Financial Planning | Investing | Life | Personal Finance | Personal Stories | Article

What I Wish I Knew When I Bought My First Investment Property

by Ooi May Sim | 10 Mar 2022

When I was in my 20s, I bought an apartment as an investment. Back then, I thought it was the adult thing to do. Plus, as I had no clue on how to invest in stocks, I thought going into the property market was THE way to go, in order to retire comfortably down the road.

I could already picture my retired self not having to work and collecting rental income every month.

But as I grew older, I realised that I had made a hasty purchase. I did very little research and simply took the word of the agent, who, now that I think of it, was out to sell me the property. So, I should have taken what he said with a pinch of salt.

And while property investment could be a consistent source of retirement income, I also had not considered all the factors that could impede on my ability to earn that retirement income, such as being unable to find a tenant.

As with all investments, property or otherwise, it’s always important to go into them knowing full well what you’re putting your money into. Here are the lessons I learnt from making my first property investment.

Lesson 1: Research the location of your property before buying

Most people dream of owning a home to live in. I, however, wanted to buy property as an investment as I had read some articles about property investing. The idea that I could live off monthly rental income appealed to me.

Besides, how hard can it be to buy a place and find someone to rent it, I had thought.

As it turns out, tenants aren’t as plentiful as I imagined. And location plays a huge role in determining whether you can find tenants and earn a decent rental income from your property investment.

Unfortunately, I didn’t research enough about the location of my property. I just thought that buying a property in a popular high-end location would fetch me a good rental yield.

What I didn’t bank on was that the location was overdeveloped. As it was a popular postcode, every developer wanted to build a condominium there.

It was only when the project for my property was being built and I paid a visit to the construction site that I realised just how many other developments were taking place in that area.

Fast forward to 2020 when I received the keys to my unit, I found it really difficult to find a tenant. The oversupply of residential units meant that competition for tenants was tough. And with the property market at a downturn due to the pandemic, the tenants held the power in negotiations.

To give you a better perspective, I had advertised for my unit to be rented out at RM2,000 a month but there were no takers for an entire year. I ended up renting out my unit at RM1,400. It was 30% less than what I had hoped for, but at that time, it was either that, or nothing.

Lesson 2: Factor bank loan interests into the overall cost of a property

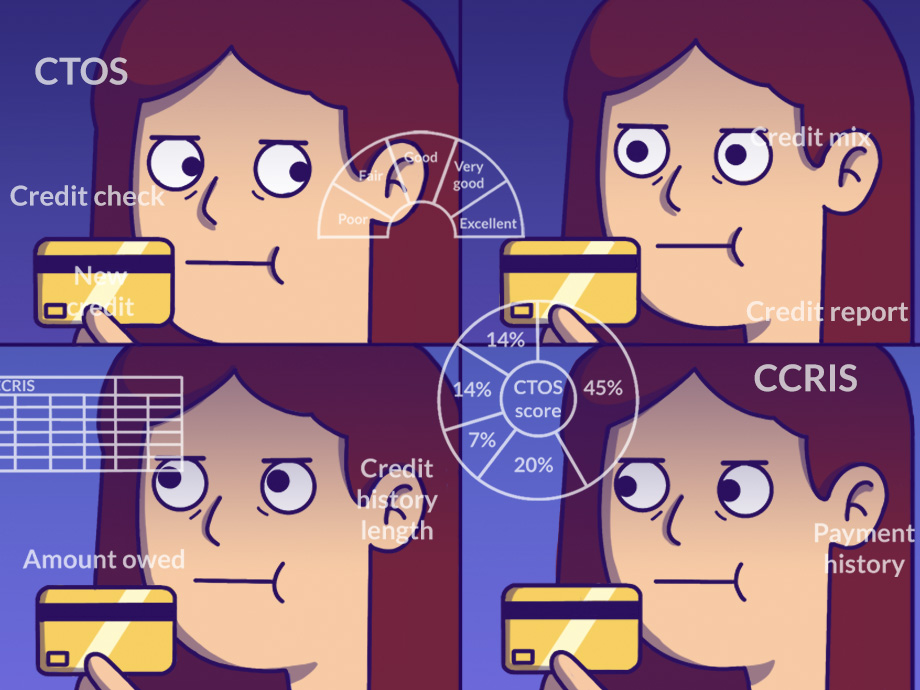

My ‘brilliant’ plan was to fork out the down payment, then take out a bank loan to fund the rest of my investment.

While taking a bank loan helps pay for the house’s mortgage, I didn’t realise how significantly it would increase the overall cost of the property.

Check out the calculations below to understand what I mean:

When I bought my unit, I didn’t even consider how much interest I would have to pay in the long run. This extra outlay could turn what seemed like a good investment into a bad one.

For instance, I bought my unit for RM430,000. If I sell the property at RM450,000 after paying off my bank loan, I would be making a HUGE loss.

On paper, it would seem like I earned RM20,000. But as I had paid RM345,123 in bank interests, I would have to make more than that amount in rental income over 35 years to make a profit.

And selling my unit isn’t an option at the moment, as property prices have dropped due to the pandemic.

While I am not entirely sure what property prices would be like in the future, banking on potential capital appreciation is a huge gamble.

