Personal Finance | Article

Microlending: Why Are People Signing Up For Microloans And Are They Dangerous?

by The Simple Sum | 12 Mar 2025

Have you ever dreamed of running your own business? Well, many of us have, but we don’t always have the means to get started.

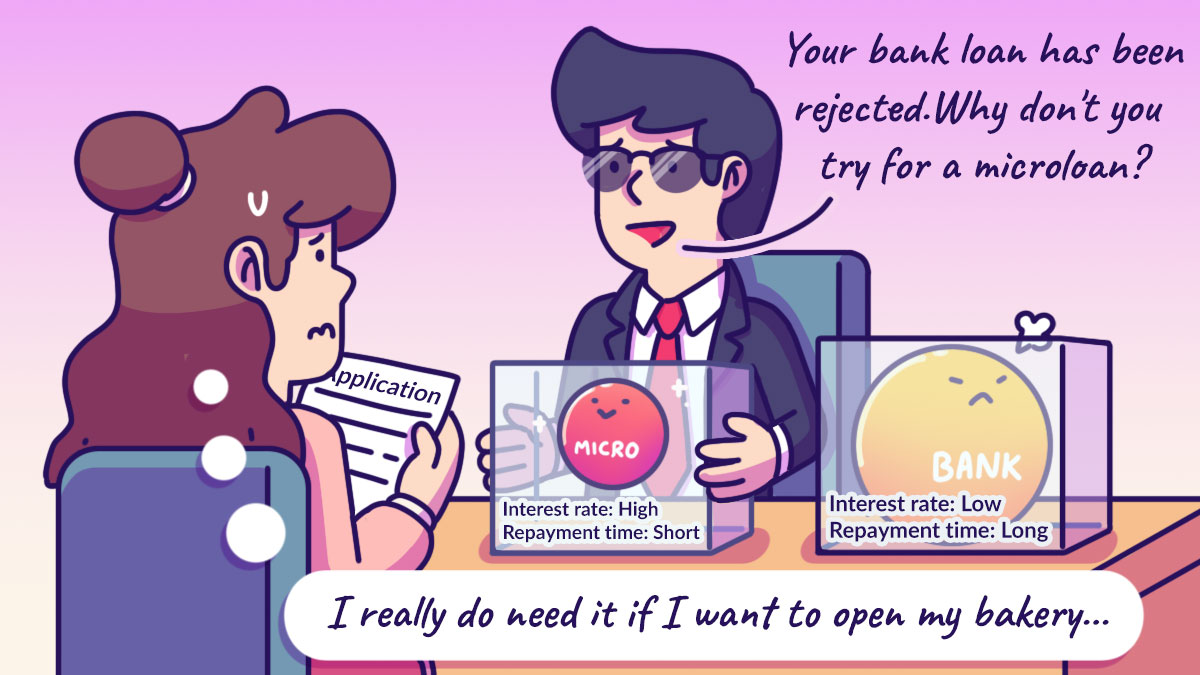

To realise your dream, you need funding. Your first thoughts might be to apply for a traditional loan from a bank. But when you get there, you find out that you need profit reports or collateral (such as property or assets) to apply for a loan. Traditional banks and financial institutions use these to assess the risk of lending and ensure that the borrower can repay the loan. However, as a startup, you might not have any of these.

That’s where microloans come in. Microloans typically have fewer requirements and can loan smaller amounts of money, making them more accessible to those who may find it difficult to secure a traditional loan.

But can these small loans really help you? And is there a catch? In this article, we’ll explore how microloans work, why they’re gaining popularity, and, most importantly, what you should be aware of before signing up for one.

Related

How can these loans help you?

As its name suggests, microloans are small loans that are given to individuals or business by nonprofit organisations, microfinance institutions (MFIs), or peer-to-peer lending platforms.

Unlike conventional loans, microloans do not require extensive paperwork, collateral, or a high credit score to apply for one. Instead, lenders typically evaluate borrowers based on their potential for success, especially for those who are borrowing to start or grow a business.

The loan amounts are also significantly smaller than conventional loans. If you are someone who would like to start a business but do not have the means to, microloans can be a powerful tool that can help you. Microloans can provide the essential capital you need to bring your business idea to life. With this financial support, you can take the first steps towards building your business, allowing you to pursue your dreams and grow your wealth over time.

For many, this financial assistance gives them an opportunity to improve their lives and access resources they wouldn’t have had otherwise.

Microloans also promote financial inclusion, especially to the underserved communities where traditional financial services may not be easily accessible. By taking a microloan, borrowers can build their credit history and improve their credit rating. This, in turn, can open doors to larger loans from banks and other financial institutions in the future.

Additionally, many microloans come with more than just financial support. They often provide financial literacy training that can benefit the borrower. This added benefit gives borrowers valuable skills that go beyond just the financial assistance itself – it gives them lessons they can take with them throughout their lives without having to repay them.

Understanding the fine print

While microloan not needing collateral benefits borrowers, they come with higher risk for lenders. And in the world of finance, the higher the risk the higher the interest rates! This is especially true for microloans that are provided by non-traditional lenders, where interest rates can be significantly higher. As a result, borrowers might end up paying far more than what they initially borrowed.

On top of the higher interest rates, microloans typically have shorter repayment periods. While this could work in your favour by reducing your total repayment amount, a shorter repayment period could place more pressure on you. Higher monthly payments might make it more challenging to manage payments and could strain your finances.

Additionally, while microloans may be easier to obtain, they can turn problematic if you borrow more than you can afford, especially if you take out multiple microloans. This could push you into a cycle of debt that’s difficult to escape.

Related

Although microloans are typically more accessible to a wide range of borrowers, they may still come with specific eligibility criteria. Lenders might ask for credit checks or even a detailed business plan before approving your loan.

Even though microloans generally involve smaller loan amounts, the combination of high interest rates and shorter repayment periods can create significant financial strain. Before committing to any loan, make sure to carefully compare interest rates, loan terms, repayment schedules, and penalties from various lenders. It is equally important to really think about how much you can realistically afford to borrow.

While microloans can promote financial inclusion by providing much-needed capital to underserved communities, they come with their own set of challenges. And while they can be a stepping stone for aspiring entrepreneurs to realise their dreams, it is essential to remember that, like all loans, microloans can become detrimental if you’re unable to repay them. So, be sure to do your research and plan your finances carefully before committing to any loan.