Managing Debt | Personal Finance | Article

Should I Buy Now, Pay Later?

by Ooi May Sim | 30 Jun 2022 | 5 mins read

Everywhere you look, you’ll see the option to Buy Now Pay Later (BNPL). From refrigerators to shirts, you can even use BNPL to fund your travel expenses. As its name suggests, BNPL allows people to buy products and services, sometimes with no upfront cost, then pay for it down the road, in instalments.

BNPL gained popularity during the Covid-19 pandemic when sellers and consumers alike were struggling with cash flow. By breaking down payments into smaller instalments, it helped consumers buy things when cash was tight and helped businesses generate sales. It seemed like a win for consumer and businesses alike.

But is buying now and paying later good financial management? Like most financial tools out there, BNPL can work to your advantage, but only if you’re able to control your spending. We break it down:

The advantages of BNPL

0% interest

When you buy an item using BNPL, you are borrowing money for your purchase. Most BNPL platforms offer 0% interest on this loan, with the condition that you repay that amount within a stipulated time frame.

If you are responsible with your payments and make them on time, you would only be paying for the price of the item.

Open to everyone

Unlike applying for a credit card, applications for BNPL services doesn’t involve long approval times and credit checks. Most of the time, all you need to do is to upload a picture of your IC, then type in your particulars like your name, phone number, home address and email.

This differs from applying for a credit card, which often asks you to submit various documents such as your pay slip, bank statements and employment information. These requirements often make it difficult for freelancers and odd-job workers to attain a credit card as they might not qualify for it.

BNPL enables people from all walks of life to purchase items on credit, then pay for it slowly, easing their cash flow.

Makes things affordable

As BNPL breaks payments down to manageable portions, it allows people to buy things that they usually cannot afford, immediately.

And if you’re thinking, “Why buy something if you can’t afford it?”, let us explain: a person who needs to buy a laptop for work, for instance, may not have RM3,000 in cash. But if this amount is broken down into six instalments, where they have to pay RM500 a month, buying a laptop becomes attainable.

Related

BNPL’s downside

It encourages you to overspend

It is no secret that retailers are using BNPL to get people to buy and spend. But being able to purchase items without having any money upfront enables buyers to spend beyond their means.

Breaking down large payments into smaller, more ‘affordable’ portions also encourages people to overspend. Imagine this: you set aside a budget of RM1,000 to buy a new refrigerator. When you get to the store, you see your dream fridge being sold for RM2,000.

Under normal circumstances, you would walk away and look for a fridge that is within your budget. But with the BNPL option, they have conveniently split this cost over a 12-month period, so you only have to pay RM167 every month. Suddenly, buying this fridge becomes feasible, although it cost double your original budget.

Makes people take on debt, unknowingly

Many times, consumers don’t even realise they are taking on debt when they use BNPL as they see it as just another payment option. However, as you are spending on borrowed money, BNPL is a form of debt, and can even affect your credit score (see below).

Plus, as BNPL does not do any background credit checks, this may lead those who are bad with money further into debt. (Sometimes, restrictions are there for a reason).

High late payment fees

If you pay late (after the stipulated date), you will be charged a penalty. Depending on the platform, these fees can be more expensive than the charges imposed by credit cards.

For example, a quick check found that one BNPL platform charges a 1.5% late payment fee, while another imposes a RM60 penalty per purchase.

