Budgeting | Financial Planning | Personal Finance | Article

Want To Set Your Financial Goals? Here Are Six Pro Tips

by The Simple Sum | 8 Jan 2025

You’ve probably heard the phrase “financial goals” tossed around a lot, but what does it mean?

Money talks are often loaded with technical jargon that can make even the most diligent savers feel lost. But, at its core, financial goal setting is about having a clear, realistic plan for how you’ll earn, save, and spend your hard-earned money to achieve what matters most to you.

“If you fail to plan, you are planning to fail!”

– Benjamin Franklin

Why are these targets so important? Because we humans are fueled by purpose – aimless wandering rarely gets us where we want to go, financially or otherwise.

We also aren’t very good at relating long term plans to day-to-day decisions. So, with clear financial goals, you transform your dreams like “buy a house someday” into concrete objectives with defined costs, timelines, and action plans. Goals are like dreams with a map, they help make your visions a reality instead of just wishful thinking.

Here are six hacks to help you set (and achieve) your money goals. Let’s dive in!

Get crystal clear on your “why”

Simply setting a financial goal like “save $20,000” isn’t enough. You need to get crystal clear on the “why”.

Is it to fund your dream travel adventure? Build a six-month emergency fund? Buy your dream home? Supporting or planning for a family? Or to go back to school? Attaching personal significance to a goal makes it tangible and provides motivation to keep you going when times get tough.

What’s the point? When you’re tempted to splurge or feeling discouraged, reconnecting with your “why” provides a meaningful focus. It gives you a choice between what you want and whatever is trying to distract you away from it. Clarity of purpose keeps you pushing forward.

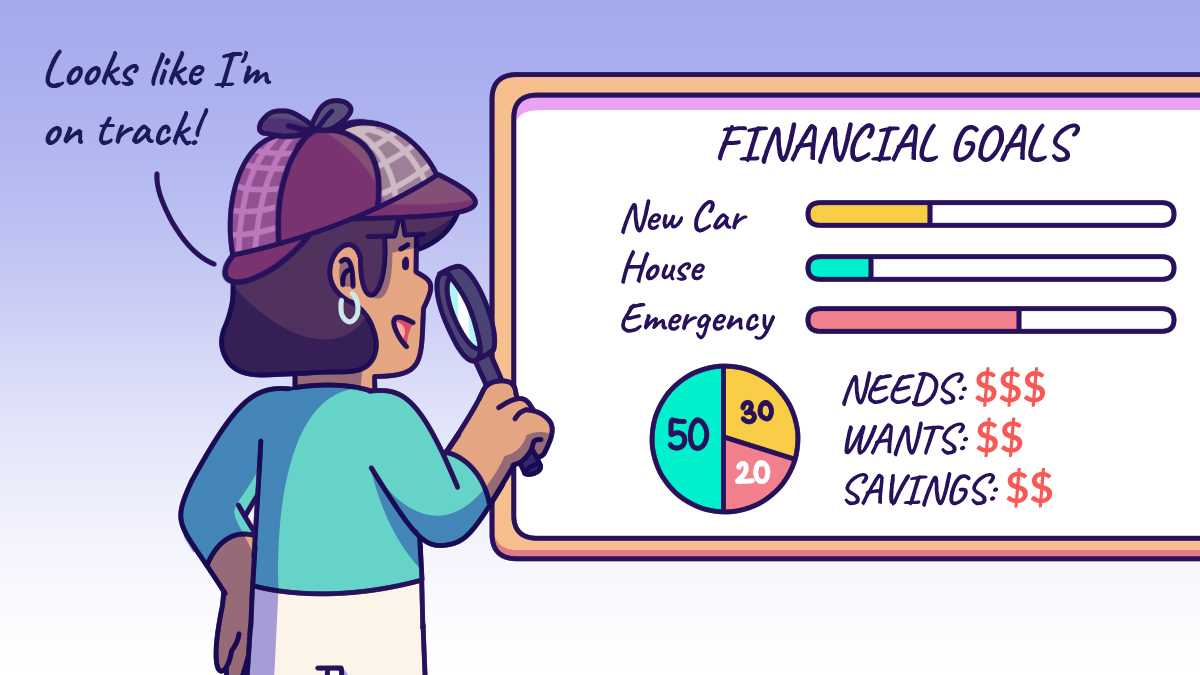

Use visual cues

You need to be able to visualise the outcome you want. Visualising your financial goals makes them feel more tangible and can promote positive action. The things you’re constantly exposed to have a powerful, subconscious influence on your habits and mindset.

