Financial Planning | Personal Finance | Article

How Does the US Banking Crisis Affect My Finances?

by Cherry | 13 Apr 2023 | 6 mins read

It’s been quite a chaotic time for the banking industry of late. Two banks in the US – Silicon Valley Bank and Signature Bank – recently went bust with a couple more banks currently in trouble. Across the pond, Credit Suisse, Switzerland’s second-largest bank was also on the brink of collapse before being taken over with the financial help of the Swiss government. For the uninitiated, this is the biggest banking crisis since 2008.

Understandably, people all around the world are concerned if these banking crises will affect their daily lives. The good news is that the US and Europe banking crisis is unlikely to cause bank collapses in this part of the world. Unfortunately, that doesn’t mean that we’ve completely dodged the bullet either – these crises affect our finances in other ways.

Here, we’ll explore what those impacts might be and how you can plan and prepare your finances and yourself for what’s to come.

It may not be easy to borrow money from banks

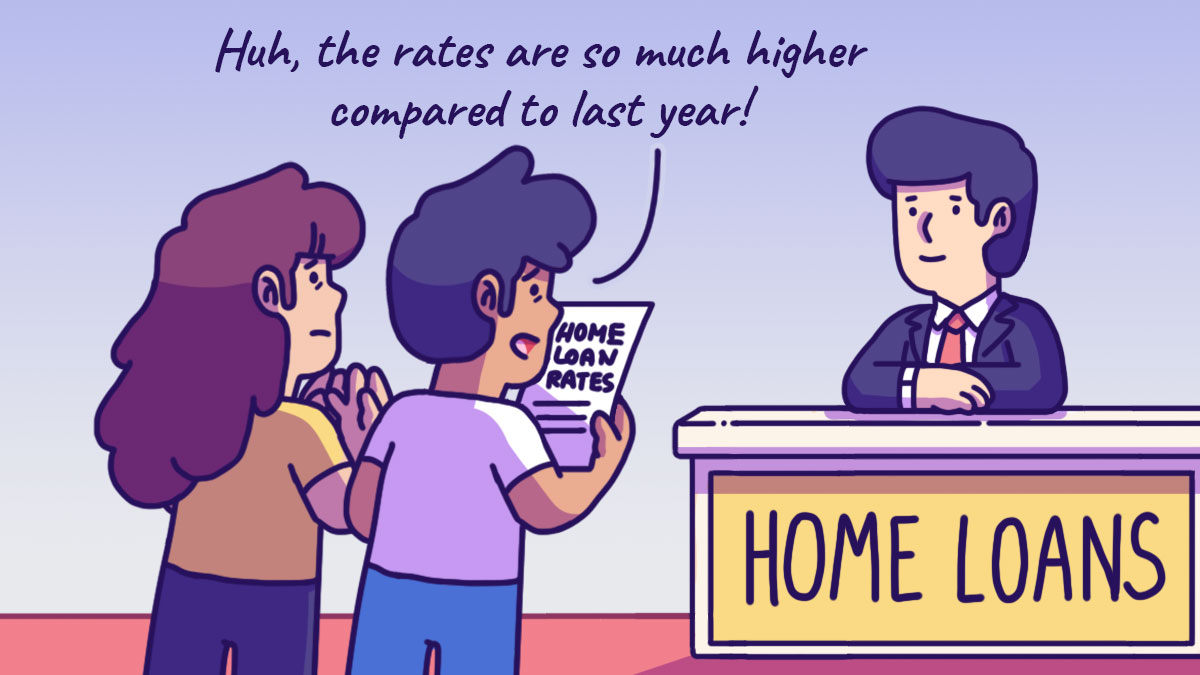

If you’re intending to take a loan for your house, car, or your business, you may find that it’s not as easy to get your application approved as it used to be.

As interest rates rise, banks are struggling to balance their investment losses with their liquidity. The interest rate pressure also makes it more costly for banks to raise capital and this, in turn, makes them more reluctant to lend money to consumers and businesses.

Banks in this region may look at what’s going on in the US and Europe and take it as a signal that they need to tighten their purse strings and be more prudent when it comes to lending. As a result, you may notice that it’s harder for regular people like us to obtain loans or credit facilities, such as credit cards, personal loans, or business loans.

It may get more expensive to borrow from the banks

Higher borrowing costs are another way that the banking crisis can affect ordinary folks. When banks have to pay more to raise capital, they may need to raise the interest rates on their loans and other financial products to make up for the increased cost. So, not only will it be harder for you to get a loan, and your loan repayments are likely going to be higher if you do get one, which can put a strain on your budget.

For instance, higher interest rates on home loans can significantly increase monthly mortgage payments, making it more expensive for homeowners to buy a home. If you’re looking to buy your first home or invest in property, you may need to spend more time planning and thinking through your decision.

The crises may speed up the economic slowdown

Since the start of 2023, there has been constant chatter about an impending recession among financial analysts and the media. The banking crises added more fuel to this fire, which means that we may see an economic slowdown or a recession sooner rather than later in the US and Europe.

Due to the interconnectedness of the global economies, a slowdown in the US and Europe could slow down economic activities in other parts of the world. For example, if there is a decrease in demand for exports from Singapore, companies may see fewer profits as a result, and may need to lay off workers to cut costs. And if businesses were to shutter locally due to lack of funding or access to credit, there’ll be fewer job opportunities too. This can lead to higher unemployment rates and lower income for affected workers.

An economic slowdown could also impact the stock markets. As companies make less money, stock prices may decline, and you may see lower or negative returns on your investments. A lower return on investment can affect your retirement savings or other long-term financial goals.

Related

So, what can you do to protect yourself?

Given these potential impacts of the recent banking crises, it is essential to take steps to safeguard your financial health. Here are a few ways that can help you better prepare for any financial downturns:

Keep an eye on your financial health: It is important to always stay on top of your finances, especially during times of financial uncertainty. You should keep track of your income, expenses, and savings, and make sure that you are living within your means. You should also watch your credit score regularly and take steps to improve it if necessary. By staying on top of your finances, you can better prepare for an economic slowdown.

Have an emergency fund in place: Having an emergency fund is critical during times of financial uncertainty. This fund should be kept in a separate account and should be easily accessible in case of an emergency. Experts generally recommend having at least six months’ worth of living expenses in your emergency fund, but you can adjust this amount based on your circumstances.

Diversify your investments and invest long-term: Investing is an important part of building wealth, but it is also important to diversify your investments to protect your portfolio from potential losses. This means investing in a variety of assets such as stocks, bonds, commodities, and real estate. By diversifying your portfolio, you can reduce your risk exposure and potentially mitigate the impact of any economic downturns.

Even if stock prices are lower, if you invest in fundamentally solid companies, over time, when business is better, their stock price will recover. You just need to be patient and wait for your investments to grow.

Stay informed about the global economy and financial system: It is important to stay up to date on current events, news and trends in the global economy and financial system. This will allow you to make informed decisions about your investments and personal finances. You can stay informed by reading financial news, attending seminars or webinars, and talking to financial professionals.

Related

The key to weathering through the now is being prepared for the future

Although the banking crises in the US and Europe are not likely to cause banks in other parts of the world to collapse, these crises still have far-reaching effects globally because of how interconnected the world is. A slowdown in the US can affect us in Asia. So, it’s essential that we are prepared by keeping an eye on our financial health, diversifying our investments, and building an emergency fund to prepare for any potential impacts on our finances.