Budgeting | Personal Finance | Article

Why It’s Important to Save RM100,000 by 30

by Marcus Lee | 27 Jan 2021 | 5 mins read

In the parlance of personal finance advisors, a certain magical number always comes up: 100,000. Here we’ll go into why this number is so special and why it’s important to save RM100,000 by 30.

To get you excited about the idea, let’s look at the math that makes RM100,000 the magic number in personal finance.

The RM100,000 math

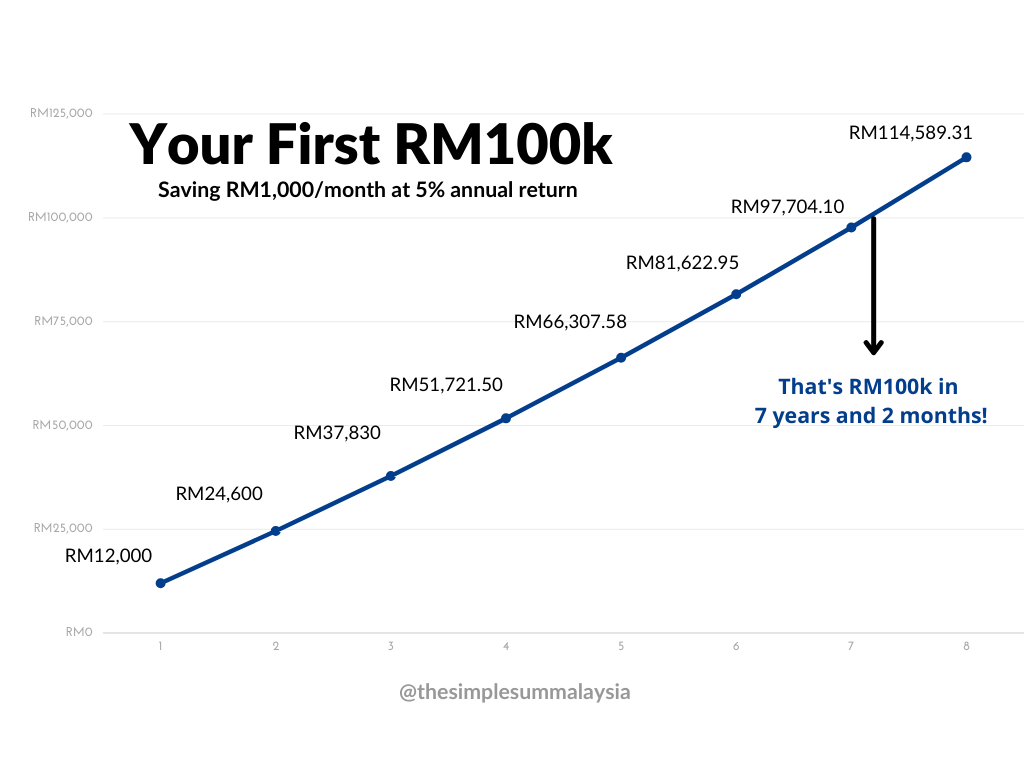

If you saved RM1,000 a month and put those savings into an investment that returns 5% annually, you’ll have grown your savings to RM100,000 in seven years and two months. Say you start work at 22 years old, by saving RM1,000 a month, you would hit that magic RM100,000 by the time you reach 30.

