Life | Managing Debt | Personal Finance | Personal Stories | Article

Should I Refinance My Housing Loan?

by Ooi May Sim | 20 Jul 2023 | 6 mins read

When I was in my twenties, I had no clue about investing but I had seen other people collect rental money from their investment properties and remember thinking what a great way that was to build wealth. So, when I got the chance to invest in a property, I jumped at the opportunity.

In hindsight, it wasn’t the best decision I made as I went in blindly without knowing anything about the property market, such as the importance of having a credit score. Back then, I had no credit card as I thought this was a financially savvy move to keep me from overspending. And because I had not taken a loan before either, I had literally no credit history.

My lack of credit rating led to multiple banks rejecting my application for a housing loan. Hence, when one bank got back to me and offered me a loan, I was thrilled and signed the agreement without realising the high interest rate it came with.

Thankfully, I’ve managed to keep up with the loan repayments ever since with little to no issues. That is until recently.

In 2022, Bank Negara Malaysia raised their overnight policy rate (OPR) four times, by 0.25% each time. The OPR determines the rate of interest for financial institutions; when it goes up, it makes it more expensive to borrow money. For me, this meant that by monthly instalments increased by over RM200 or RM2,400 annually.

And in May this year, the OPR was raised yet again to 3%.

With high interest rates and an imminent rise in OPR, I began asking myself if refinancing would help me reduce my financial burden.

Looking out for better rates

In general, there are three main reasons homeowners refinance their properties:

- To get better rates that could potentially save them thousands in loan repayments.

- To cash out on the appreciated value of the property and use the lump sum funds for:

-

- Debt consolidation where a person who usually has a few loans uses the money to pay off high-interest debt so they can concentrate on paying back lower-interest debt such as their housing loan, which generally charges lower interest rates compared to personal loans and credit card.

- Children’s education.

- Renovation on the property to further increase its value.

- Business or cashflow.

3. To switch the type of loan they have, usually between a fixed mortgage term loan, a flexi mortgage loan or a semi-flexi mortgage loan.

For me, my goal for exploring refinancing options was to try to get better interest rates from banks, since my original rates were not very favourable. This would reduce my monthly repayment, and thus, the overall sum I would be paying for my house.

The current interest rate for my 35-year semi-flexi housing loan is BFR* – 1.80% which is currently 6.75 – 1.80 = 4.95%.

So, I was looking for a bank that could offer me a package with interest rates that were lower than 4.95%.

Related

The refinancing process

However, it wasn’t as easy and straightforward as I thought it would be.

To get the exact amount I still owed the bank for my housing loan, I would need to apply for a final settlement report from my bank, MBSB, which costs RM50 and takes five working days. (The final settlement process and fee may differ from bank to bank).

The report will indicate how much I still owed the bank, and how much it would cost me to settle the loan early. The amount would include any discounts or penalties for early settlement.

And to get an offer from a new bank (to transfer my loan to), I would need to formally apply for a loan by submitting these items:

- Information about the current loan

- Copy of Sales and Purchase Agreement

- Property details

- Salary slip (last three to six months)

- Latest income tax form (B/BE Form)

The bank will then calculate my debt-service ratio to determine if I can afford the loan I am applying for, and the monthly instalment I can afford. Upon successful application, the bank will then get back to me with an offer, with the interest rate.

