Career & Education | Life | Article

Your Step by Step Guide to Filing Your Income Tax Online With LHDN

by The Simple Sum Team | 9 Mar 2023

It’s that time of the year again – the dreaded income tax season!

The problem with income tax is that as it is only carried out once a year, we often learn everything we need to know about it, then forget how to do it after a year. So once tax season comes around again, we must scramble to relearn everything… only for the cycle to repeat itself the following year.

But whether you are new to income tax filing or a veteran who simply forgot how to file their taxes (no judgement!), don’t be intimidated. To ease you through the process, we will guide you through each step.

How is income tax calculated?

By definition, income tax is a payment that is imposed on your personal income by the government. This acts as a source of revenue for the country. In Malaysia, taxes are collected by Lembaga Hasil Dalam Negeri (LHDN).

How much tax you pay is determined by how much you make. As we follow a progressive tax rate that increases along with your income bracket, the higher your salary, the more taxes you pay.

Do note that whenever you file your taxes, you are always basing it on the previous Year of Assessment (YA). For instance, if you are filing taxes this year, it is based on how much money you made in total last year (YA 2022).

But first, let’s determine whether you even need to pay tax. If you earned more than RM34,000 in total (after EPF deductions) last year, you must pay tax. This translates to an income of RM3,200 per month before EPF deductions.

Taxes also apply to gig workers who do not hold permanent positions. If you are one, you need to add up your total annual earnings for last year, and if it passes the 34k mark, your income is taxable. But if you earn less than that, you are exempted from paying taxes.

If you earned more than RM34,000, it’s time to register as a taxpayer.

Related

If you are filing income tax for the first time, follow these steps:

1. Register as a taxpayer

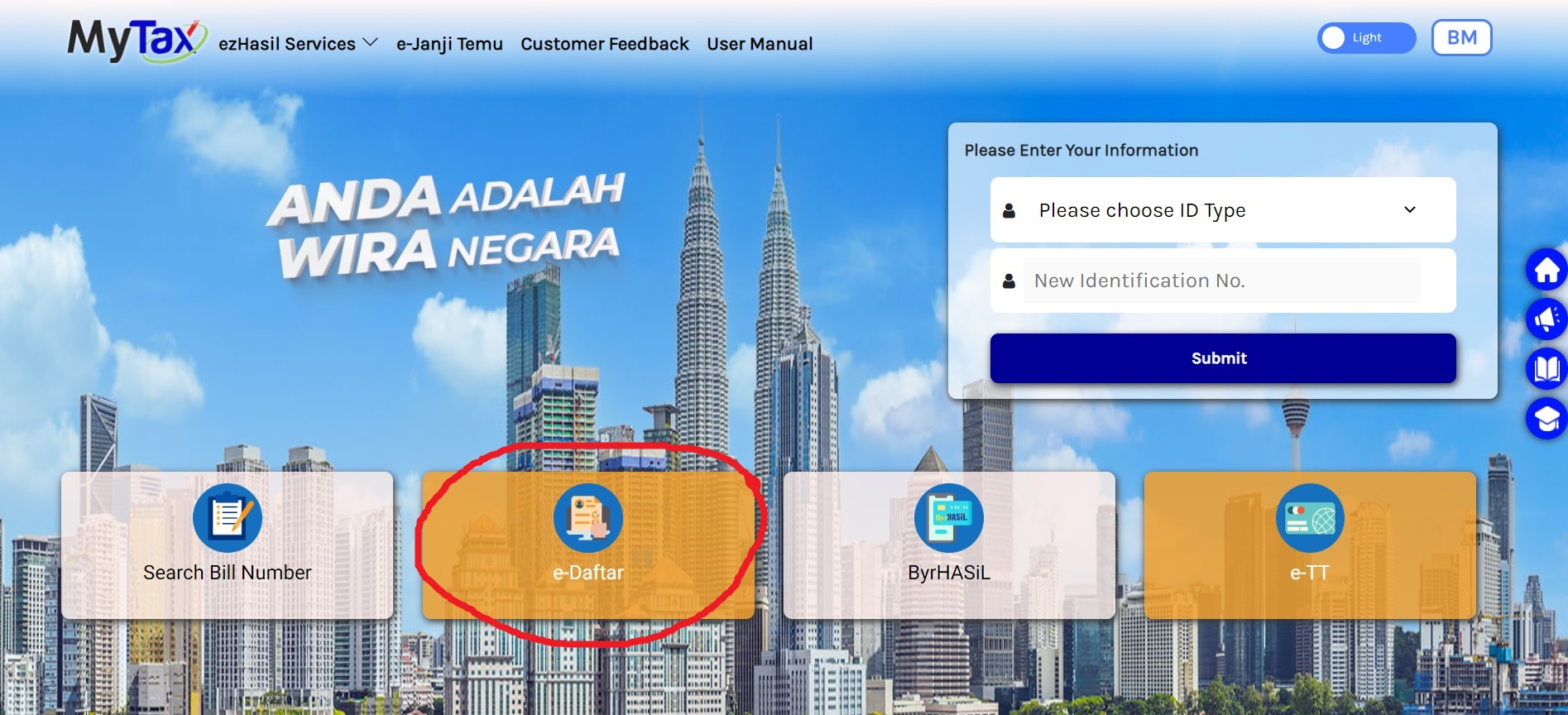

Go to LHDN’s MyTax website and click on the e-Daftar button (see pic below). You will then be asked to fill in a form to get your income tax number.

