Financial Planning | Personal Finance | Article

Following Conventional Wisdom Might Be A Mistake

by Marcus Lee | 22 Apr 2021 | 5 mins read

“Stick with what you know” and “Honesty is the best policy” are some of the phrases that we hear commonly tossed around. While these are cliches, they are also nuggets of conventional wisdom, otherwise known as generally accepted theories or belief.

It’s not just limited to things that affect our everyday lives; it extends to the way we spend, save, and invest.

But here’s the thing: Life changes and sometimes the beliefs that you grew up with just aren’t relevant anymore and could do us (and our financial health) more harm than help.

Here are three pieces of conventional wisdom you might want to reconsider for the sake of your bank account.

You should buy a new car instead of a used one

You’ve probably heard well-meaning advice that it’s better to buy a new car because getting a second hand car means multiple visits to the workshop — you’ll pay about the same amount of money overall for a used car, so you might as well get a new one.

But do the costs always add up to be the same?

Well, the value of a new car depreciates as soon as you get it. Typically, its monetary value decreases by 20% to 30% within the first year, and while it continues to go down every year, it’s at a reduced rate.

Hence, the difference in price between a brand new car and a similar model that is five years old can be pretty significant.

It’s also not always true that you will end up spending a huge sum on workshops. You can do your due diligence, like looking into the service history of the car, to avoid getting a lemon. You can also stick to purchasing models that are known to be reliable if you decide to go second hand.

If owning a car — new or used — still stretches your budget a little too much, you might want to consider going car-less altogether. Yes, it’s popular notion among urban Malaysians that you need a car to get around.

But that conventional wisdom doesn’t hold much water these days when there are more commuting alternatives such as short-term car rentals, ride-sharing services and better public transportation.

Buying a home is (always) better than renting

“If you rent you’re only paying someone else’s mortgage. If you buy it, it’s an investment that will always appreciate in value.”

While this is not untrue, buying a house may not always be the best choice even if it is an investment,

This is because owning a property is a huge commitment that you are tying yourself to, especially if you’re thinking of moving to another state or country for work in the near future.

Even if relocating isn’t in the horizon, you can choose to stop renting and move back in with your parents. Not making your monthly payments for your housing loan, on the other hand, will land you in a lot of trouble.

While a house is an asset that you can rent out for additional income, doing so comes with its own set of risks such as tenants damage your house or don’t pay up on time. And there’s no guarantees that you’ll even find a tenant willing to rent your house.

As for selling off your house for profit later since it’s “An investment that appreciates in value”, it may not be as feasible as it sounds especially since the number of unsold residential properties is on the rise in Malaysia.

Hence, if you ever decide to downgrade or move elsewhere in the future, renting may be a better option for you now. It might even help you save up enough money for other financial goals you have (that is if owning a home isn’t your financial goal).

Keeping your money in a fixed deposit is the best way to grow it

Some of you may have been brought up on the idea that saving money in a fixed deposit account is the safest and best way to go.

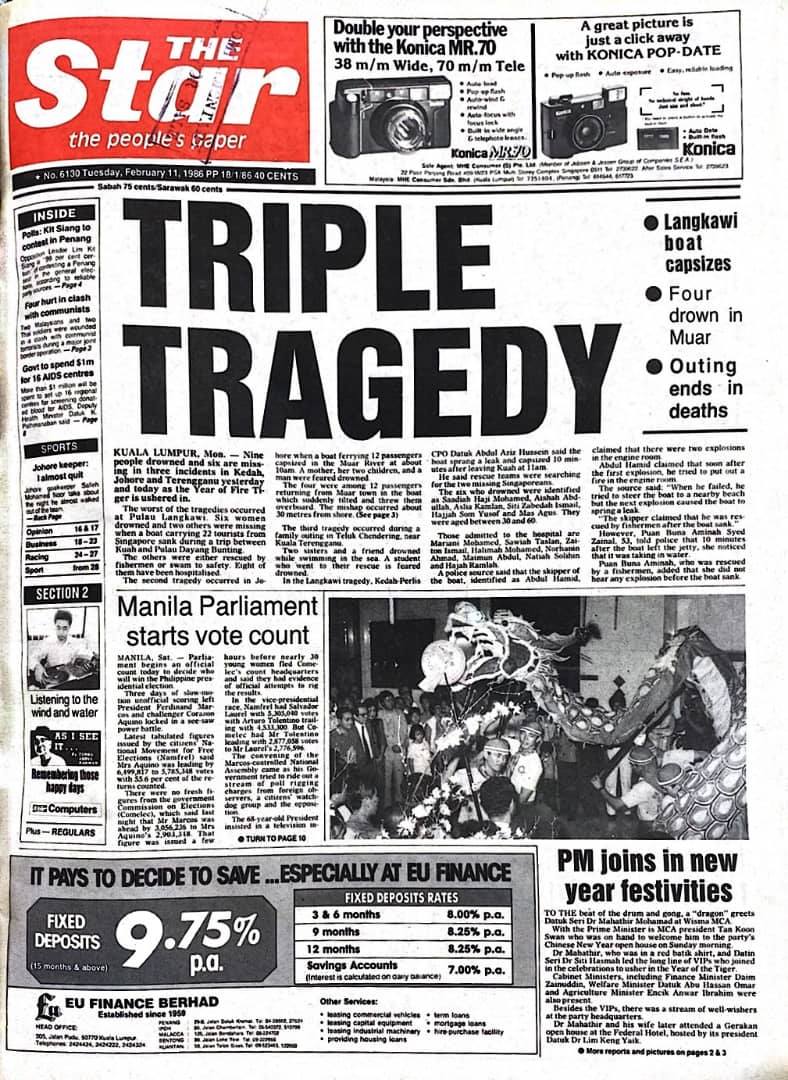

While it certainly is one of the safest ways to grow your money, it doesn’t necessarily give you the most value, especially with the interest rates you get today. The front page ad on The Star from Feb 11, 1986 gives you an idea why fixed deposits were so popular with our parents’ generation.

The regular rate for a fixed deposit used to be 9.75% per annum, while today, 3% per annum would be considered a high interest rate. Most fixed deposits offer rates that can barely beat inflation.

If you’re looking to grow your money over the long-term, investing it would be a better option. If you don’t have the time to watch the markets or don’t know how to pick stocks, investing using a robo-advisors or investing in ETFs directly can be the way to go.

Albeit, there is a certain amount of risk you’re taking when investing your money in the market. But historically, equity markets tend to go up over the long-term.

So, if you can stay the course and don’t need your money so soon, your money will have the opportunity to earn returns despite any short term drops in the market.

TL;DR: You’ll probably get better returns on your money than simply leaving it in the bank.