Financial Planning | Personal Finance | Article

Did You Know You Can Claim More Than RM37,850 In Tax Reliefs?

by Ooi May Sim | 2 Jun 2022

Updated March 20, 2023: After the tabling of Budget 2023, we have updated the tax relief table to include additional tax incentives that were announced by the government. Yay!

______________________________________________________________________________________________________________________________________

Okay, so the problem with taxes is that we never, ever think about it until it comes time to file it. As soon as tax season is upon us, we break out our calculators and do our best to calculate all our income and expenses…all within a matter of days (because, who does their taxes early?).

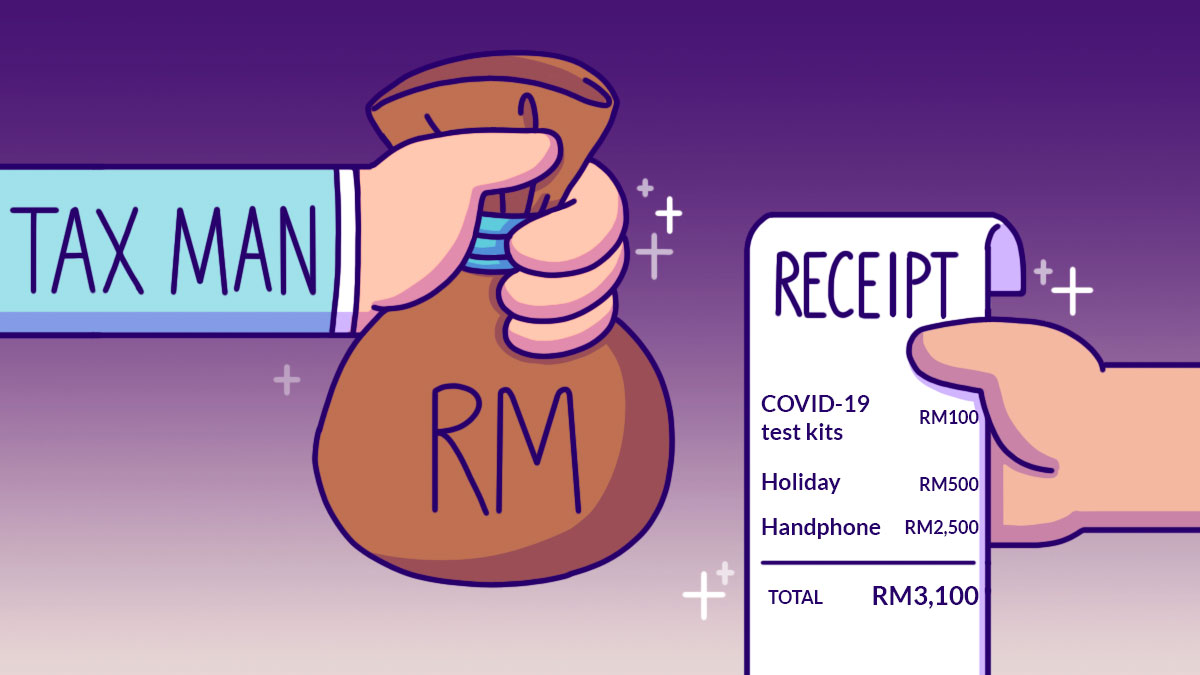

Adding to the problem, we often forget to keep receipts for purchases or payments that can be claimed as tax reliefs. Sometimes, we are not even aware of some of these rebates. So, we are often scrambling about, looking for bits of paper (receipts) that we may have left in an old bag, or scouring emails for receipts for online purchases.

And so, filing taxes becomes a stressful endeavour.

If this is you, it is time to get your taxes in order. You can get ahead of each tax season by being up to date on available tax reliefs and incentives, and by making a conscious effort to keep receipts of expenses that are eligible for tax deductions.

