Investing | Personal Finance | Article

Should I Use A Robo-Advisor For My Investments?

by The Simple Sum Team | 10 Feb 2022 | 8 mins read

What do robot vacuum cleaners and robo–advisors have in common? They both function to help humans with things that we may not have the time or desire to do but are necessary in our lives. In the case of robo-advisors, these platforms make investing convenient for us. It is no wonder then why robo–advisors have become all the rage lately.

Although robo-advisors have been around since 2008, it was only available in our country in late–2018. Now, there are several robo-advisory platforms available in Malaysia, which include Stashaway, Wahed Invest, MYTHEO, Akru, Best, Raiz and UOBAM. For Muslims, Wahed Invest and Best also offer Syariah–compliant investing.

But just because robo-advisors offer us convenience, is it the best option for our investments? Well, before we answer that, it is important to first understand how robo–advisors work.

How does a robo-advisor work?

Contrary to its name, robo-advisors are not actual robots. They are, however, a wealth manager not unlike the traditional unit trusts that we all know of.

The key differences of robo-advisors from a traditional wealth manager is:

1. Robo-advisors remove wealth advisors from the equation

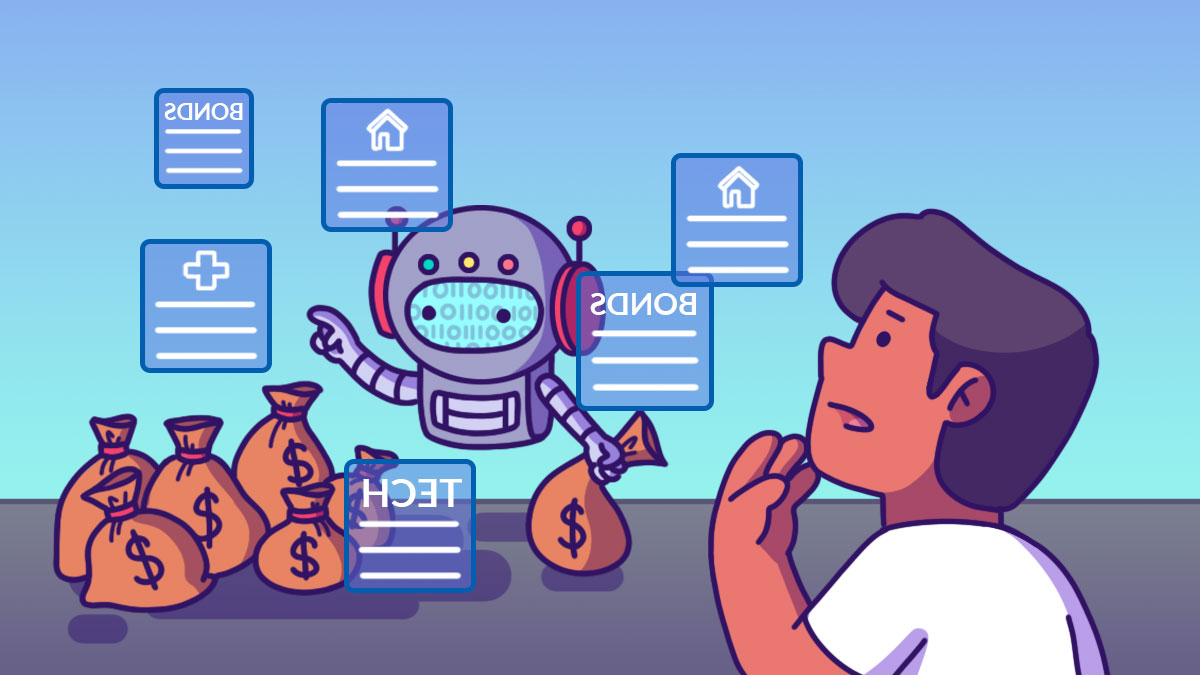

While traditional wealth managers have human advisors that would advise you on which funds or portfolios to put your money into, robo-advisors do not give such advice. Instead, they build portfolios based on risk levels, and it’s up to you to choose the ones that suit your risk appetite.

Typically, a robo-advisor will ask investors a set of questions such as income, risk tolerance and financial goals. This is to assess their preferences, risks and goals; features needed to ascertain an investor’s profile. It will then use this data to recommend portfolios to you from which you can choose.