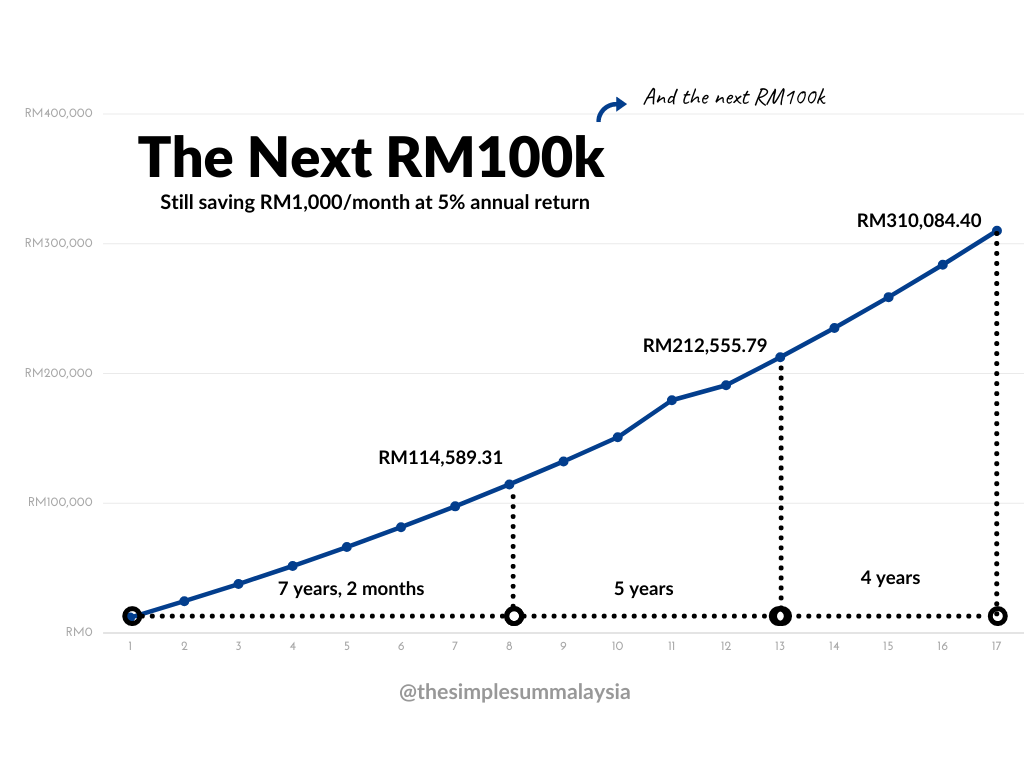

Saving RM1,000 a month feels like a lot, especially in your 20s. But by saving and investing this amount earlier in your life, you’ll take less time to get to your next RM100,000 – all thanks to the power of compounding!

In fact, the power of compounding cuts down the time you need to get to RM200,000 from seven years to only five years! (Not to mention, you don’t have to save as much money to get to RM200,000).

If you keep on saving RM1,000 a month throughout your life, you’ll begin to see a snowball effect in your interest earnings.

Most of your first RM100,000 comes from the effort you put by saving. In our example, 83% (or RM96,000) of the RM114,589.31 you’ve accumulated in year 8 is your own savings. The remaining RM18,589.31 is the gain from investing your savings.

But after that initial RM100,000, you only need to save an additional RM60,000 for 5 years to get to RM212,555.79. So, instead of taking seven years to get to the next RM100,000, you only need five years. And instead of having to save RM96,000, you only need to save RM60,000.

At this trajectory, by the time you retire at 60, assuming you start work at 22, you’ll have a cool RM1.2 million in savings – just by saving RM1,000 a month!

This is why every finance guru harps on this magical number of RM100,000.

The best place to start saving

Businessman and shark enthusiast Shark Tank star Kevin O’Leary says that by the time you’re 33, you should have $100,000 saved somewhere.

When you’re just starting at your first job, saddled with student debt, and earning something like RM2,200 a month, it may seem impossible to have RM100,000 by the time you’re 30.

But let’s not forget that, as Malaysians, our EPF contribution is the first and best way to build our savings.

Assuming you earn RM2,200 a month, your employer will contribute 12% of your salary to your EPF (RM264), while 11% (RM242) comes out of your salary. That’s RM484 a month in mandatory savings.

All you’ve got to do after that is to top up the remaining RM516 every month to take your contribution to RM1,000. And you still have RM1,464 left from your salary to spend.

Assuming that your salary doesn’t increase as you progress in your career (highly unlikely), you’ll reach RM100,000 in 7 years.

This is the easiest way to ensure you have RM100,000 saved somewhere.

Saving RM100,000 by 30 sounds impossible!

We’ll put your mind at ease: 30 is just an arbitrary number. Sure, we can all aspire to achieve this milestone by 30 but if you can’t get to RM100,000 by that age, that shouldn’t put you off from saving and investing.

While having RM100,000 saved is important, we also understand that it may be difficult (or almost impossible) to some.

If you’re 30 and just now finding out about this, maybe have a peek at your EPF account and see if it needs some help getting to RM100,000. If you have a ways to go, divide your payments (to yourself) into manageable chunks and see if you’d still like to increase those payments once your salary increases. Your future self thanks you.

If you’re in your early 20s and find it hard to save, then make use of your best assets: time and energy. Use your time and energy for side hustles or for developing new skills. Or simply spend less, avoid debt, and live within your means. Read our advice on Money Mistakes Fresh Graduates Make for more on that.

Of course, your quality of life is certainly more important than the quantity you have in your bank account; eating Maggi Cup for every meal and stealing your neighbour’s Wi-Fi is no way to live.

So, even if you don’t get to RM100,000 by 30, that’s fine. Just think of it as a goal that you’d like to get to at some point in your life. As long as you get into the habit of saving consistently, you’ll eventually get there.

It’s not difficult to get to RM 100,000

To put it simply, save as soon as possible and save as much as possible. If you feel like the pressure to save is too much, let some months go by without saving and catch up in the following months.

More than accumulating wealth, the goal of saving RM100,00 is about cultivating a healthy habit of saving and being in charge of your finances.