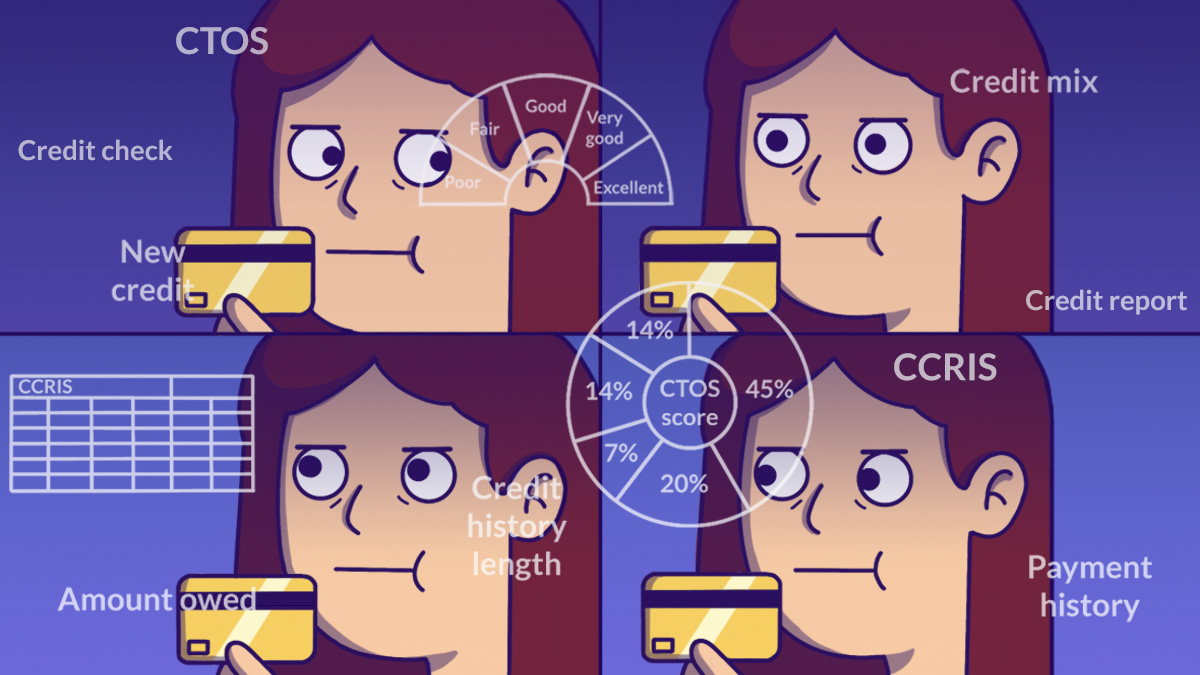

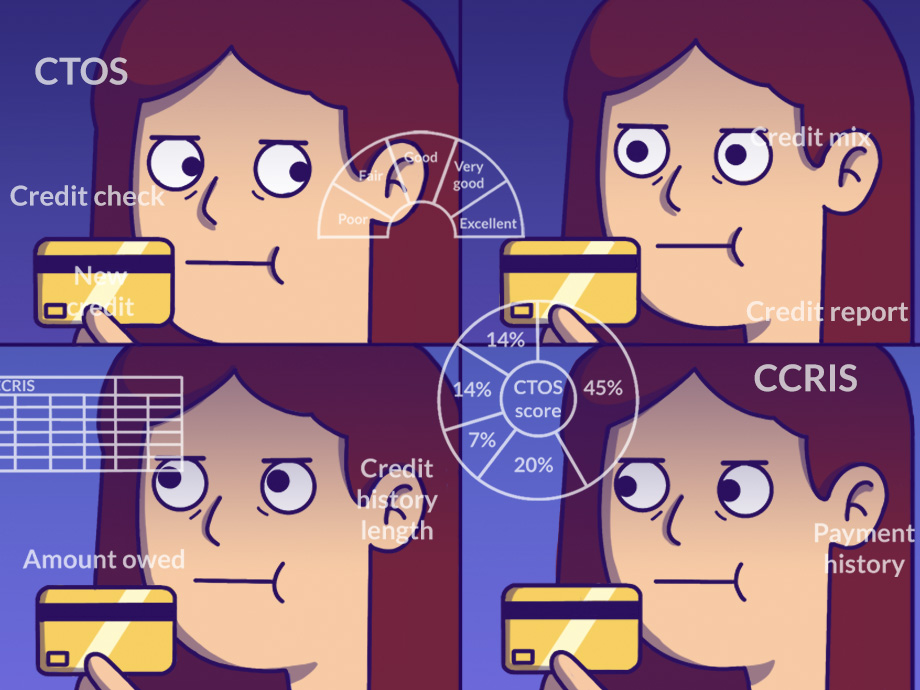

Can affect your credit score

Buyers who miss payments might get reported to the credit bureau, which could hurt their credit score. Those who have a bad credit rating could find it hard to apply for a housing, car or credit card loan in the future.