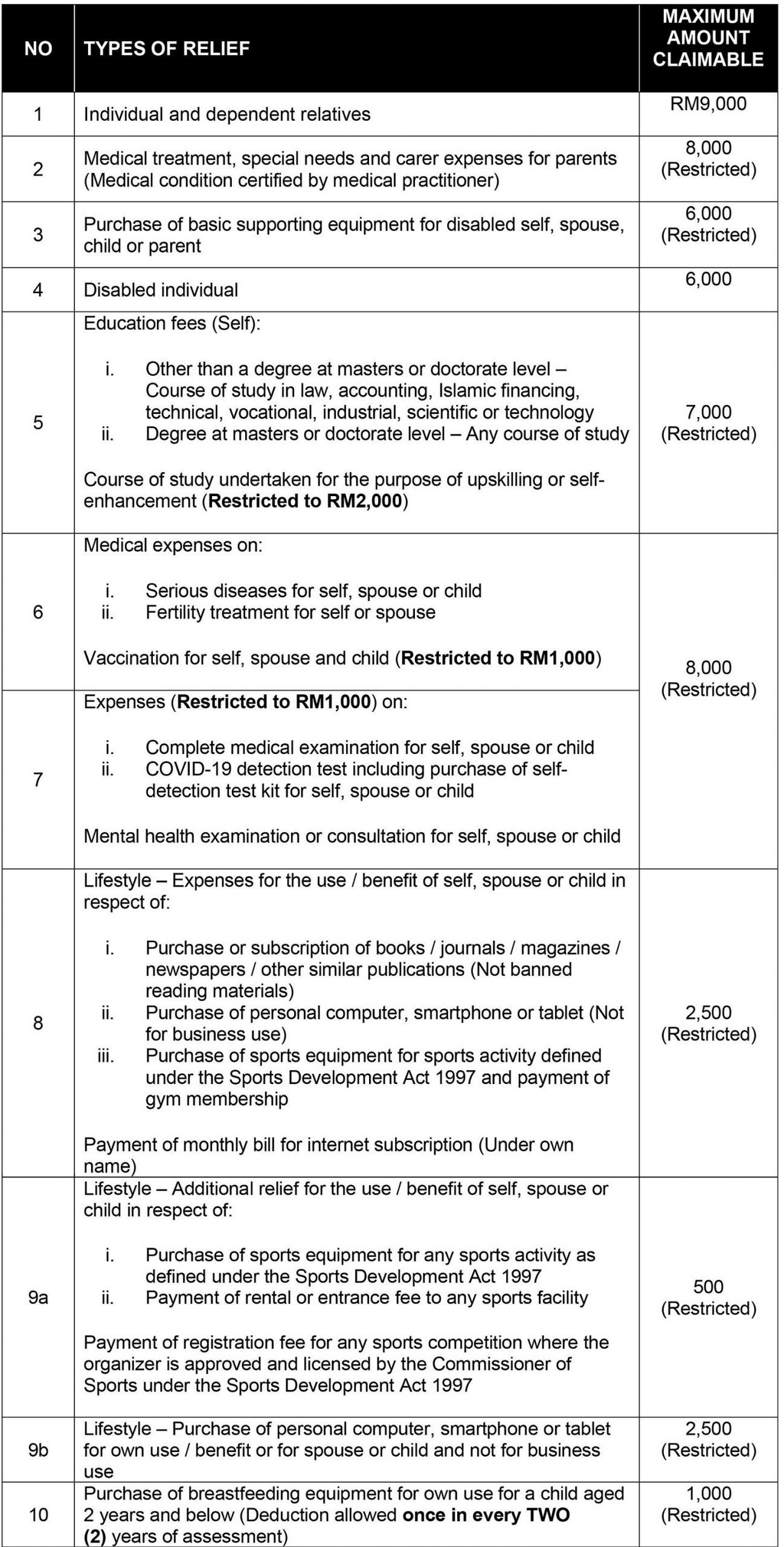

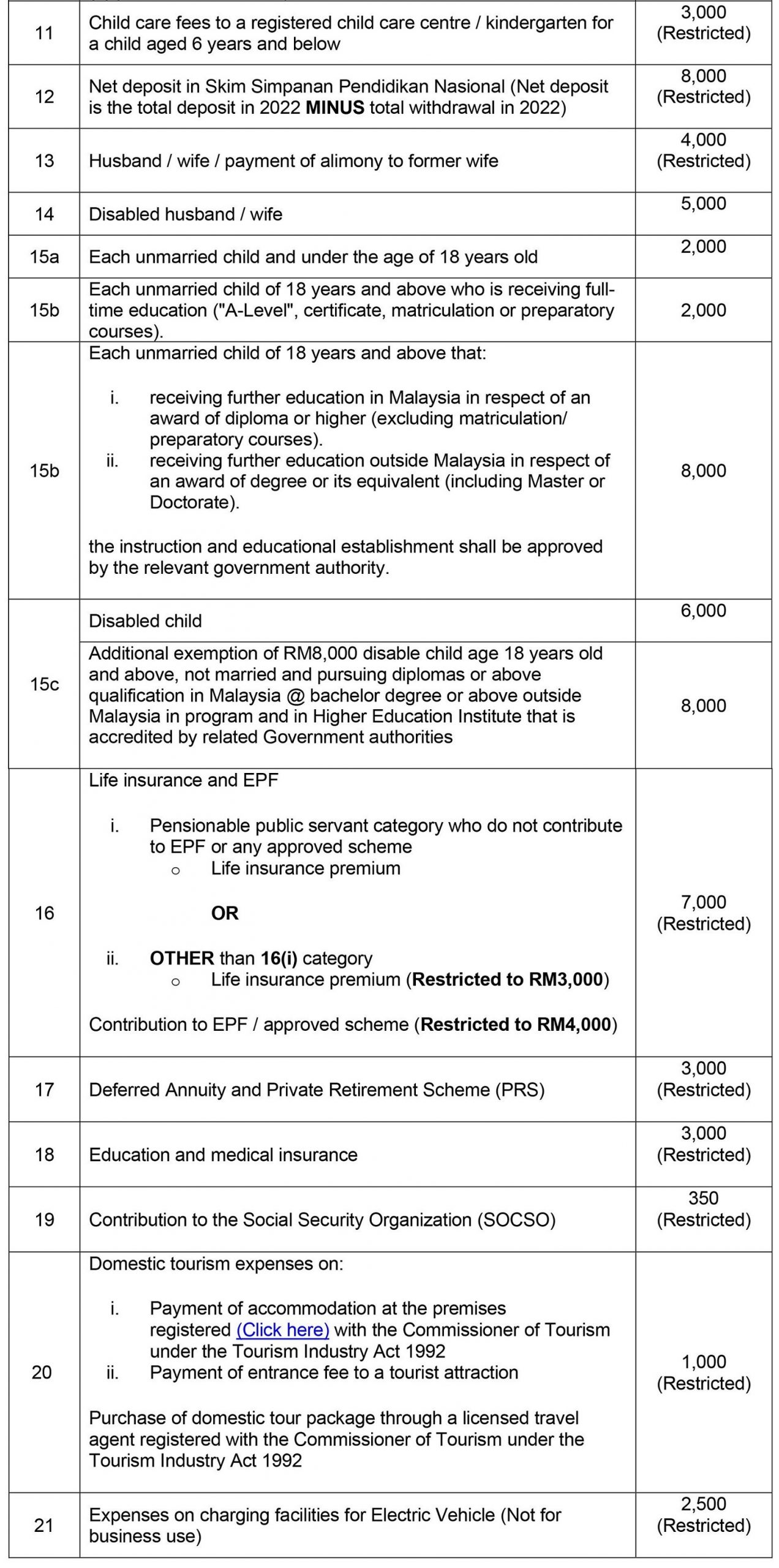

To help you, here are tax rebates you can claim for next year (2023, for Year of Assessment 2022), which you should start saving your receipts for:

Related

Important reminder

Remember to keep the receipts for all your claimable expenses because even if you have spent in these categories and are eligible for a tax rebate, if you cannot furnish a receipt for payment or proof of purchase, you would not be able to claim for it.

