Financial Planning | Life | Personal Finance | Personal Stories | Relationships & Family | Article

Money Lessons I Learnt While Caring for My Sick Mother

by Nur Sabihah Zainuddin | 11 Jan 2024 | 4 mins read

Last year, my family and I spent months planning for a family vacation to Tasik Kenyir, Terengganu. We were going to live on a houseboat and were all very excited about the novel experience. However, life had a different plan.

A day before the trip, my mother lost her balance and fell. When we brought her to the clinic, we found that she had had a minor stroke. We were all in shock. Prior to this, she had always seemed healthy. In a blink of an eye, our Kenyir adventure was replaced with visits to the hospital.

This unexpected turn of events made me realise that life can throw you a curveball when we least expect it, so it’s crucial to be financially prepared for such situations.

Here are the money lessons I learnt while caring for my sick mother.

Related

Lesson 1: Build emergency savings

After my mother’s stroke, we had to get medical equipment and make modifications to our home to ensure her safety and comfort. And the amount required was not small.

We purchased a wheelchair and a walker, which cost RM450 and RM200, so that she could get around more easily. We also installed handrails around the house, which gave her much-needed support and stability when moving around. We installed these ourselves to save on cost, but still spent around RM100 to purchase the items.

As the bathroom can be a dangerous place because of its slippery surfaces, we installed an anti-slip mat there. This simple addition cost RM50 and significantly reduced the risk of falling. It also gave my mother more confidence to use the bathroom on her own.

There were also transportation costs we had to bear while my mother was recovering. As we live in a village that is far from the city, we had to make long trips to the hospital each time my mother needed a check-up.

Each trip cost over RM50. As we had to do it regularly, this added up over time and started to put a strain on our money.

These additional costs made me realise the importance of having an emergency fund.

Previously, my family and I had saved for fun things like vacations and dining out, but we had never considered the need to build a safety net for medical emergencies and it was a lesson we learnt with heavy hearts only after this unfortunate incident occurred.

Related

Lesson 2: Health insurance is important

My mother did not have a medical card or health insurance, so we were worried when she got admitted to a hospital.

Luckily, as I am a government staff, I was able to use my Guarantee Letter to cover her entire medical bill, which was over RM3,000.

However, this served as a wake-up call for me because it showed me that anything can happen in an instant, so it is important to always be prepared for it. I am now planning to update my health insurance policy because I have been diagnosed with young hypertension and I’m at risk for a stroke. Updating my health insurance acts as a safety net for any health surprises that may come my way.

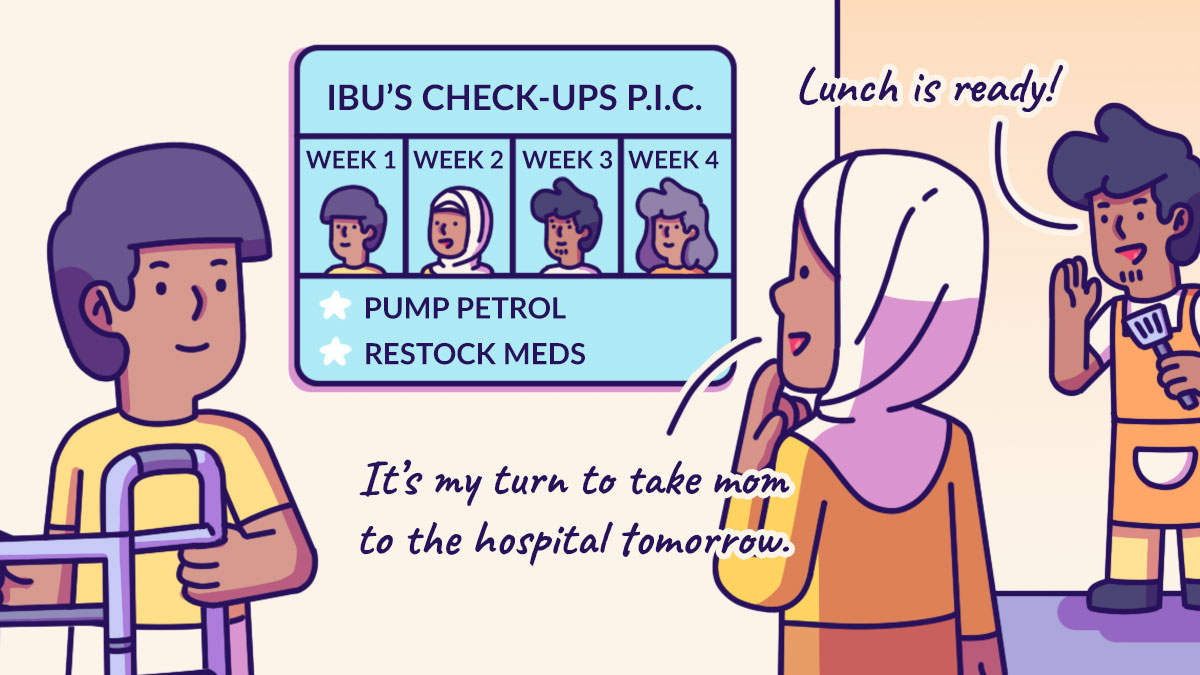

Lesson 3: Have a strong support network

During these challenging times, we realised the importance of staying connected and building a strong support system within the family. We relied on each other for both emotional and financial support.

We took turns accompanying my mother to her doctor’s appointments, and after every visit, we shared updates in our family’s WhatsApp group so everyone was always informed.

However, the most remarkable part is that we established a financial support system within the family. In case of an emergency, we would all contribute to the fund. This ensures that everyone is taken care of and that we have each other’s backs, no matter what life throws our way.

Lesson 4: Re-evaluate my financial priorities

When my mother fell ill, I had to alter my financial plans and goals to ensure we could cover all her medical needs. This meant looking closely at where all my money was going; I had to decide which things were important and which I could do without.

I realised that what I thought was important before seemed less important now. So, I began re-evaluating my financial priorities by deciding to focus on what truly mattered to me, which is my family’s and my own health and wellbeing.

My mother’s emotional journey through her illness and recovery taught me valuable lessons that has changed my perception on life and how I manage my finances for the better.