Financial Planning | Personal Finance | Article

Thinking About Withdrawing Your EPF Savings? Here’s Why You Shouldn’t

by Cherry | 18 Mar 2022 | 5 mins read

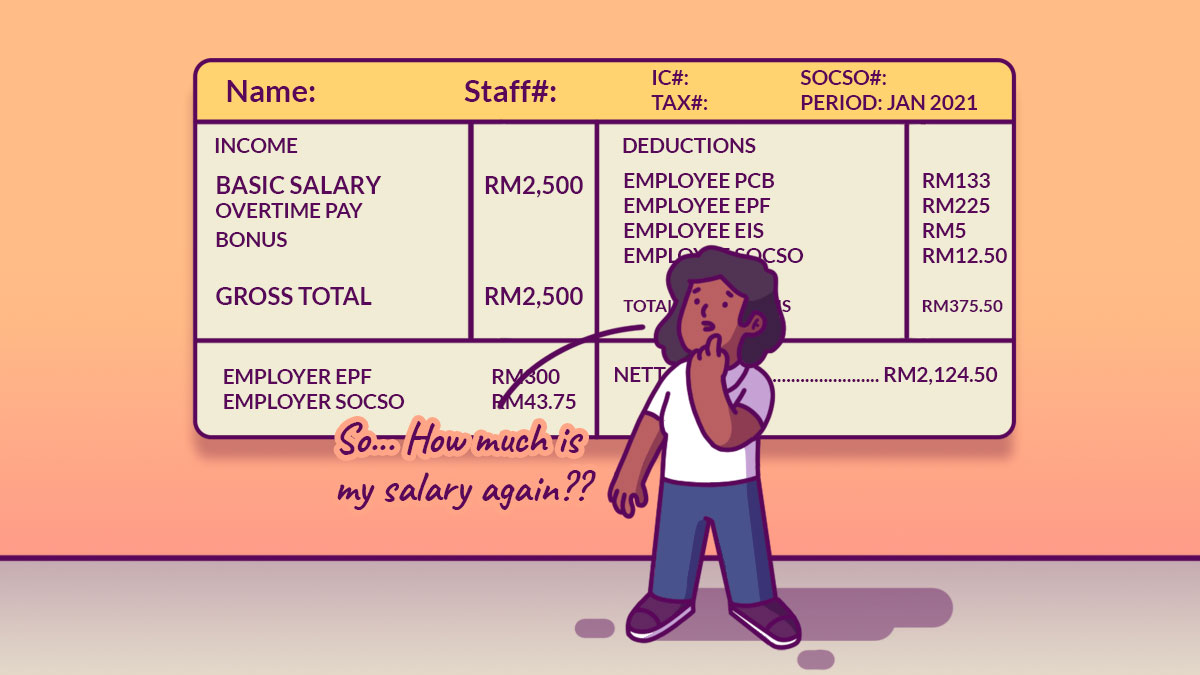

For most of us, every month, a portion of our salary is credited to our Employees Provident Fund (EPF) as part of the government’s efforts to prepare for our retirement. Typically, this amount cannot be touched unless there are special circumstances.

However, there have been occasions where the Malaysian government has approved special EPF withdrawals, such as the special RM10,000 EPF withdrawal that was announced in March 2022 to help those who are still financially affected by the pandemic.

But just because you’re allowed to withdraw from your EPF, does it mean you should do it?

While it can be tempting to withdraw and use the money for the many growing expenses in everyday life, you will benefit far more by leaving your cash in your EPF.

Keep money in EPF to grow your retirement fund because you will need it

For many Malaysians, EPF savings is the only financial safety net for their retirement years. Most do not have any private retirement savings and are solely dependent on their EPF savings to see them through their old age.

EPF currently recommends that you should have at least RM240,000 when you retire. This can sustain 20 years of retirement at RM1,000 a month. The best way to achieve this is to leave it in your EPF savings and earn compounding interest over time.