Related

Lesson 3: Shop for the best bank loan

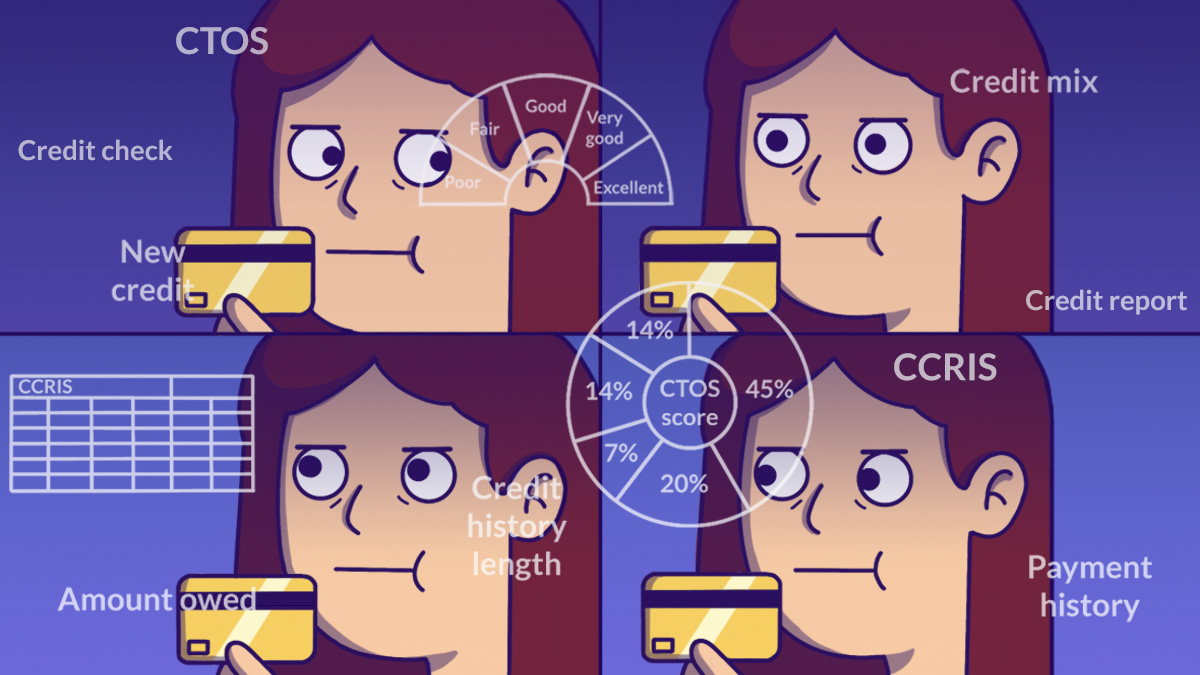

I only started looking for a bank loan after placing a deposit for the property. Back then, I didn’t have a credit card, so I had no credit score. (Banks use credit scores to evaluate a person’s ability to repay debt).

With nothing to go on, two banks rejected my loan application. So, when a third bank took me on, I quickly signed the papers without scouting for other offers. The interest for my bank loan is quite high as that is how the bank safeguards itself against borrowers with no credit history.

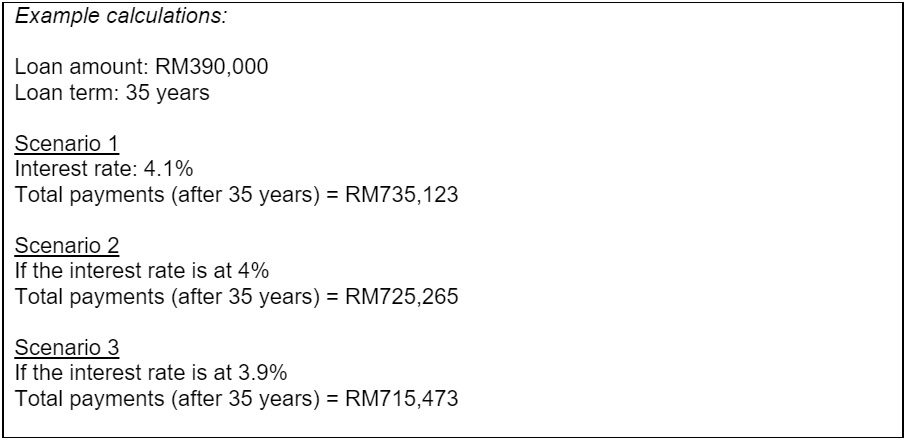

Looking back, I should have continued to shop around for a loan with a lower interest rate.

As these are huge sums of money, a slight difference in interest rate can add up to a lot in the long run.

As you can see, a mere 0.1% difference in interest rates could have saved me RM9,858, whereas I would have saved RM19,650 if my interest rate was 0.2% less. Those are not small sums of money.

Related

Lesson 4: Calculate ALL the costs of property investment

Although I knew that property investment would cost more than the initial price tag, I wasn’t ready for just how much more it would cost me upfront.

The only payment I had prepared for was the down payment (which was 10% of the property price). So, I was caught off guard when I learnt that there were other fees I had to pay for when making the property purchase. These include the sales and purchase agreement fee, legal fees, stamp duty, and valuation fees – which added up to quite a lot!

I had to withdraw all my savings to pay for these and had no emergency fund or safety net for months.

And the payments didn’t stop there.

Once I received the keys to my unit, I had to start paying the maintenance fee, quit rent (known as cukai tanah in Malay), assessment rates (cukai pintu) and utility bills.

Of course, I had no clue that the utility fees for commercial properties cost more than non-commercial ones. As my property falls under commercial development, my electricity bill cost double that of a regular residence.

Also, as my unit was empty, I had to spend money renovating and furnishing the unit to make it rental ready.

Luckily, there were a few years between purchasing my unit and receiving the keys to the completed unit and this gave me some time to recoup my savings.

Lessons learnt

Looking back, I jumped at the prospect of property investment too quickly, without thinking of the long-term implications on my wealth.

I am still paying for this property and will be financially tied down for the next 30 years.

While investing in property remains a highly sought-after strategy to growing wealth because of its high return on investment, finding the right property is crucial.

Preparation is the name of the game, especially with such a big purchase like this. And, as this is going to be a long-term plan, take your time and don’t rush into it. With that, I hope your journey into the property market would be better than mine.