Create vision boards with images representing what you’re saving towards, like a dream home or holiday destination. Use charts to literally watch your money grow as you make progress.

It’s also harder to lose sight of your goals when they keep ‘hanging around’ you. Visuals help to reinforce your ‘why‘ and encourage you to keep going.

Visual cues are a powerful mindset hack. The human brain can’t get excited about invisible, abstract goals. Can you vividly picture the future you want?

Break it down…

Starting out with a huge financial goal like saving $1,000,000 for retirement in 30 years can feel incredibly daunting. Where do you even start?

The key is to break it down into bite-sized, achievable milestones along the way. First focus on saving $5,000 in 2 years, then $50,000 in 5 years, $100,000 by the age of 30, and so on.

If you have one broad, general goal like “I want to invest and grow my wealth,” it is better to split it into separate, well-defined and measurable goals.

For example, you could set distinct goals such as “Building a retirement fund through stock investments,” “Generating passive income from real estate,” and “Starting a business to create an additional revenue stream.” By separating your overarching financial objective into precise goals, you create a clearer path to track progress towards each one.

Celebrating each smaller win provides a dopamine boost that keeps you persisting. It’s like climbing a mountain – overwhelming if you only look at the massive summit in the distance, but totally doable one base camp at a time. Small wins lead to big victories when you make your goals feel manageable.

…and increase incrementally

Don’t bite off more than you can chew. Start by committing to an amount you know you can realistically afford to save each month without stretching yourself too thin.

Once you’ve built that habit, slowly increase the amount by realistic increments as you cut spending or when your income grows.

It’s the monetary version of slowly increasing weights at the gym. The tiny bumps are manageable but compounded over the years, those small savings grow exponentially.

Ease into your goals at a sustainable pace rather than trying drastic overnight changes you can’t realistically achieve or sustain.

Don’t focus on one goal at a time

Don’t put all your eggs in one financial goal basket. Instead, categorise goals into buckets such as essentials (emergency fund, debt repayment), short-term (1-2 years for an expensive holiday or down payment for a home), and long-term (5+ years for children’s education and your retirement).

Prioritise essentials first, then fund short and long-term goals concurrently with the remaining money. As you hit goals in each bucket, reallocate funds to the next priority.

This balanced approach prevents neglecting important goals just to achieve one objective. It creates a holistic, evolving financial plan to responsibly manage all your goals based on current life circumstances and shifting priorities.

Schedule money dates

Just like regularly scheduled date nights to keep the relationship going, schedule recurring money dates to stay on track with your financial goals.

Set recurring calendar reminders each week or month to thoroughly review your budget, spending, savings progress, and overall status of your plans.

These check-ins keep you accountable and highlight areas where you need to adjust. It’s all too easy to get off track when you’re not consistently self-auditing. By having regular money dates, your financial goals, and your future self, get the quality time and attention they deserve.

Have a splurge allowance

Okay, you still need to have fun and indulge yourself. Pursuing financial goals shouldn’t mean deprivation – that’s a sure way to burn out.

Instead, have a splurge ‘fun’ fund for guilt-free spending on whatever indulgences, such as dining out or entertainment, that you enjoy.

This is a release valve to prevent feelings of a ‘strict lockdown’. It can help, psychologically, to make it easier to stick to your goals.

A little balanced fun can go a long way towards making your financial diet sustainable long-term. And, if you decide not to spend the funds, you can just transfer them into your financial goal buckets!