Budgeting | Life | Personal Finance | Article

Living Paycheck To Paycheck? Here’s A Guide To Effectively Track Your Expenses

by The Simple Sum | 14 Mar 2025

If you live paycheck to paycheck, you understand the stress that builds as the month nears its end and all your savings have run dry. With no additional funds to speak of, even a minor financial emergency can throw you into debt and derail your finances.

There are ways you can break free from this cycle, and it starts with tracking your expenses.

Tracking your expenses helps:

- Understanding your spending, which helps you live within your means

- Prioritising essential versus discretionary spending

- Setting aside emergency funds

- Saving towards future goals and retirement

Making expenditure tracking a regular habit might seem daunting, but these five fun and easy tips can make it as instinctive and automatic as brushing your teeth!

#1 Choose your tracking method

Taking note of every single expense may feel exhausting, but with a little practice, you will be able to do it in your sleep!

The key is to find a tracking method that works for you. If the method is too much of a hassle or too time-consuming, the habit may become unsustainable, causing you to lose momentum.

Fortunately, there are several quick and easy ways to track your expenses. For those who are tech savvy, a spreadsheet (e.g., Microsoft Excel or Google Sheets) or a budgeting app (e.g., Nugget, Excel) are ideal.

But if dealing with tech and apps feels like a chore try something a little more analogue, a notebook works as well. Keep it simple and neat: record the date, the amount and the nature of the expense.

If you allocate a specific time for expense tracking, one that works with your routine (perhaps at the end of the day), you are far more likely to stick with it long term. Once expense tracking becomes an effortless habit, you’ll have a much better handle on where your money is going each day, week and month.

Related

#2 Record your expenses regularly

After buying something, it is common to use or consume the product without recording the expense because we often assume we can do it later. However, as we all know, “later” rarely comes as we tend to forget about it.

To prevent this, it’s important to record every expense as soon as possible. As expenses accumulate, it becomes increasingly difficult to accurately track your spending. Whether you use an app, a spreadsheet, or are just writing it down, enter the expense right away while it’s fresh in your mind. As an added benefit, the simple act of recording each swipe, tap or scan can prompt you to think more critically about the purchases you are making, helping you steer away from impulsive splurges.

#3 Create categories for different expenses

Day-to-day expenses can become overwhelming to organise when you have a lot to think about – for example stocking up on instant noodles, phone bills, cloud storage costs, the designer swag you just couldn’t resist, and those tickets to that upcoming concert for your birthday.

Categorising your expenses makes things much clearer. Start by splitting your expenses into “Needs” and “Wants”.

Needs are those must-haves for survival like rent, loan repayments, utilities and food.

Wants, on the other hand, are all the extras that make life fun but aren’t 100% necessary. They are treats or little indulgences like dining out, buying new shoes or booking weekend trips with friends. Enjoyable, but not essential.

By categorising your expenses, you can easily prioritise your spending, making sure the necessary expenses are covered while being mindful of not overspending on discretionary expenses.

Related

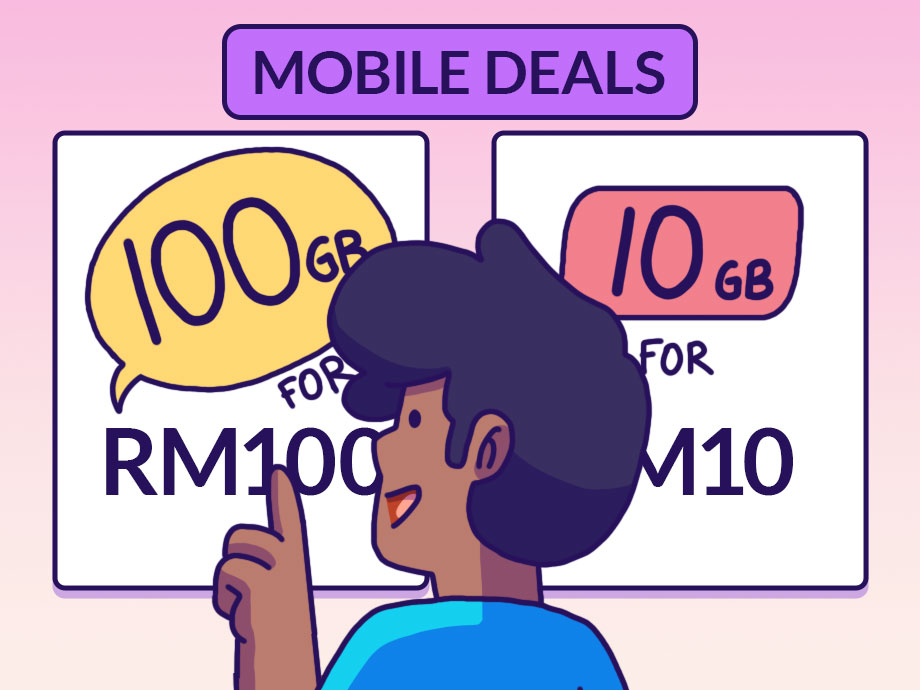

#4 Identify and tackle spending blunders

Reviewing your expenses is the critical next step to understanding how you have been spending your money. By analysing your spending, you can spot bad spending habits and make necessary adjustments to avoid repeating these financial mistakes. Try to go through your expenses at least once a month to prevent unplanned spending from creeping up on you.

For example, if you find yourself spending a lot on dining out because your friends always invite you out, you might want to politely explain your situation to them and cut back on these hangouts. You could also invite them over for a potluck get-together.

#5 Set your limits and goals

Setting limits and goals are important ways you can gain control of your finances. Limits are clear boundaries for different expense categories, kind of like guardrails that prevent you from going overboard.

Goals give you something specific to work towards, whether it’s saving for a house, paying off debts, or building an emergency fund. For example, the 50-30-20 rule where you set aside 50% of your salary to your needs, 30% towards wants and 20% to your savings.

Having targets motivates you and makes tracking expenses more meaningful because you can monitor your progress. First, decide on your spending limits for each category, then set goals for what you intend to do with the money that is saved. You can break up big goals into smaller targets, such as saving a specified amount every year for your house fund.

Regularly reviewing your expenses against these limits and goals can help you stay focused and on track to achieve your financial targets. And remember to celebrate not just when you reach your main goal, but also when you achieve smaller milestones!

While tracking expenses may seem tedious, it’s crucial to develop this positive habit for your financial well-being. And if you stumble or make mistakes along the way, don’t be too hard on yourself – just pick yourself back up and resume where you left off because this journey is a marathon, not a sprint.

This content is part of the Temasek – Financial Times Challenge, a financial literacy education series in Singapore for youths.