Budgeting | Financial Planning | Life | Personal Finance | Personal Stories | Article

I Tried Going On a Financial Diet and Gained RM298 in a Week

by Ooi May Sim | 21 Jul 2022

It’s no longer a big secret or surprise that the cost of goods has been increasing. And with rising interest rates and electricity prices forecasted to go up, it can be hard to stay optimistic about the state of our wallets.

Rising prices have greatly affected our day-to-day spending and our monthly budget. Many of us are finding it increasingly difficult to get by each month and are starting to tighten our belts to make ends meet.

So, instead of writing the regular ‘budget and save’ article, I decided to go on a financial diet myself to see just how much more I could save on a regular week.

My financial diet experiment parameters

For this experiment, I decided to focus on cutting down on my food and transport spending, as I would be able to see the quickest results in these categories.

Generally, I do not believe in eliminating an item completely as it would leave me unsatisfied and would probably make me crave for that item more. For instance, I have a sweet tooth so if I stop buying chocolate because it is ‘unnecessary’, that would be a rather bitter life for me.

To better ascertain how much I could save, I tracked my regular spending for a week, otherwise dubbed the Standard Week. In the following week, referred to as the Miser Week, I tried to reduce my spending as much as possible by cooking, swapping restaurant food with homemade alternatives and not driving to places to save on parking.

This is what my regular weekly spending looks like and how I fared in my one-week financial diet.

Related

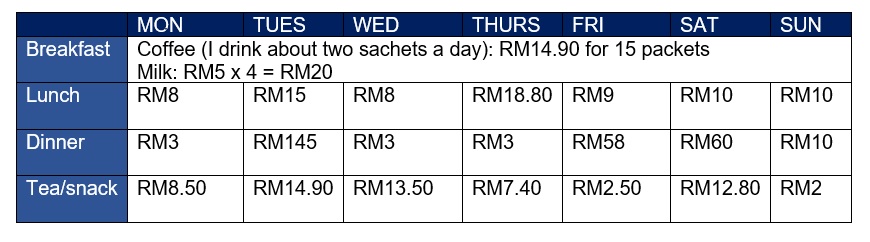

The Standard Week

Food expenditure: RM457.30

I’m not into fashion or beauty so you won’t see me carrying a branded handbag, but my kryptonite is food. On a regular week, I would bungkus takeaway for lunch and on most days, for dinner as well. On top of that, I tend to snack a lot so food is a major expenditure for me.

Since the pandemic began, I haven’t met up with many of my friends much. However, my “standard week” was an unusually social week for me as I had two catch up sessions with my friends (on Tuesday and Saturday), along with my regular once-a-week family outing (on Friday). Tuesday’s session even included beers, which further added to my expenses.

Below is how much I spent in the week:

My total food bill for this week was RM454.80 (please don’t judge me). This is just for one week. But, like I said, this included three dining out excursions to restaurants, which we all know is really pricey.

Transport, toll, parking expenditure: RM128

As I work from home most of the time, I didn’t think that I spend a lot on transport. But after tracking my expenses, I learnt that I spent RM30 on petrol and RM34 on parking during the week.

For one of my outings, my friends had pre-empted me that the restaurant we were going to didn’t have a lot of parking, so I thought it would be easier to take a Grab there, but the charges (especially during rush hour) were insane! I ended up spending RM64 (RM46 to get to the restaurant and RM18 to get home) on Grab and that trip alone doubled my entire week’s travel expenditure.

Related

The Miser Week

Food: RM260.74

To save money on food, the plan was to cook all my meals while also recreating the restaurant meals I had – for the latter, I made my own sashimi bowl (pretty cheap and easy, although I used normal rice and not Japanese rice), and pesto spaghetti.

And instead of heading to a restaurant for a gathering with my friends, I invited them over to my house for a potluck dinner instead. One friend bought KFC, another came with dessert and I took care of drinks, which was a carton of beer (24 cans) that cost RM150.90.

While this seemed quite expensive, we each only drank four cans of beer, so I still had half the carton after they left (3 friends x 4 cans = 12 cans of beer). In total, I spent RM75.45 on my night with friends instead of RM145, which was how much I spent when I went out with them the week before.