2. Robo-advisors manages a person’s investment portfolio using little to no human supervision.

Traditional wealth managers have people that monitor the portfolio allocations and carry out rebalancing manually. Robo-advisors are digital wealth management platforms that automate this rebalancing process using algorithms.

Rebalancing is where an investor’s portfolio is realigned to maintain the original asset allocation or risk level. This is because, throughout the investing process, the weighting of each asset class may differ slightly.

For example, say your original portfolio invests 50% in stocks and 50% in bonds. If stocks performed well during a period, your stock weightings may have increased to 60%. Rebalancing would mean selling some stocks and buying some bonds so your portfolio will go back to its original 50/50 allocation so that your risk level is maintained.

Related

What do robo-advisors invest in?

Robo-advisors build portfolios using various asset classes such as stocks, bonds, real estate, currencies and precious metals, to name a few.

Generally, robo-advisors don’t buy these assets directly, nor do they trade these assets in the short-term. Instead, they buy and hold exchange-traded funds (ETFs), which are funds that hold a basket of companies or assets that track a particular index.

A portfolio with a robo-advisor could contain four ETFs – a US stocks ETF, a US bond ETF, an Asia stocks ETF and an Asia bond ETF. This means that your investments are not only spread across stocks and bonds, but also across different countries, and multiple companies that make up the ETF. This level of diversification helps to reduce risk in your investments.

In addition, a robo-advisor would increase or decrease your weightage to each asset class according to the risk level you choose.

For example, if you are a conservative investor, they might invest more of your money in bonds and cash investments. A client that chooses to take on more risk on the other hand would see more of their money being invested in high-growth stocks and stocks in emerging markets.

Benefits of using a robo-advisor

Low fees

Since robo-advisors pretty much do all the investing legwork for you, you would naturally think that it would come with an exorbitant price tag. Surprisingly, it doesn’t.

Because robo-advisors invest in ETFs, don’t actively pick individual assets, and automate their rebalancing process, they’re able to keep their costs low and pass on less of it to us.

Management fees are typically below 1% a year and go as low as 0.2% annually and RM1.50 monthly. For comparison, some unit trust funds charge up to 5% as their sales charges and another 5% once you redeem your investment value.

To break it down for you, a RM10,000 investment with a 0.2% fee would come up to RM20. That means, you only pay RM1.70 a month.

There are also no transaction or withdrawal fees, but some robo-advisors do charge a sum for when they rebalance your portfolio.