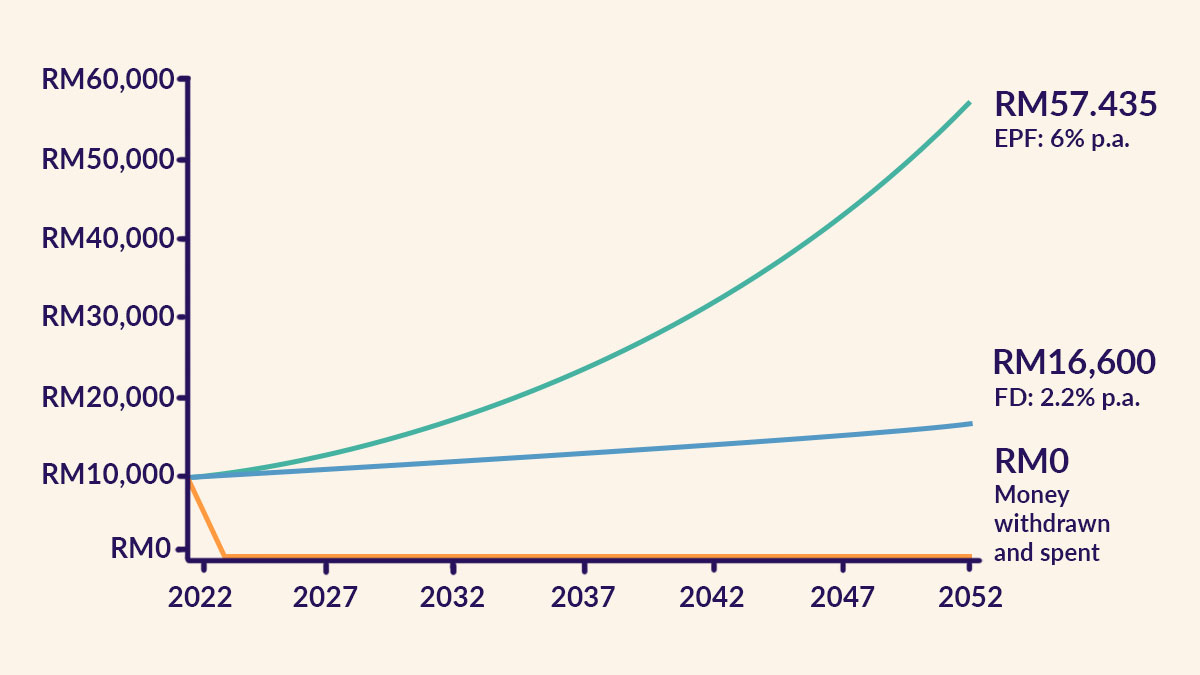

In the last 10 years, the EPF has declared an average annual dividend of 6.11% (the dividend for 2021 was 6.1%). Even if their investments don’t do well, you are guaranteed a yearly 2.5% dividend which is higher than most fixed deposit rates currently.

Here’s a chart that shows how much impact time can have on your EPF savings.

Leave your money in the hands of professionals

Perhaps you may be thinking of using this special withdrawal as an opportunity to unlock money for other investments.

You may want to pick your own stocks with that money but consider this; EPF is a professionally managed investment fund that invests in very diversified businesses and companies that can effectively grow your money and protect your money against economic shocks. The last thing you want is for your retirement funds to be wiped out because you picked the wrong stock, or sold in a panic when stock prices went down.

And unlike other private fund management companies, you don’t have to fork out a single cent on management and administration fees.

Related

Use EPF only for life’s big expenses

While the main purpose of EPF savings is for retirement, the government knows that most of us have milestone expenses that require huge sums of money. And for these purposes, you can use what you have in your EPF Account 2.

So, you don’t need to feel as if you must make use of every opportunity available to withdraw money from EPF — use it only for life’s important expenses.

All EPF members can make partial withdrawal from Account 2 for:

- Education — to fund your own or your children’s education

- Buy Home — to purchase a house

- Build Home — to build a house

- Reduce/Redeem Housing Loan — to reduce/redeem housing loan balance

- Housing Loan Monthly Instalment — to pay the monthly housing loan instalment

- Flexible Housing — Use current and future EPF savings to increase loan eligibility limit

- PR1MA Housing — to purchase a PR1MA house

- Hajj — to perform Hajj

- Health — to cover medical expenses AND/OR to buy healthcare equipment

Withdraw from EPF if it is your only option

It is not without much consideration that the government has decided to allow special withdrawals to take place, especially from 2020 to 2022, where many Malaysians are facing great financial hardship. This special EPF withdrawal is meant to help those who have lost their source of income and are having difficulties in managing their daily finances.

However, these withdrawals put the retirement savings of many at risk. From 2020 to 2021, 7.3 million EPF contributors took out RM101 billion from their EPF under the emergency EPF withdrawal programmes, i-Lestari, i-Sinar and i-Citra.

As a result, almost 50% of EPF contributors under the age of 55 now only have savings of less than RM10,000 for their retirement. According to economist Prof Dr Barjoyai Bardai, by the time these individuals retire, they will only have between RM15,000 and RM20,000.

However, if you are really in need of cash to pay for your everyday needs such as food, overdue utility bills and rental, or essentials that need an immediate solution, perhaps you should consider making special EPF withdrawals when they are available.

But if you are thinking of using it for overdue debts such as housing and car loans or even credit card repayments, drawing from your EPF savings may not be the best solution. Instead, try negotiating with the banks to extend the repayment moratorium and restructure the loan when you get a job instead.

Doing this allows your money to grow at the most optimal rate for your retirement and other big life expenses.

Related

Prepare for emergencies as soon as possible

If you are someone who is currently in financial hardship, this special concession to withdraw your EPF funds is definitely helpful.

But that doesn’t mean that you should continually rely on money meant for your future to help you out of difficult financial circumstances. What you should do instead is to find ways to build an emergency fund, whether that’s by cutting back on your expenses or taking up side hustles to help you increase your income and savings.

When you’re prepared for emergencies, you can ride through the hard times while still protecting your retirement savings.