Life | Personal Finance | Article

Is Money Stressing You Out?

by Ooi May Sim | 24 Nov 2022

Money is one of the biggest stressors in life. Lately, the rising cost of living, stagnant income and meagre savings is causing many of us to stay up late at night worrying about our finances.

Last year, a survey found that financial stress faced by Malaysians rose by 35%. The study, conducted by Credit Counselling and Debt Management Agency (AKPK) titled “Money and Mental Well-Being” revealed that more than 65% of the respondents felt that financial stress affected their job performance, while a further 41% admitted that financial stress has taken a toll on their mental health, The Star newspaper reported.

Furthermore, the survey found that those aged between 30 and 39 have the highest financial stress scores compared to other age groups, and that the main reasons given by respondents aged 29 and below for being stressed are low salaries and overspending.

Here, we delve into the reasons behind financial stress and share ways to alleviate money anxiety.

People from different income levels worry about different things

Financial stress affects people from all walks of life. Those in the lower income bracket feel stress and anxiety when they can’t afford basic needs such as paying rent and putting food on the table, says Ronald Lee Wei Shiong, mental health counsellor from HELP University’s Centre for Psychology and Counselling Services.

“In Maslow’s hierarchy of needs, the most (fundamental human requirements) are physiological needs such as having food, water, shelter, and safety. For people in the lower socioeconomic class, it’s really about fulfilling these needs,” he says.

In this instance, Ronald suggests finding ways to increase one’s skillset and income, and to learn budgeting skills to help them get through the month without going into debt.

“For the middle-income group, financial stress stems from psychological needs, or not having enough to sustain a certain lifestyle,” he adds.

If you are having financial difficulties and your friends meet up somewhere nice every month, you may need to forego these social interactions, explains Ronald. He adds that this causes people a lot of stress because they feel isolated and like they don’t belong with their usual circle of friends.

“You need money to sustain relationships and be in a social group,” says Ronald.

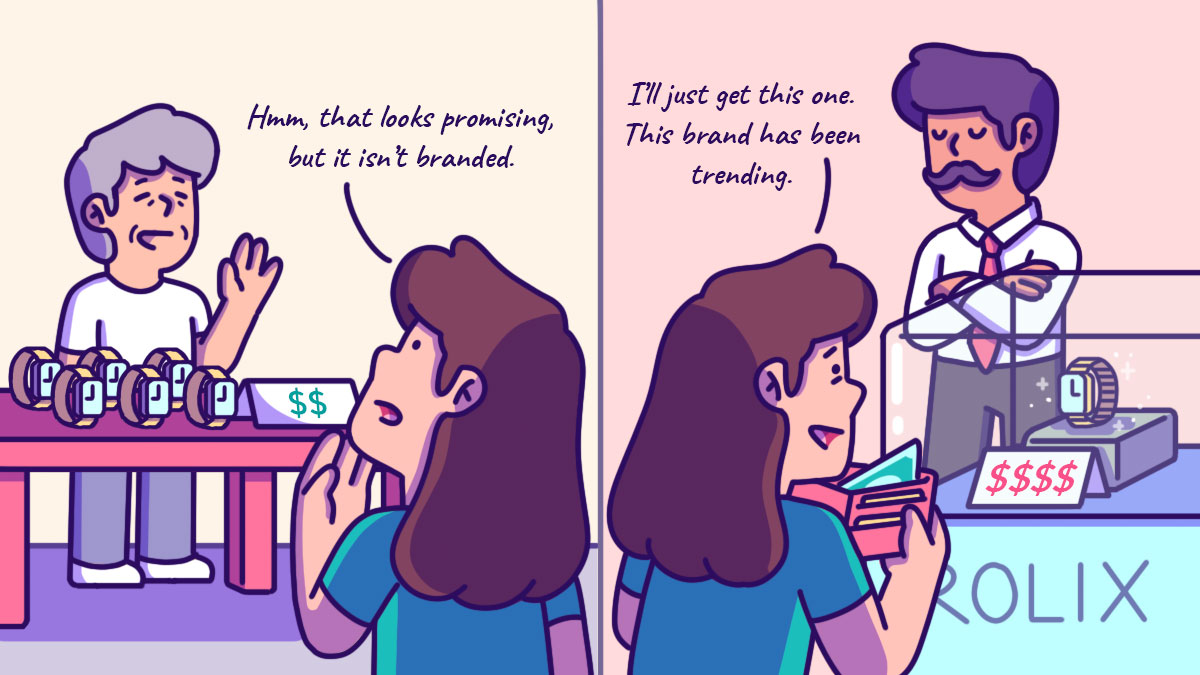

Reluctance to downgrade and social pressures

When funds are low, the obvious solution is to downgrade your lifestyle. But that’s easier said than done. This is made more difficult if you are used to a certain lifestyle and have to downgrade due to inflation eating at your budget and other factors such as getting laid off from work.

