Investing | Personal Finance | Article

The 10 Questions To Ask Yourself Before Investing Your Money

by Cherry Wong | 30 May 2024 | 8 mins read

Investing is an important step towards financial growth and security.

Even so, the world of investing is a realm of boundless opportunities, and investing is not without its challenges and risks.

Investing is not a one-size-fits-all. What works for one person may not be suitable for another.

Instead of just jumping into any investment that catches your eye, you should ask yourself this list of questions first to ensure that the investment you’re making is the right one for you to achieve the goals that you have.

Pre-Investing Questions

This is a list of questions you can ask yourself before you start your investing journey.

Take time to answer these questions clearly and honestly because your answers can guide you to find the investment strategy that is suited to your objectives, risk appetite, and the dynamics of the investments you choose.

| Question 1: What Are My Financial Goals?

|

| Why Ask: Knowing your financial goal is crucial because it defines your investing purpose and gives a clear direction for your investments. Without defined goals, you may make haphazard investment decisions that don’t align with your goals. Knowing your goals allows you to tailor your investment strategy to meet specific financial milestones.

Suppose your financial goal is to buy a home in the next three years. Knowing this is your investing purpose, you can structure your investments to generate the returns that you need within that timeframe.

|

| Action: Clearly define short-term and long-term financial goals. Quantify them where possible and set up a timeline. This will guide your investment decisions and help you prioritize where to allocate your funds.

|

| Example: If your financial goal is to save $50,000 for a down payment on a home within the next three years, your investment strategy might involve a combination of conservative investments like high-yield savings accounts and short-term bonds to protect your principal while generating some returns.

|

| Question 2: What Is My Risk Tolerance?

|

| Why Ask: Every investment comes with a level of risk. Understanding your risk tolerance ensures that you are comfortable with the ups and downs of the market. This prevents you from making emotionally driven decisions during market fluctuations and ensures your investment aligns with your comfort level. Investing beyond your risk comfort level can lead to panic selling during market downturns or accepting excessive risk without proper consideration.

|

| Action: Assess your emotional and financial ability to withstand market fluctuations. Choose investments that align with your risk tolerance to prevent making decisions driven by fear or greed. Be honest about your risk tolerance and choose investments that match it. A risk assessment questionnaire or consultation with a financial advisor can aid in this process.

|

| Example: If you have a low-risk tolerance and invest heavily in high-volatility stocks, a sudden market downturn may cause anxiety and prompt you to sell at a loss.

Knowing that you are more risk-adverse, blue-chip stocks and bonds might suit you better.

|

| Question 3: What Is My Time Horizon?

|

| Why Ask: Your time horizon, or how long you plan to hold an investment, is an important factor to consider when planning your investment strategy. It affects the types of assets you should consider and helps decide the level of risk you can afford to take.

|

| Action: Align your investments with your time horizon. Having a longer time horizon allows you to weather short-term market fluctuations and pursue higher-risk, higher-reward assets like stocks, potentially benefiting from their long-term growth.

|

| Example: If you’re 30 years old and investing for retirement, your time horizon might be 30 years or more. This longer horizon allows you to weather short-term market fluctuations and allocate a higher percentage of your portfolio to higher-risk, higher-reward assets like stocks.

|

Related

| Question 4: Do I Understand the Investment?

|

| Why Ask: Never invest in something you don’t understand. Lack of knowledge and understanding of investment products can lead to increased risks and poor decisions. Investing in something you don’t understand increases the likelihood of losses due to unforeseen factors.

|

| Action: Educate yourself about the investment. Reduce the chances of making decisions based on speculation or incomplete information by taking time to research the market, understand the product or company, and seek advice from financial experts if necessary. Only invest in what you understand thoroughly. This knowledge empowers you to navigate the market with confidence.

|

| Example: If you are considering investing in a biotechnology company. If you lack a basic understanding of the biotech industry, drug development processes, and the regulatory landscape, you might struggle to assess the company’s potential.

|

| Question 5: What Are the Costs Involved?

|

| Why Ask: Investments often come with fees and expenses that can affect your returns. Understanding these costs is essential for accurate performance evaluation. Ignoring these costs may lead to under or overestimating the true performance of your investments.

|

| Action: Find out all associated costs, including transaction fees, management fees, and taxes. Evaluating costs helps you accurately assess the profitability of your investments and strategies to optimise your returns over time.

|

| Example: You’re considering two mutual funds with similar returns, but one has significantly higher management fees. Understanding the costs involved helps you choose the fund with lower fees, allowing you to keep more of your investment returns.

|

| Question 6: How Diversified Is My Portfolio?

|

| Why Ask: Diversification helps spread risk across different assets, reducing the impact of poor performance in a single investment. Diversifying across sectors and asset classes helps protect your portfolio from the impact of poor performance in any one area. Without diversification, your portfolio becomes vulnerable to the performance of a single investment, exposing you to higher levels of risk.

|

| Action: Ensuring your portfolio is diversified safeguards your investments against the underperformance of any single asset.

|

| Example: If your entire investment portfolio is invested in tech stocks, a downturn in the tech sector could lead to substantial losses. Diversifying your portfolio across sectors (technology, healthcare, finance) and asset classes (stocks, bonds) helps spread risk.