Related

Explore refinancing with estimated amounts

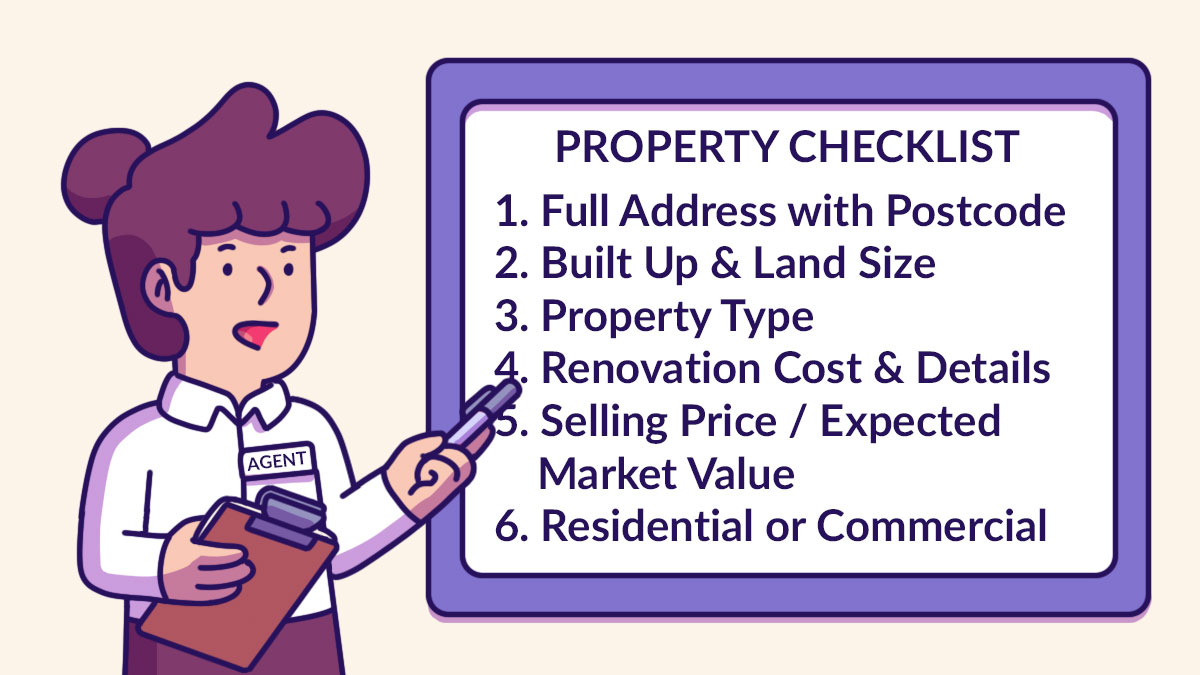

The application process above takes upwards of a month to complete. As I wanted to gauge informal estimates without having to go through all the paperwork, I contacted a mortgage manager and a bank manager to get an idea of what rates I could get if I refinanced my housing loan. To obtain this, I sent them information about my current loan, a copy of my Sales and Purchase Agreement, and details of my property, such as:

Once all that information was provided, the mortgage manager told me that I could only get a 60% loan for my remaining RM370,000 loan balance, which means I would have to pay RM148,000 upfront. As I am unable to do that, this was not a viable option for me.

The bank manager, however, said I would be able to get a 100% loan for RM370,000 at around 4.5% interest. If I refinanced my loan, it’s estimated that I could save over RM40,000 in total interest (compared to my original loan).

However, this figure does not include moving costs, which are fees required to transfer my loan to another bank. If I choose to refinance my mortgage, I will need to pay for:

- Property Valuation Fees (compulsory): When a bank evaluates the property’s actual market value and the reasons why it is worth that amount. This typically costs 0.3% to 0.5% of the original loan amount. If the property’s market value is RM410,000, I would need to pay RM1,230.

- Loan Agreement Fees (compulsory): This consists of stamp duty, legal fees and disbursement fees. The total fees range from 2% to 3% of my approved loan amount. So, if I take a RM370,000 loan, the maximum fees I would pay for this (at 3%) is RM11,100.

- Bank Processing Fees: Banks sometimes charge a fee to process mortgage refinancing application (some banks waive this fee).

Choosing not to refinance

After doing some calculations, I realised that I won’t be saving much money after deducting all the admin fees involved if I refinance. Moreover, interest rates are currently high at the moment so it would be more favourable for me to refinance when rates are lower.

While it’s upsetting that I didn’t manage to obtain a beneficial package, the good news is that I will at least be prepared and equipped with the knowledge needed if I ever explore refinancing options down the road.

*BFR (Base Financing Rate) is used by Islamic banking to price their financial products and correlates with the OPR set by BNM.