loan repayments, a chunk of your salary will go towards loan repayment. This financial commitment may limit your career choices, job flexibility and your ability to save and invest in other life goals. It could also affect your chances of getting another loan in the future.

You ‘ll also need to be aware of the interest that is charged on the loan, which will increase your repayment amount.

So, before you take a student loan, it is crucial to do your research and understand both the benefits and the drawbacks to ensure you are making the right decision and so there won’t be any negative repercussions to your finances.