Financial Planning | Life | Personal Stories | Article

Money Conversations I Wish I Had With My Partner Before I Got Married

by Ooi May Sim | 6 Jul 2023 | 5 mins read

Marriage is a beautiful union between two people who want to spend the rest of their lives together. It is full of love, happiness, sunshine, and more. Okay, now that we’ve got the pleasantries out of the way, let’s be real – marriage is hard, especially when finances come into play!

Combining and managing finances with someone is difficult and nothing really prepares you for it. Before I got married, I thought I was compatible with my husband in every way, but like many Malaysians, we didn’t think about our financial compatibility. And this led to some hiccups down the road.

Now that I have been married for 10 years, I look back at my naïve self and contemplate all the things I should have done differently.

Learn about your partner’s income and spending patterns

When I was younger, I thought discussing money and income would make me seem materialistic, so I avoided talking about it.

I also believed that since we were both working, we could simply use our own money to buy things we wanted so it wasn’t necessary for me to know how much he earned.

As I got older, however, I realised that our income sets the benchmark for things we can do, and the kind of lifestyle we are able to lead. To illustrate, if I am earning RM5,000 a month, I won’t be able to afford a RM1mil property or a RM30,000 handbag.

So, talking about income is not only practical; it’s necessary in a long-term relationship.

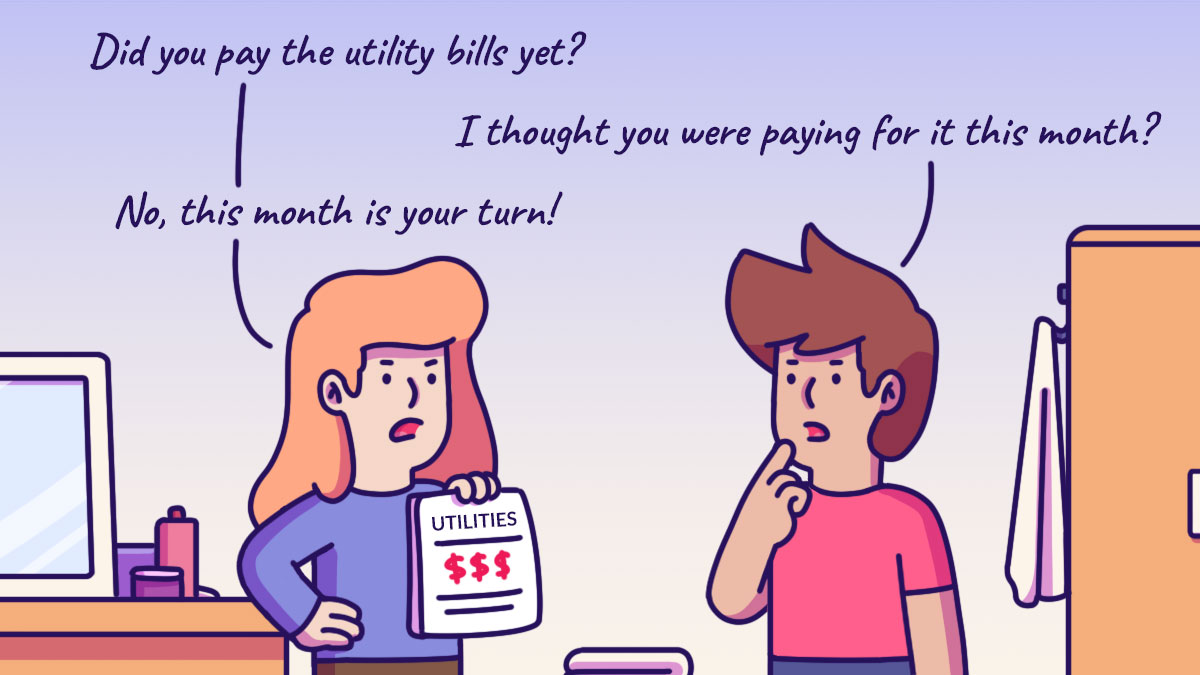

Split financial roles and expenses

We didn’t have any set roles for our joint expenses when we started living together. Bills were paid by whoever saw it and decided to pay for it. For example, I would pay the electricity and water bill whenever I found the statement in our mailbox. And my husband would do the same likewise.

This posed a problem because as no one was “assigned” to be in charge of paying for specific bills, neither of us were aware of when the bills were due, or overdue. There were months where neither one of us paid our bills and were slapped with late payment fines.

Talk about debt

When we were ready to settle down, I wanted to take a joint loan with my husband to buy a property of our own to live in. Little did I know that my partner had active loans which made him ineligible to apply for another loan.

This meant that any housing loan had to be under my name. It also reduced the amount of money we could borrow from the bank as a chunk of my partner’s salary was used to pay off his debt.

Related

Learn about your partner’s financial past and present

When I wanted to buy a property with my husband, I found out that I had zero credit history because I had never taken a loan and didn’t even own a credit card. Because of that, my credit rating was low, and the loans that were offered to me by the banks were not very favourable.

To make matters worse, my husband had active loans, so he was not eligible to apply for another loan. Hence, I felt like had no choice but to settle for a loan with higher interest rates.

Looking back, I realise that this situation could have had better outcomes if we had been open about our finances. We would have been able to map out a proper plan, like having me apply for a credit card to obtain a credit rating.

Children or no children?

As foolish as it sounds, my husband and I never spoke about children before we got married. It is really fortunate that both of us wanted kids, because can you imagine what would have happened if we had differing views?

Furthermore, having children not only changes the dynamics of a relationship – it also impacts a couple’s finances. To give you an indication of what I mean, we spent RM10,000 from conception to the birth of our child. The money was spent on supplements, tests, delivery costs and hospital charges.

We only started saving for a child after we got married and welcomed our baby after a few years of saving up. But if we had wanted to start a family immediately after marriage, we would not have been able to do so because of financial constraints.

Related

Plan long-term financial goals together

When the Covid-19 pandemic hit, my husband and I were both unemployed. For over a year, we had to survive on part-time gigs and on our savings. We would pool our money together to see how much we made every month.

It was then that I realised just how interconnected our finances were and that we both needed to be on the same page when it came to money. Because even if I have enough savings for my retirement, if my husband doesn’t, I would have to support both of us, and vice versa.

The pandemic made us relook the way we manage our finances for the better. As soon as we were back in the workforce full-time, we set up an education fund for our children and an emergency fund for any unplanned situations that came our way. We also began actively planning for our retirement by setting aside a set amount of money every month.

For couples who are thinking about taking the next big step in their relationship by getting married, have these important money conversations with your partner so both of you are financially aligned for your journey ahead.