Having worked as a counsellor at HELP University since 2016, and as an active volunteer counsellor and trainer at PT Foundation’s community healthcare centre, Ronald shares that the majority of people he has met were stressed about downgrading or foregoing a certain lifestyle because it affects their self-esteem and image.

“When you downgrade, you suddenly don’t belong to (your regular) social group, yet you cannot identify with people from the lower income group. Some people cannot see themselves living in a certain apartment or condominium.

“That’s because maintaining an image is very important as it has to do with the formation of identity,” he says.

In other words, people feel that the things they own represents who they are. And these personal and social expectations increases as we age.

For example, it is acceptable and even considered the norm for someone to drive a beat-up junk car when they are in college or have just started working, but as they progress in life, people expect them to drive a nicer car. In fact, they come to expect it themselves.

Ronald shares that as people age, they begin to question: “‘At this age, what car should I be driving?’ and ‘What kind of lifestyle should I be leading?’ to show that I am successful. They think, ‘If I drive a (cheaper) car model, it means I am not doing well or living an ideal life.”

Holding unrealistic or inaccurate perceptions about how one should live life, such as the thought that having a lavish lifestyle equates to being successful, leads to biased judgements and poor decision-making, reiterates Chin Xiuli, clinical psychologist of Eunoia Mind Wellness Hub.

Related

Making poor financial decisions

Xiuli shares that difficulty in delaying gratification or managing impulses also encourage people to be less prudent with their resources, including money.

“In terms of behavioural patterns, when a person is not mindful of their spending habits, or engages in risky behaviours, there are severe monetary consequences that follow,” Xiuli says.

Dependents can add to the burden

There are also environmental influences that may lead to stress. For instance, spending habits of dependents that are left unchecked, or becoming a caregiver to an elderly, sickly or disabled family member can also add pressure to an already constrained budget, says Xiuli.

Symptoms of financial stress

Stress can affect people in multiple ways, namely physical, mental, emotional, behavioural, and interpersonal.

“Physical symptoms (include) rapid heartbeat, sweaty palms, cold sweat, shaking, aches and pains. In terms of cognitive problems, people who are highly stressed tend to be less attentive to details, thus reducing their judgement and logical deduction processes,” says Xiuli.

She adds that emotionally, people typically suffer from anxiety and fear, prolonged periods of sadness and depression, intense irritability, anger or rage.

And people who are distressed are more likely to engage in detrimental behaviours as a way to ease the emotional pain that they are suffering, even adopting unhealthy lifestyle (habits) such as smoking and excessive drinking.

In a nutshell, chronic financial stress can be debilitating and overwhelming. As a result, it can lead to more financial costs such as medical bills and job loss caused by behavioural changes and the inability to work.

Related

Here are some ways to alleviate financial stress

1. Read about personal finance

We need to equip ourselves with the knowledge and skills needed to manage our finances, adds Xiuli.

She suggests attending classes or obtaining information from reliable sources to improve your personal finance knowledge.

2. Track your spending and have an emergency fund.

You should track your expenses periodically, to ensure that your finances are in good shape, says Xiuli.

You need to have money set aside for a rainy day. Unexpected events in and of itself is stressful to deal with, so you don’t want to be caught not having enough funds to deal with them.

3. Communicate openly and set clear boundaries with dependents

Having someone depend on you financially can be stressful as it affects your budget and savings.

Thus, it is vital to talk to loved ones about their expectations and set clear boundaries on what you can and cannot provide, says Ronald.

4. Talk to a professional

If you are stressed because you feel the need to maintain a certain identity or are inflexible in making lifestyle changes such as downgrading, my advice is to talk to a professional, says Ronald.

Together, you can reprioritise and realign your needs, wants and goals, based on your values, he adds.