|

| Question 7: What is the Liquidity of the Investment?

|

| Why Ask: Liquidity refers to how quickly you can convert an investment into cash. Understanding liquidity makes sure that you can sell your investments in times of emergencies or unforeseen financial needs.

|

| Action: Assess the liquidity of your investments and strike a balance between liquid and illiquid assets. Emergency funds should be readily accessible, while long-term investments can have a more extended liquidity horizon.

|

| Example: Imagine having all your funds tied up in real estate, and suddenly, you face an unexpected medical expense. If your investments lack liquidity, you may struggle to access cash quickly.

|

Related

| Question 8: Is This the Right Time to Invest?

|

| Why Ask: Market timing is challenging but can significantly affect returns. Assessing the current market conditions helps decide if it’s an opportune time to invest. Timing is important because entering the market at the right juncture can affect your returns. However, trying to time the market perfectly is challenging. While timing shouldn’t be the sole driver of your investment choices, understanding market trends can guide you towards opportune entry points.

|

| Action: Consider economic indicators, market trends, and your financial situation before making investment decisions. Avoid making impulsive decisions based on short-term market fluctuations.

|

| Example: During a market downturn, some investors panic and sell off their investments at a loss. If you’ve assessed the right time to invest based on economic indicators and market trends, you may resist the urge to sell during a temporary decline because you know prices will recover.

|

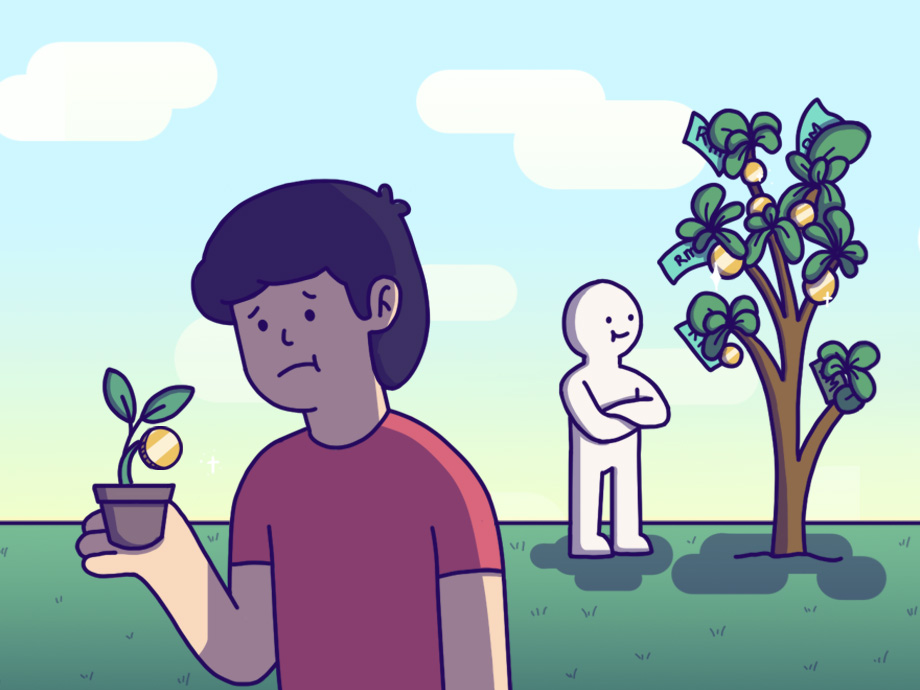

| Question 9: Am I Patient Enough for Long-Term Growth?

|

| Why Ask: Some investments, especially in growth stocks and real estate, require a long-term perspective for optimal growth. Impatience or a lack of commitment to the long term can lead to premature selling and missed opportunities.

|

| Action: Evaluate your patience and willingness to withstand market volatility. If you seek long-term growth, you will need a lot of patience to wait for your investments to grow. Choose investments that match your willingness to withstand market fluctuations for potential long-term gains.

|

| Example: If you’re investing for retirement but lack the patience for long-term growth, you might be tempted to sell during market fluctuations. Evaluating your patience helps you align your strategy with the time required for investments to grow.

|

| Question 10: Do I Need Professional Advice?

|

| Why Ask: While self-directed investing is possible, professional advice can provide valuable insights, especially for complex investment products or financial planning. Professionals can offer a broader perspective, especially when dealing with intricate investment products or financial planning. If you have difficulty understanding investing and investments, it is not a bad idea to get professional help.

|

| Action: Assessing your knowledge and experience in investing helps you decide whether seeking professional advice is necessary. If you’re unsure or dealing with significant assets, consulting with a financial advisor can provide personalised guidance and increase the likelihood of making better decisions.

|

Conclusion

Investing is not a one-size-fits-all endeavour.

What works for one person may not be suitable for another because all investors are different, and they have different goals. This pre-investing exercise helps put in perspective why and how to invest for better outcomes.

Investing is not merely about multiplying your wealth; it is about achieving your financial goals.

Hence before diving headfirst into the world of investments, take calculated steps towards realising your goals.