Financial Planning | Personal Finance | Article

Health Is Wealth: Why Being Financially Healthy Is Important for Your Physical Health

by The Simple Sum Team | 23 Nov 2023 | 5 mins read

When you think of being healthy, what usually comes to mind is eating a balanced meal and exercising regularly. But being financially healthy is just as important, and it also has a role to play in how physically healthy you are.

A study by HSBC in 2021 found that financial, physical and mental wellbeing are interconnected. More than 10,000 were surveyed and 52% of those who were physically fit considered themselves as financially fit. However, only 24% of those were physically unfit were financial fit.

The study also showed that when a person’s financial well-being was boosted, his/her physical health would improve, and vice versa.

Related

How the state of your finances affects your physical health

Although your financial and physical wellbeing may seem like two separate entities, how much money you have plays a significant role towards having better physical health.

General wellbeing

It is easy to develop chronic stress when you are constantly bogged down by financial worries. This can lead to a host of physical ailments such as high blood pressure, heart disease and stroke. Stress can also weaken immune function and impact your overall physical well-being.

Mental health issues

In addition to physical ailments, worrying about money also increases your risk of mental health disorders such as depression and anxiety.

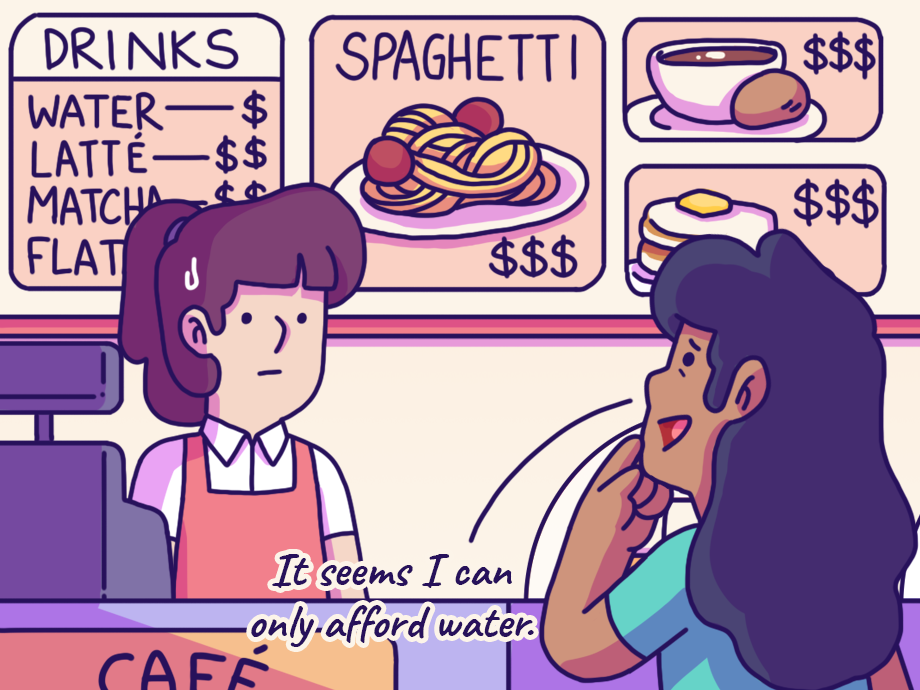

Poor nutrition

The type of food that we buy depends significantly on our household income. And when you don’t have a lot to spend on food, you tend to opt for groceries that are cheaper and that will fill the tummy for longer – processed foods that are high in salt and sugar, and low in nutritional value, such as instant noodles.

The lack of healthy and nutritious food in one’s diet leads to a higher risk of obesity, malnutrition and diabetes.

Healthcare access

Medicines and doctor’s appointments cost money. Thus, you may skip seeking medical help, even if you need it, because you can’t afford it. This is likely to cause your condition to worsen and lead to higher healthcare costs down the road.

Regular health screenings and check-ups such as going for blood tests are usually recommended for early detection of any illness as they can be treated at an earlier stage, which is cheaper and has a higher chance of recovery. The absence of money means foregoing such screenings which could lead to undiagnosed health problems.