You are also required to keep records and receipts of purchases for up to 7 years.

If you get audited and fail to produce a receipt, you may be fined, imprisoned, or both! (Yikes!)

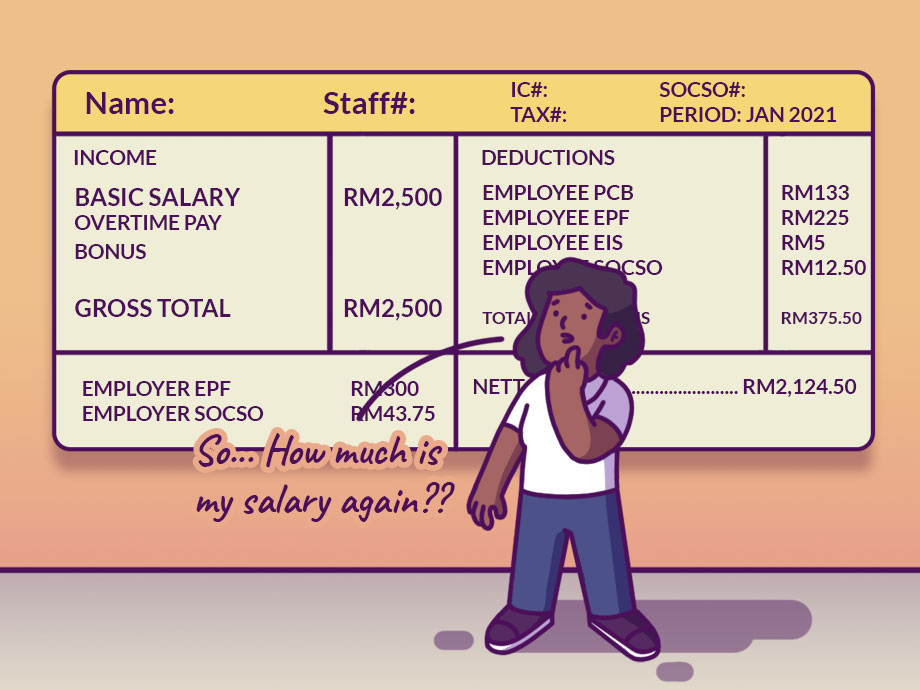

How does tax relief work?

For the majority of us, our employers deduct monthly tax payments from our income, which is also known as potongan cukai bulanan (PCB). These deductions are paid to the Inland Revenue Board, which is known as Lembaga Hasil Dalam Negeri Malaysia (LHDN, aka the tax department) and are based on your projected annual income for that year.

When you claim tax reliefs and rebates, you are reducing your taxable income. For example, if your annual income is RM50,000 and you claimed RM15,000 in tax reliefs, your taxable income would be reduced to RM35,000.