Below is the breakdown on how much I spent on food this week:

Meat

Chicken: RM16.30 (whole chicken) x 2 = RM32.60

Trout fillet: RM12.60 (it was 50% off)

Fish ball: RM2.80/packet

Grains/Noodles

Rice: RM13/5kg

Bihun: RM3.09/400g

Spaghetti: RM3/packet

Bread: RM8.90

Vegetables

Siew pak choy: RM1.50 (packet) x 2 = RM3

Potatoes: RM7.50/800g

Carrots: RM2.90/packet

Broccoli: RM4.90/floret

Corn: RM4.50/two pieces

Komatsuna: RM4.90/packet

Butterhead: RM6.30/200g

Dairy, eggs and drinks

Coffee: RM14.90/packet of 15 sachets

Milk: RM5 (carton) x4 = RM20

Sliced cheese: RM8.30/packet

Beer: RM75.45/carton

Eggs: RM6.20/carton of 10 eggs

Fruits

Mangoes: RM10/three fruits

Apples: RM2.50 (per fruit) x 2 = RM5

Pears: RM2 (per fruit) x 5 = RM10

Bananas: RM3.40/bunch

Homemade Pesto Pasta

I recreated the pesto pasta I had at a restaurant for RM2.63. Watch the video below to see how you can do it too.

At the end of the week, I still had chicken, fish balls, rice, bihun, bread, cheese, eggs and some apples left over.

Transport, toll, parking: RM26.50

After seeing how much I spent on parking during the Standard Week, I decided to lower my parking expenses during the Miser Week. I did this by planning my schedule with my husband and getting him to send me to work with his motorcycle. This reduced my petrol cost to RM20, and parking to RM6.50 for the week.

The results and verdict of the experience

By cooking all my meals at home, I managed to save RM196.56 (RM457.30 – RM260.74) on food alone. On transport, I brought down my expenditure from RM128 to RM26.50, which is a RM101.50 difference.

All in, I saved RM298.06 in a week!

What I learnt from this experience is that nothing is free in life, and that you get what you pay for.

While I was happy that I managed to save RM298, whatever I saved in cash, I ended up “paying for” with time or by compromising on quality.

For example, to prepare homecooked meals, I spent a great deal of time in the kitchen. I know I sound really lazy, but time spent in the kitchen meant time away from my family, and after not seeing them for the whole day due to work, I want nothing more than to spend time talking and connecting with them. As such, while I can save a fair bit by cooking all my meals, I personally feel that it takes up too much time and energy.

Instead, I plan to cook more (just not every meal) and eat out less as dining out can add up pretty quickly, especially if you have alcohol with your meal.

Meal planning can also help save cost, time and energy. I plan to make bigger meals, portion them out, then freeze them for convenience. In time, I hope to have frozen boxes of different meals so I wouldn’t have to eat the same thing every day.

Also, better quality products tend to cost more. For instance, I bought store brand kitchen towels and locally made chocolate instead of the regular brands that I normally buy and the quality difference is apparent.

For some items such as the kitchen towels, the quality difference doesn’t matter much as they are used to wipe spills in the kitchen.

However, for the chocolate, the stark difference couldn’t be ignored. Sadly, the locally made chocolate didn’t have much flavour to it, aside from sugary sweetness. Although it cost less than an imported bar of chocolate, I wouldn’t purchase it as a replacement in the future because chocolate is not something I eat every day, so when I do indulge in it, I want to thoroughly enjoy it. Saving money may be important, but certain things may be worth its higher price tag, especially if you are paying for better quality.

For transport, relying on someone to ferry you around can be quite troublesome, as you have to work around two busy schedules. Plus, it’s also inevitable that one person would have to wait for the other at times. These, for me, were the biggest obstacles.

Even though my husband and I set fixed pick-up and drop-off times, there were a few instances where the both of us had to wait for one another. If I had driven my car, I could just go home whenever I was done with work, or after an outing with friends and not waste time waiting around for him, time that I could use to rest or do something else instead.

Having said that, a little planning goes a long way, especially if you’re trying to cut down on expenses to save money. While it is close to impossible to plan our schedules to reflect each other’s all the time (unless one or both of us have flexible work schedules), I will try to get him to send me to work more often, as the parking fees at my workplace is pretty steep.

When it comes to cutting down expenses, there are many ways you can do it and save money. But it important to find methods that work for you and your lifestyle. You also don’t need to try to do it all at once; take small steps so you don’t get overwhelmed by all the changes.