Investing | Article

Investing in Gold: Why and How to Do It in Malaysia

by The Simple Sum Team | 24 Aug 2022 | 7 mins read

This article is brought to you by Maybank Islamic Gold Account-i.

When you think about gold, you often think about culture and heritage such as your grandmother wearing delicate gold bangles and rings, or family heirlooms being passed down from one generation to another.

However, gold, is far from being old-fashioned and people are seeing an increasing need to invest in this precious metal, as seen from the increasing amount of gold investment companies popping up.

But why should you invest in this natural commodity?

Reasons to include gold in your portfolio

1. Gold’s value increases over time

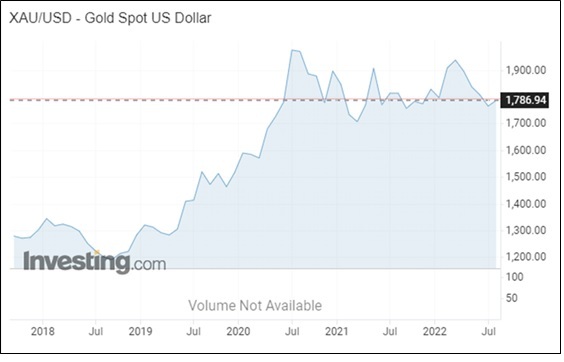

Historically, gold has been a good hedge against inflation because its price tends to increase in tandem with the cost of living.

In July 2022, gold prices hit US$2,000, and appreciated by 53% in the past five years. That means, if you had bought a RM5,000 gold bar in 2017, you could potentially sell it for RM7,650 today.

2. Balances risk by diversifying your portfolio

Financial analysts have long touted the benefits of having a diversified portfolio. That means, spreading your money across different assets such as stock, bonds and gold so you won’t lose all your investment if one asset or company goes down in value.

This is because different assets react differently in different economic situation, so having some of your investments in gold will help balance things out.

3. It is a safe haven

Traditionally, gold is viewed as a safe investment that increases in value during times of geopolitical crisis and political instability. Many people invest in gold as a form of ‘insurance’ which can be used in the event of an emergency.

Although the Malaysian ringgit has been rather stable throughout the years, if it were to ever devalue to the point where it has little to no value, having gold can prove useful as it is known to hold its value during times of crises.

Ways you can invest in gold in Malaysia

1. Physical gold

This is the most traditional way of owning and investing in this precious metal. It is also the most accessible form of gold as you can purchase it in the form of coins, bars and jewellery.

The biggest draw of physical gold is that it is a tangible asset that you can see and touch, which gives investors a sense of security as they can hold their investment. Some doomsayers believe in having actual gold in hand in case paper money becomes worthless one day.

But safekeeping physical gold comes with its own set of risks and costs. If you decide to keep your gold at home, you run the risk of it being stolen. You will probably also need to get insurance to safeguard your investment. And if you store your gold in a safe deposit box in a bank or with a third-party depository, there are additional costs and fees involved.

Though all forms of pure gold have monetary value, each form comes with its own pros and cons. Gold bars are a good way of storing large amounts of wealth in a small space, but can cost upwards of a thousand ringgit. Its bigger size (compared to gold coins) also makes it harder to liquidate – you have to sell the entire bar at a go.

Related

Gold coins, on the other hand, are more affordable and easier to liquidate due to its size. But unlike gold bars, gold coins often cost more due to its minting fee.

Likewise, gold jewellery may not be the most profitable investment, pound for pound, compared to gold bars and coins because of the markup for design, craftsmanship and marketing costs. Price markups can be 20% to over three times the value of the raw material itself.

Plus, it isn’t easy to sell gold jewellery, as you’ll need to find a buyer who likes the piece’s design. Some buyers only want to pay for the weight of the gold, meaning you would have lost out as you paid more for the jewellery’s craftsmanship.

The other potential downside of investing in physical gold is that you lose out on potential dividend payments. Unlike stocks that often pay regular dividends (quarterly, yearly or half-yearly), holding on to gold only brings appreciation value.

Whichever form you choose, be sure to buy gold from a reputable dealer or financial institution. Also, check the gold’s purity, form, size and weight before purchasing.

2. Digitised gold

Digitised gold is basically physical gold that is being traded electronically. It allows you to buy and sell physical gold that is held at secure vaults, digitally. Investors prove ownership of their gold through digital records.

This is one of the most efficient ways of owning and trading in gold. It also solves the issue of safety and storage that owning physical gold has, as you can own gold without having the responsibility and hassle safekeeping it, reducing the cost and risk of owning gold.

Digitised gold is also easier to trade. You have the flexibility to determine where, when and how you would like to buy or sell your asset. Plus, as trading is done online, it is highly liquid and can be done round the clock.

Digitised gold gives you the option to enter the market at a lower cost and risk through fractional investing. When gold is digitised, it can be ‘broken down’ to smaller fractions, breaking the high entry barriers to gold investing, compared to physical gold.

For instance, a 1 ounce (28g) Kijang Emas gold bar, in August, was sold for RM8,321. For many new investors, that can be steep. If you break this down to 1g unit, your entry requirement is reduced to RM297, which is more affordable.

3. Gold stocks

When you invest in gold stocks, you are not exactly investing in this precious metal but in the companies that mine gold or produce gold products.

Although returns are indirectly tied to gold prices (based on, among other factors, the company’s performance on how well it can mine or sell its gold products), it is still susceptible to other market forces.

As you are trading on the stock market, this form of gold investments has high liquidity, meaning is easy to buy and sell.

Related

4. Gold Exchange Traded Funds (ETFs)

ETFs hold baskets of securities that tracks and reflects gold prices. However, just like gold stocks, you are not buying gold but are investing in the ETFs that are backed by gold. It operates like trusts that hold physical gold and issues shares for it. And because ETFs hold physical gold, their prices vary according to gold market prices.

You can buy as little as one share, making it a good platform for beginner investors who would like to gain exposure in gold.

ETFs also have high liquidity and there is no storage costs and you won’t be holding on to physical gold.

Content sponsored by Maybank Islamic Gold Account-i.

Maybank Islamic Gold Account-i (MIGA-i) is a Shariah-compliant savings and investment that helps you to trade in gold. Backed by physical gold deposits, MIGA-i allows you to own gold without the hassle of storage and having to pay no additional fees when you transfer the gold from one MIGA-i account to another MIGA-i account via online.

And as everything is conducted online, you are able to buy and sell at competitive rates, real time on MIGA-i at a lower spread, which is the difference between your purchase price and your selling price, increasing your profit margins. You can also opt to get notified when your asset has achieved more than 10% profit and set it to buy low and sell high.

Investments on MIGA-i are Shariah-compliant and as it is fully backed by physical gold, you can convert your investment into minted gold bars that can be couriered to your doorstep!

The best part is that you don’t need a lot to get started. The minimum purchase is RM10, making this a great entry into gold investing. You can also support your favourite influencer campaign by making an initial investment of RM100 to earn 0.01g complimentary gold. Campaign ends 6th September 2022.

And if you are below the age of 18, you can open a MIGA-i account, with a parent or legal guardian.

Visit maybank2u.com.my to learn more about opening your very own MIGA-i account.