Not regulated

Currently, there are about eight main BNPL platforms in Malaysia, and all of them are from non-banking backgrounds. They are also not regulated.

This may pose a problem for consumers, especially if something were to go wrong as there are no laws protecting them. So, unscrupulous sellers may get away with selling faulty or below par products.

Without regulation, there is also fear that consumer debt may increase. To curb this, the Malaysian government is looking at formulating a comprehensive legal framework to regulate BNPL.

Related

So…is BNPL the way to go?

While BNPL can help with cash flow, our advice is to always be cautious when taking on debt. You should only use BNPL for necessary big purchases, if you cannot afford to pay for an item at one go.

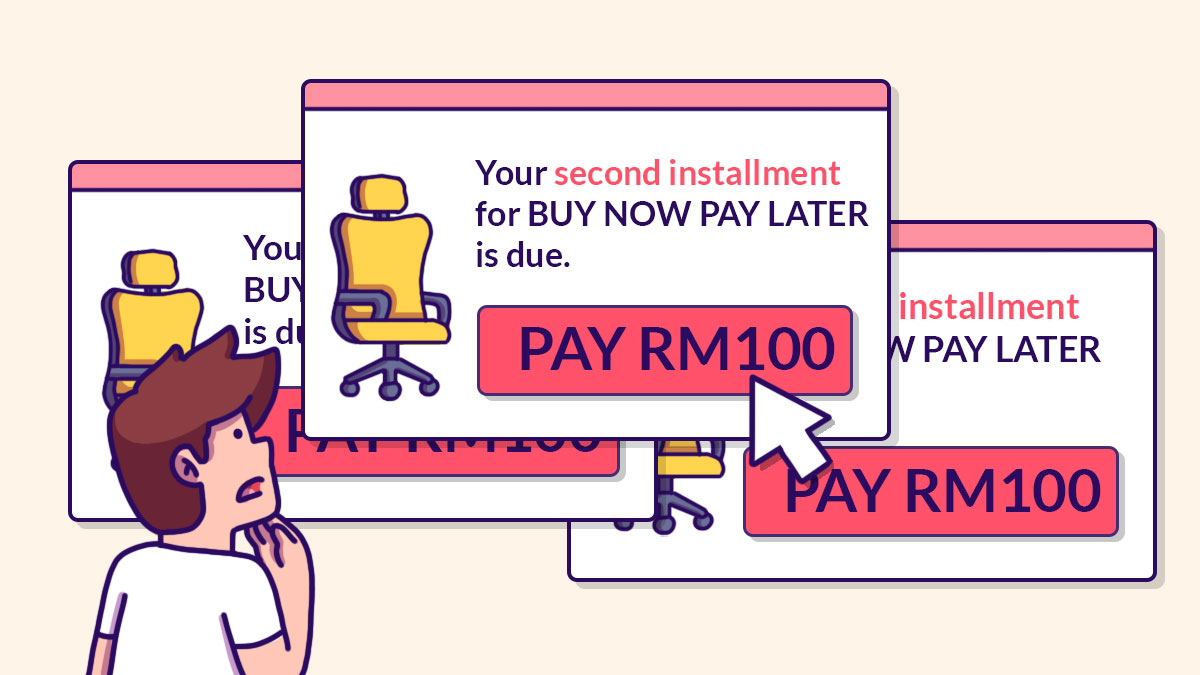

If possible, refrain from paying using BNPL too often, especially for smaller purchases. This is because the chances of forgetting to pay off multiple purchases increases in tandem with the number or check-outs you make as you would need to keep up with different payments.

Ultimately, the decision lies with you. If you plan on using BNPL, remember to budget for it and make payments on time.