Unhealthy lifestyle habits

People who are constantly faced with financial stress tend to look for ways to cope. This may result in them turning to unhealthy lifestyle habits such as smoking, excessive alcohol consumption or substance abuse. Needless to say, these poor lifestyle habits have it has a detrimental effect on their physical health.

Related

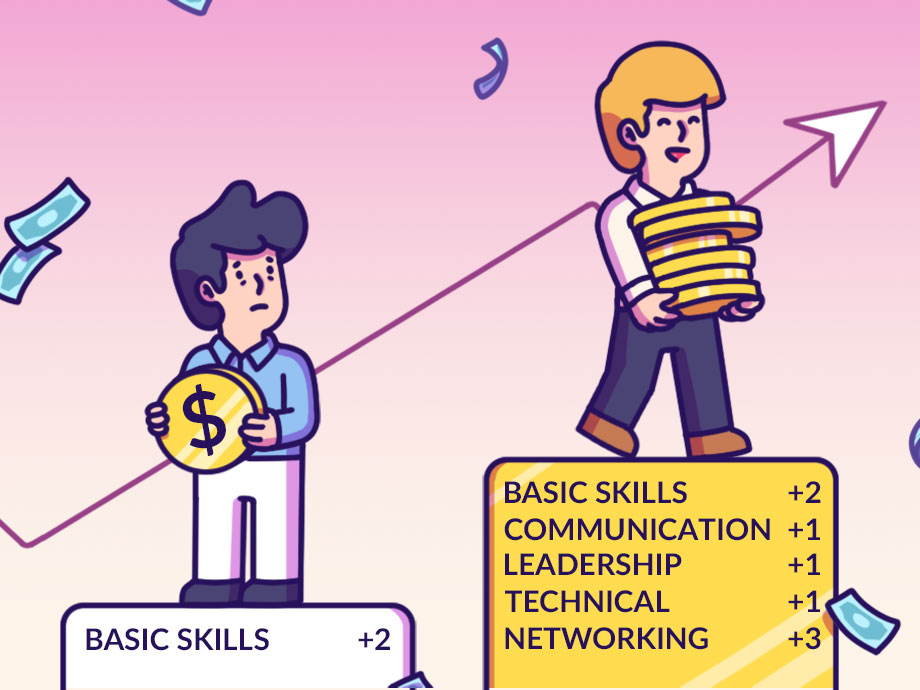

Improve your physical health to boost your financial health

While a lack of money can lead to poorer health, there are ways to work on your fitness with a limited budget. And you’ll want to work on being physically fit as it helps alleviate stress and anxiety. Being healthy also means less visits to the doctor, which boosts your savings.

Here are some ways you can keep up with your health while not breaking the bank:

Cook at home

We know that cooking takes up a lot of time and energy, but it is well worth the effort if you think about how it can improve your health and savings.

Home-cooking is not only cheaper than eating out; it is also healthier as it allows you to control ingredients and portion size. You can make healthier dishes that have less oil, salt and sugar, and reduce portions to suite your appetite, reducing food wastage.

If time if your concern, you can make meals in bulk and freeze them. You’d be able to reap the benefits of having a homecooked meal while saving time, energy and effort.

Exercise for free

You don’t need a gym membership to stay active. With free public parks located within every neighbourhood, you can always go for a walk or run there.

You can also increase your step count by making minor changes to your daily routine. For instance, you can opt for the stairs instead of taking the lift or walk to a nearby eatery during your lunch break instead of driving there.

Go for public health checks

In Malaysia, there are many subsidised health programmes that citizens are eligible for such as only having to pay RM1 for consultation and outpatient treatments at government hospitals and clinics. Take advantage of them to keep your health in check.

Use wellness apps

When it comes to staying active, consistency is the name of the game. There are a lot of free wellness apps that you can download onto your phone that can monitor your daily routine and help keep you on track towards your fitness goals.

These apps can monitor anything from nutrition and diet to the hours of sleep you are getting and the number of calories you are losing from calculating your workouts, heart rate and number of steps.

Financial health is directly connected to our physical health. But with careful planning, there are ways we can stay healthy on a budget. These steps are necessary to avoid bigger and costlier concerns that can affect our health and wallets in the future. Because we should always prioritise our physical and our financial health!