Life | Personal Stories | Article

I Am Caught In A Cycle Of Impulse Shopping And My Bank Balance Is Negative

by The Simple Sum | 11 Nov 2024

I’ve always considered myself a rational person, someone who weighs the pros and cons before making a decision. However, when it comes to shopping, my self-control just seems to evaporate.

My impulsive shopping habit has reached a point where I can no longer ignore the consequences, especially when I find myself standing in the middle of a crowded shopping centre, holding several shopping bags and staring at my negative bank balance.

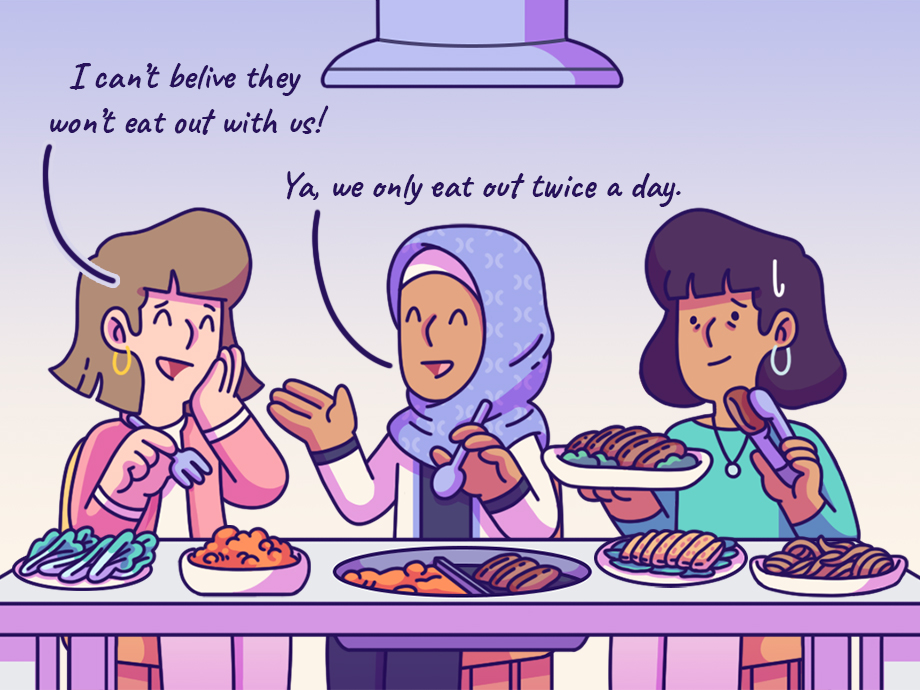

It started innocently enough. A casual stroll through the city with friends, perhaps over a coffee at my favourite café. As I chatted and laughed, the window displays caught my eye. The pretty colours, the latest fashions and the feeling of being outdated all drew me in. Before I know it, I’ve stepped inside the store, lured by the promise of ‘limited-time offers’. The thrill of shopping for new clothes or accessories triggers an excitement that I find hard to resist.

Once I’m inside the store, I suddenly start picking things up, convinced that each purchase will make me feel better, more fashionable or happier. My inner justification came easily: “I deserve this,” I tell myself. “It’s been a tough week.” And so, my shopping spree begins. I moved from one item to the next, feeling a surge of joy with each new purchase. I felt alive, and wanted to rebel a little, as if I were defying the routine of everyday life.

However, once the bags were in hand and the euphoria began to fade, reality set in.

Related

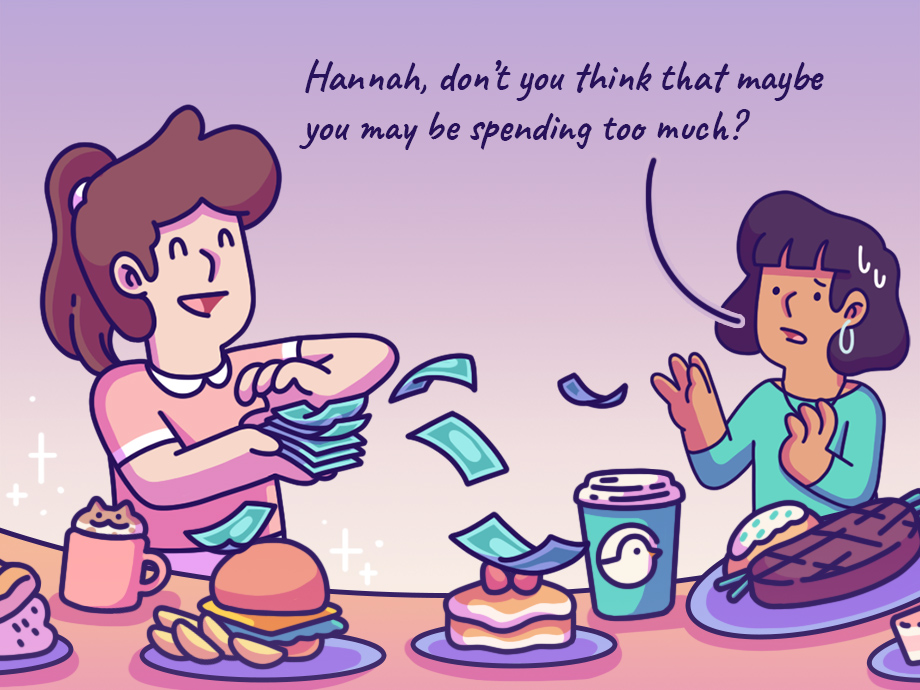

I stepped out of the store and glanced down at my phone, only to be greeted by a reminder of my financial situation. My bank balance showed a disappointing figure, and a wave of guilt washed over me. In that moment, I realised that I had made a mistake. The bag I was carrying, full of items I probably didn’t need, now felt like a burden. Instead of the excitement I felt moments ago, I felt a sinking feeling in my stomach.

As I walked home, the thrill of the shopping trip was replaced by regret. I think of all the bills I have to pay, the savings I should have accumulated, and the insecurity of my financial future. Feeling the bags get heavier, brought up a stark reminder of my inability to control my shopping habit. I promised myself that this would be the last time, that I would learn from this experience.

But the cycle continued, and I found myself back in the same situation not long later, trapped in a cycle of impulse buying and buyer’s remorse. It’s a vicious cycle, and I often wonder how to break free from it. I try to set budgets and make lists, but when I get stuck in that state, these strategies often don’t work very well.

Ultimately, I knew that I had to regain control of my shopping habits. I want to be able to enjoy shopping as a treat, not a compulsion. The thrill of the purchase should not outweigh the satisfaction of financial stability.

It’s time for me to face this habit head on, to find healthier ways of coping with stress and redefine what brings me pleasure. Until then, I will continue to bear the brunt of impulse buying in various ways.

This article is part of TSS Confessions, a weekly column where we delve into personal finance topics that are unscripted and genuine real accounts from people.