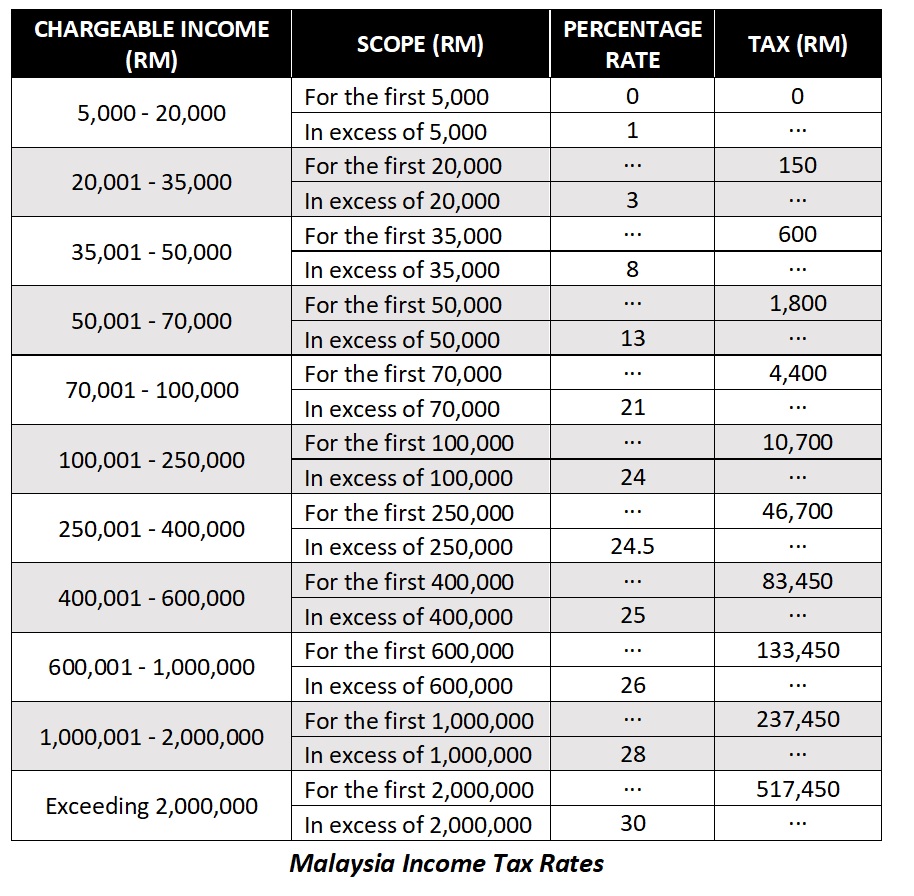

As you can see from the income tax table above, if your taxable income is RM35,000, you fall into the fourth level and have to pay a total of RM600 in taxes.

But as your annual income is RM50,000, your employer would have deducted a total of RM1800 (fifth level) from you to be paid to the LHDN. So, after filing your taxes and claiming all your rebates, you would be able to get a RM1,200 refund from the LHDN. This would be credited into the bank account you listed on your tax form, within 30 working days after your tax submission.

After filing your taxes, you may also find that you owe the LHDN more in taxes and would need to pay them the balance. Or, in the case where a company does not deduct PCB, an employee would have to declare their income when filing and pay the LHDN a lump sum amount in taxes, after filing.

Related

How much can you actually get back from tax rebates?

So, is keeping boxes full of receipts worth it? The answer to that is – yes! But how much you get back would depend on your income, which tax bracket you fall in, and how many tax reliefs you are able to claim.

To elaborate this point, here are two examples:

SCENARIO 1

Ramli makes RM5,000 a month, has an annual income of RM60,000 and pays RM3,100 in taxes. If he claims the maximum tax relief in every category which is RM37,850 (total of all the tax reliefs stated above), that will reduce his chargeable income to RM22,150. This would change his taxes from RM3,100 to RM214.50, saving him RM2,958.50.

Net annual income: RM60,000

Taxes (before reliefs): RM3,100

New chargeable income: RM22,150

Taxes (after reliefs): RM214.50

TOTAL SAVINGS: RM2,885.50

SCENARIO 2

Aminah makes RM10,000 a month, has an annual income of RM120,000 and pays RM15,500 in taxes. If she claims the maximum tax relief in every category – RM37,850 (total of all the tax reliefs stated above), that would reduce her chargeable income to RM82,150. This would change her taxes from RM15,500 to RM6,951.50, saving her RM8,548.50.

Net annual income: RM120,000

Taxes (before reliefs): RM15,500

New chargeable income: RM82,150

Taxes (after reliefs): RM6,951.50

TOTAL SAVINGS: RM8,548.50

That is A LOT of money!

So, take some time to keep this list in mind and remember to keep receipts whenever you make a purchase or payment you can claim. It is worth the trouble.