Financial Planning | Personal Finance | Article

Financial Independence and Retire Early? Set Me on FIRE!

by Marcus Lee | 6 Jan 2021

Financial Independence / Retire Early. That’s the FIRE movement. Is it achievable? And if it is, can you make it your New Year’s resolution? Let’s find out.

Financial independence

In a nutshell, you may call yourself financially independent if you have enough money set aside and earn enough passive income from that savings to never have to work again. While not everyone wants to retire early, many of us in the workforce with demanding jobs can relate to the desire to never have to check your emails again.

That said, how do you achieve this goal? How much do you need to set aside every month? And how early do you want to retire? We’ll try to answer all of that in our FIRE breakdown.

Retire early

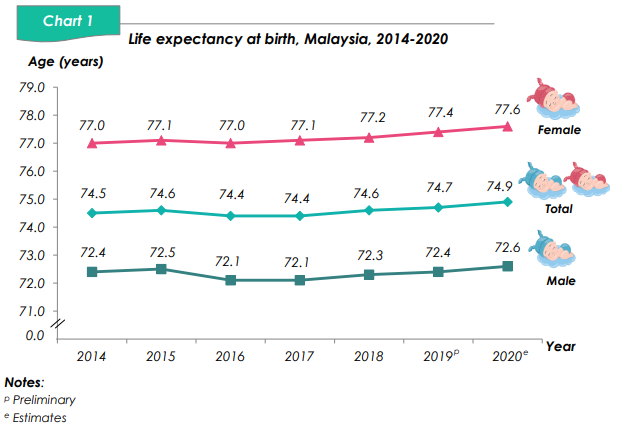

According to the latest study by the Department of Statistics in Malaysia, the life expectancy of a Malaysian born in 2020 is at least until the age of 75 – longer if you’re a woman. The current age of retirement is 60 in Malaysia and if you were to retire earlier, say at 40, you would need to have passive income to support you for at least 35 years!

35 years of never driving to work again, never hating Mondays again, never having to answer to anyone again… sounds good?

Related

Achieving FIRE

To achieve FIRE, you need to have passive income greater than your expenditure. Mr Money Moustache, an advocate and educator of the movement, distills the requirements for FIRE into two variables: how much (money) you take home each year and how much can you live on. The FIRE movement hinges on your ability to save and to limit frivolous spending.

Your salary after deductions is important, but not as important as how much you can live on. Your ability to never work again hinges greatly on how much you like to spend, or how little. We’ll illustrate this with an example.

How much do I need to save?

The principle of saving in the FIRE movement is for you to live off the interest payouts alone. For example, if you have RM1 million in your EPF and the dividend payout is 6%, you would have RM60,000 to live on TAX FREE for that year. Assuming you live a debt-free life, you would have at least RM5,000 each month.

To ensure you’re able to keep living without a job, your spending cannot surpass this dividend payout.

Can It Be That Easy?

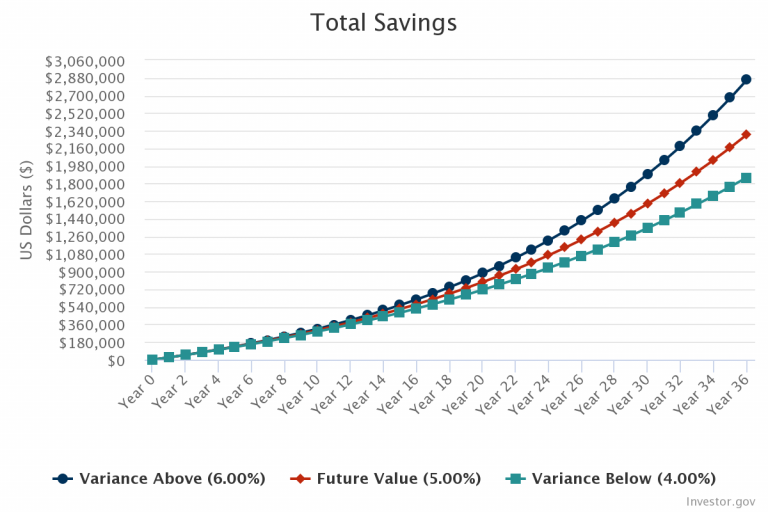

Let’s get to the math using the power of compounding interest. Let’s assume you take home RM4,000 at 24 years old after EPF, tax, and SOCSO. Assume you can live on only RM2,000 a month and you save RM2,000 a month every month until you retire. At 5% interest per annum accounting for 1% variance, when you hit 60, your savings would be about RM2.3 million.

That’s RM115,000 a year in dividends! Now the point of FIRE is to keep your expenses low and live off the dividends each year without dipping into your principal savings, so if you maintain expenditure at RM2,000, you have a cool RM67,000 a year extra to work with.

FIRE proponents urge you to reinvest this extra dividends each year to hedge from interest rate fluctuation. In fact, if your life mirrors our example exactly, you’ll only have to work for 17 years and you can retire at 41 years old according to this Retirement Calculator.

The math:

| Savings in investments at 41 years old | RM620,168.79 | ||

| Yearly dividend received at 5% | RM31,008.44 | ||

| (minus) Yearly expenditure 4% | RM24,806.75 | ||

| (minus) Reinvestment to hedge interest fluctuation 1% | RM6,201.69 |

On FIRE or burnt out?

Saving 50% of your take home salary is of course difficult. In our previous example, to retire at 41, your yearly expenses has to stay at RM24,000 even at 41, and that’s almost impossible for many. There are examples of bloggers who live in tents to adhere to the FIRE principle while others use the FIRE principle to retire from the hustle and pursue their actual dreams that may not have high monetary returns.

You don’t have to look hard to find people who chased FIRE only to experience burnout. These people caution that while the idea of never working again is romantic, sometimes you don’t want to retire from work altogether, you just want to retire from your current job.

New Year’s resolution?

The FIRE movement is targeted to individuals who want to live happier with less, quit the rat race early, and eschew the ways of capitalism. If this sounds like you, then great! It’s never too late, nor too early, to start.

If you’re the sort that enjoys what you do, then keep on keeping on. Keeping in mind the power of compounding interest and the benefits of putting away as much as possible as early as possible.

Make 2021 the year your start taking better care of your finances! Even if you don’t adopt FIRE, start taking a closer look at your balance sheet.