Career & Education | Life | Article

HELP! I Don’t Understand My Payslip

by Ooi May Sim | 21 Oct 2021

After years of tertiary education, you’ve finally landed your first job. And now, after slogging for a month, it is finally here – your first pay cheque. Yahoo!

While your payslip may seem like a flimsy piece of paper (most employers send online versions these days), they hold a lot of importance. Firstly, you can use it to apply for loans and mortgages. That’s because banks and companies need to know that you are employed before approving a loan – how else would you be able to repay it?

It is also proof of income, which can be used to file income tax returns.

But, err…what do all these alphabets – EPF, PCB, EIS and Socso – on my payslip mean?

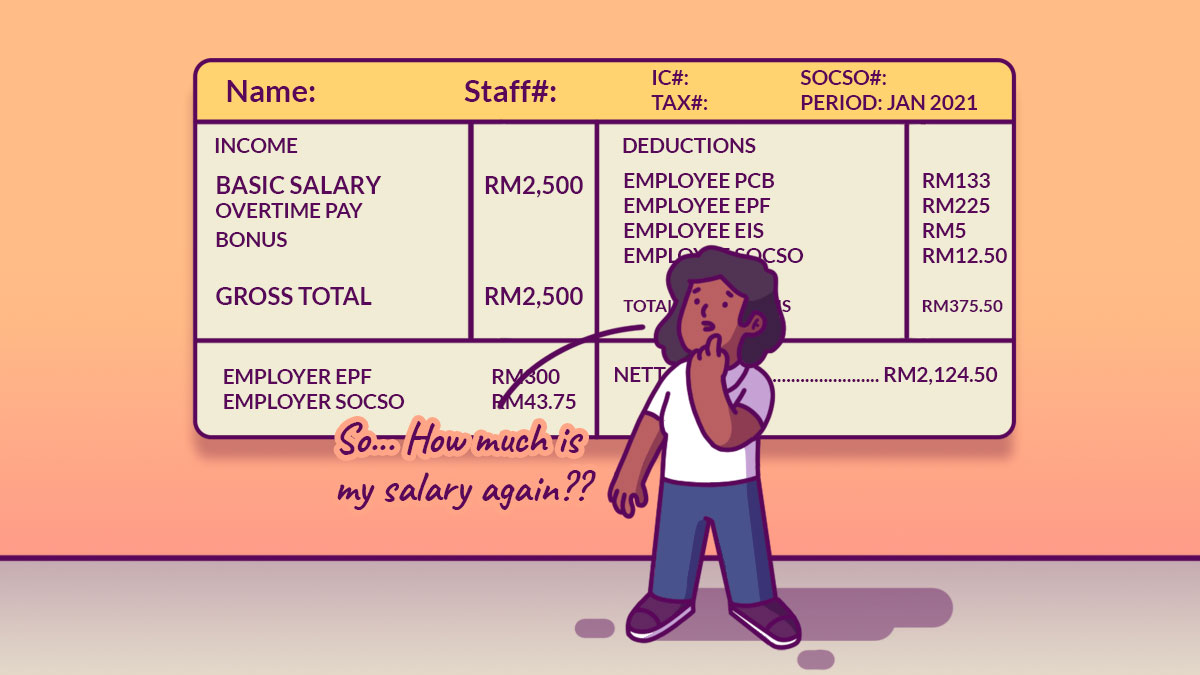

The format: Earnings and deductions

Payslips normally consists of two sections – one section shows your earnings, while the other, the deductions.

Earnings

- Basic Salary: How much the company pays you for the work that you do. This does not include overtime (OT).

- Benefits: This can be allowance, transport, medical, etc.

- Reimbursements: These are expenditure that you have paid for, that can be claimed from the company. For example, if you are working on a project that requires you to use your mobile phone, your company might allow you to claim for your phone bill.

Now comes the confusing part – the deductions.

- PCB, or Potongan Cukai Bulanan, is income tax deduction. Your employer will deduct a certain amount of your salary every month – depending on which tax bracket you are in – and give it to the Inland Revenue Board, or income tax department. The higher your salary, the more tax you have to pay.

This monthly deduction is more convenient and less ‘painful’ than having to pay a lump sum of, say, RM10,000 at the end of the financial year, or when it is time to file your annual taxes.

- EPF (Employees’ Provident Fund) is compulsory savings kept by the government for an employee’s retirement.

Generally, 9% of an employee’s income is deducted and placed in his/her EPF fund as forced savings, while employers have to contribute 12% to 13%. While it may seem like a huge chunk of your money is being deducted, it benefits you in the long run.

How? Firstly, you are getting ‘extra money’ from your employer (when they contribute to your retirement fund), and secondly, EPF usually pay interest rates of 5% to 6%, which is higher than inflation rates (2% to 3%). This means that your money will still be worth its value when you retire. And, since your money has ‘grown’, you’ll even have money to spare.

As this is a retirement fund, you will be able to withdraw these savings when you reach age 50. But prior to this, you can also use a certain amount of your EPF to pay for your housing loan, education or for health-related treatments.

Related

- Socso, which stands for Social Security Organisation (known as Pertubuhan Keselamatan Sosial, or Perkeso in Malay) covers all employees in the private sector in case of workplace injuries, emergencies, occupational illness, and death.

Both the employer and employee contribute to Socso, with the former paying 1.75% and the latter, 0.5%. The money goes into the Employment Injury Insurance Scheme and the Invalidity Pension Scheme.

Basically, what this means is that if you get injured, or sustain a fatal injury, you or your family are eligible for medical and cash benefits. The organisation also provides rehabilitation and other forms of aid to help employees get back on their feet.

- EIS, or Employment Insurance Scheme) is a financial policy aimed at helping employees who have lost their jobs.

Employees in the private sector have to pay 0.2% of their monthly salary, and employers contribute another 0.2%.

The main benefit offered by EIS is the Job Search Allowance which is given to those who have lost their only source of income. Successful applicants will be given a monthly allowance for three to six months, while they look for a new job.

EIS also assists the unemployed to find work by providing aid such as career counselling, training, and job matching and placements.

Conclusion

Chances are that you might be taking home less money than expected after all the deductions. But as these deductions are necessary, at least now you know where your money is going.