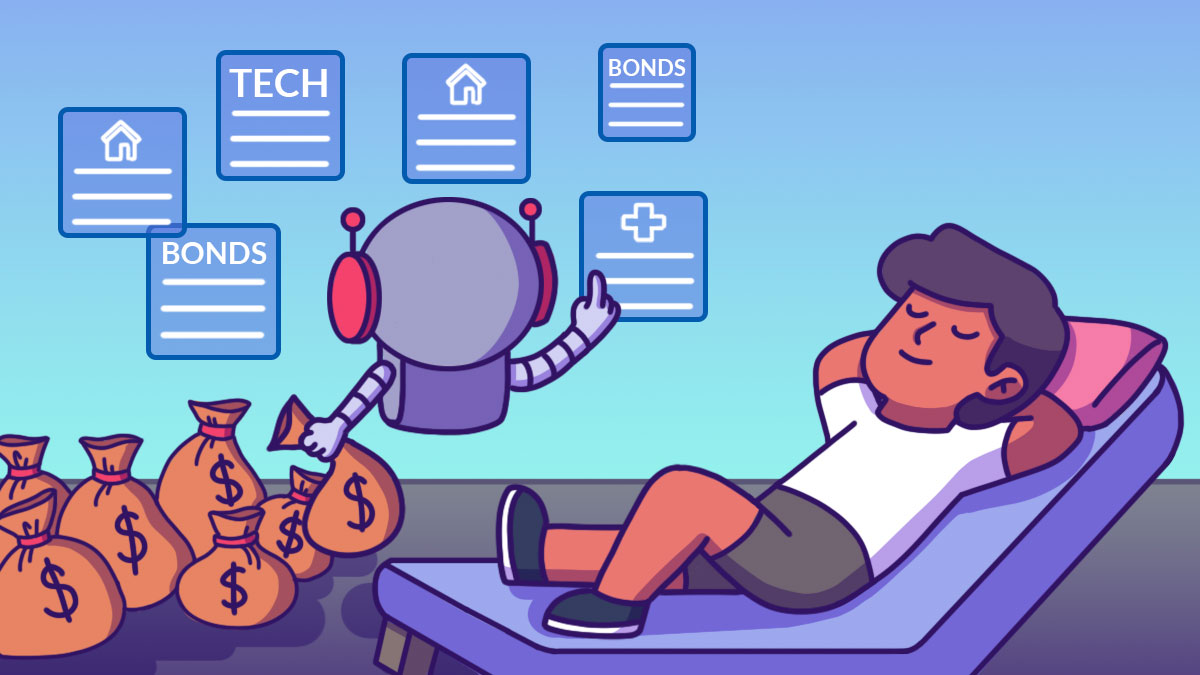

Hands-off approach

While we are aware of the importance of investing, many people do not know how to do it, nor do they know where to start. And we don’t blame them – scouring annual reports and looking at price charts can be pretty daunting.

That is where robo-advisors come in. As the robo-advisor does the investing for you, this hands-off approach is ideal for investing noobs.

All you need to do is pick a portfolio risk that you’re comfortable with and you can just sit back and let them do all the hard work. You don’t have to monitor your investments like you would if you were to pick stocks yourself.

Of course, if you are curious, you can still look into the assets that robo-advisors invest in.

Ease of setting up an account

Setting up an account is very easy. Unlike a bank account, you need not leave your home, and can set up a robo-advisor account in a matter of minutes, on your phone from anywhere.

Easy diversification

Investments are also diversified, which means they don’t just bet on one stock.

Instead, they reduce risk by spreading your investment across many different asset types and even regions. This mean that if a particular investment doesn’t perform, your investments may not be significantly affected as you have other types of investments.

Low minimum amount

One of the most important aspects of a robo-advisor is its low minimum investment amount. Most investment vehicles require you to put a minimum investment that start at hundreds to thousands of ringgit. (Heck, even fixed deposits these days usually have a minimum amount of RM500). That makes investing out of reach for many mid- to lower-income earners who do not have a lot of disposable income.

As robo-advisors require no minimum initial investment, investors can place however much money they wish, whenever they can afford to.

This democratises investing, opening the doors to a different demographic of people. Robo-advisors encourage those who do not have mass wealth to gradually grow their wealth.

Because unlike other investments, you don’t need a lot of money, time or knowledge to get started.

Convenient and flexible

Just like a savings account, your investment profile can be accessed round-the-clock. And with no lock-in period and no minimum balance requirement, this means you can withdraw your money in its entirety, at any time.

Related

Drawbacks of investing with a robo-advisor

Limited customisation

While having a robo-advisor invest for you may be convenient, the downside to that is that you have limited say in where your money should go. You cannot choose (or exclude) an individual asset or a geographical region. And if a robo-advisor changes their investment strategy such as changing the ETFs they invest in, or the countries they invest in, you may be forced to accept these changes.

Performance is not guaranteed

Although robo-advisors have lower risk due to their diversified portfolios, performance is not guaranteed.

Just like any investment, there will be ups and downs. So, an opportunity for returns also brings its risk of losing money.

Dividend withholding tax

Some robo-advisors invest heavily in American securities. A Malaysian buying US stocks is subject to 30% withholding tax, which may reduce your gains.

The big question: Should I invest using a robo-advisor?

The greatest appeal of a robo-advisor is the fact that there is very little work on your part to get started investing, and that you can start with small amounts at a cheaper cost.

So, these platforms are suited for people who are just dipping their toes into investing, those who may not have the time to do research, and those who may not have a lot of money to invest.

Though you can take a hands-off approach to investing with a robo-advisor, it doesn’t hurt to read up about each robo-advisor platform, compare their fees, and look into the assets or portfolios that they’ve built to see if it fits with your investment goals.

At the end of the day, investing is personal journey and should be catered to your needs and your risk appetite. If using a robo-advisor is for you, great! If not, look for other ways to grow your money. But just don’t leave it untouched.