Fill in your details. You will need a digital copy of your IC (front and back).

You can also visit a LHDN branch to register your account. Find a branch that is close to you and remember to check its operating hours. Before you go, make sure to bring along a copy of your IC, a copy of your latest salary slip or EA Form, and a copy of your marriage certificate (if applicable).

After registering, LHDN will email you your income tax number within three working days. You can also check on your status via e-Daftar or give LHDN a call at 03-89111000.

2. Set up your e-Filing account

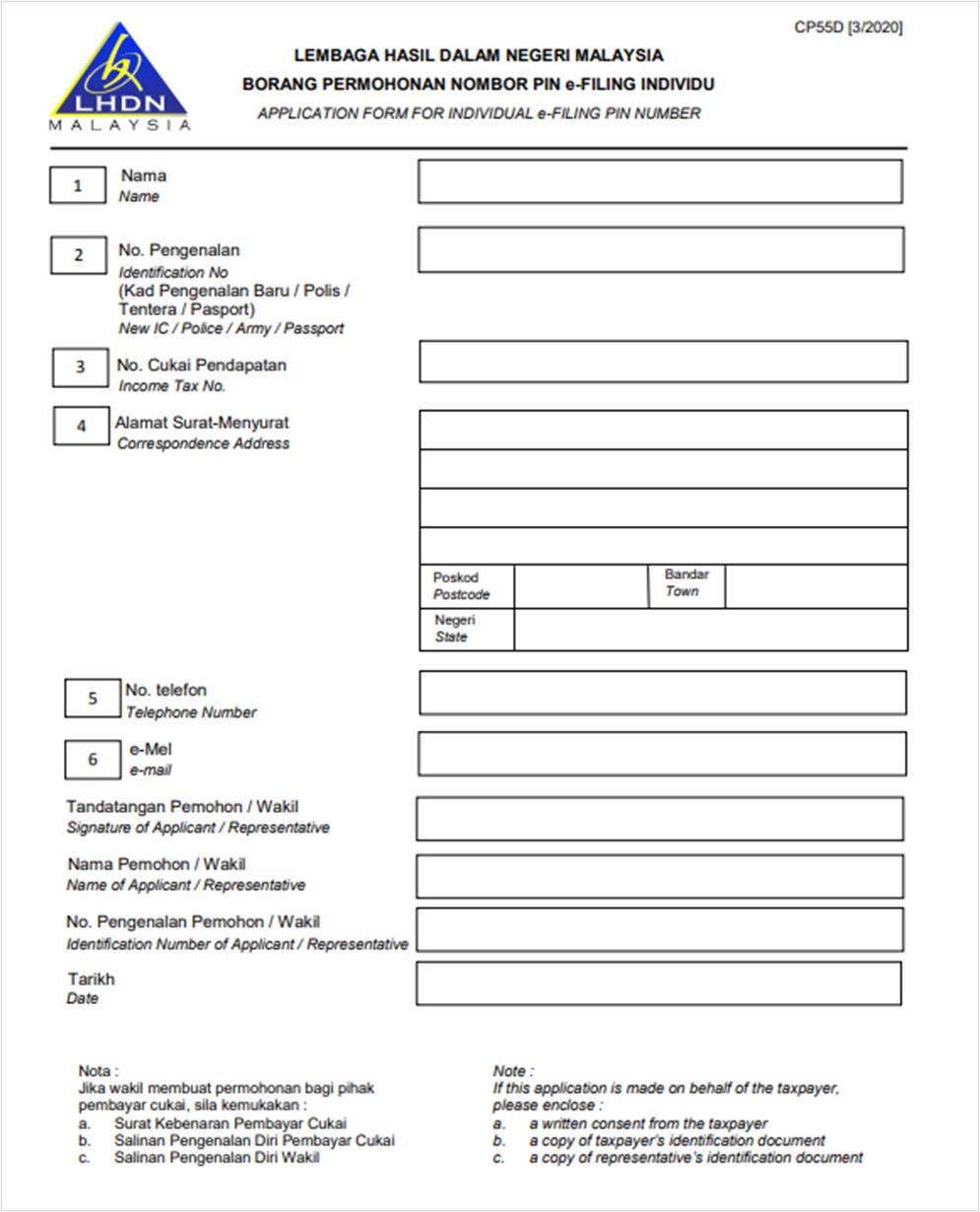

Once you have your income tax number, go to the MyTax website again and key in your IC number. The system will display “Digital Certificate does not exist”. Select e-CP55D (Application Form for Individual e-Filing Pin Number, pictured below), then fill in your details and click “Send”.

Application Form for Individual e-Filing Pin Number

A “Success” notification will pop up. The activation link will be sent to your registered email. Do note that the link is valid for two days only and you’ll need to activate it to be able to file your taxes online.

If you are an existing taxpayer who needs a refresher on how to file your taxes, start here:

3. File your taxes

When you log into your MyTax account, you will be taken to your Individual Tax Dashboard Summary that displays information such as if you have outstanding tax balance and travel restrictions. You can also view your previous income tax submission form(s).

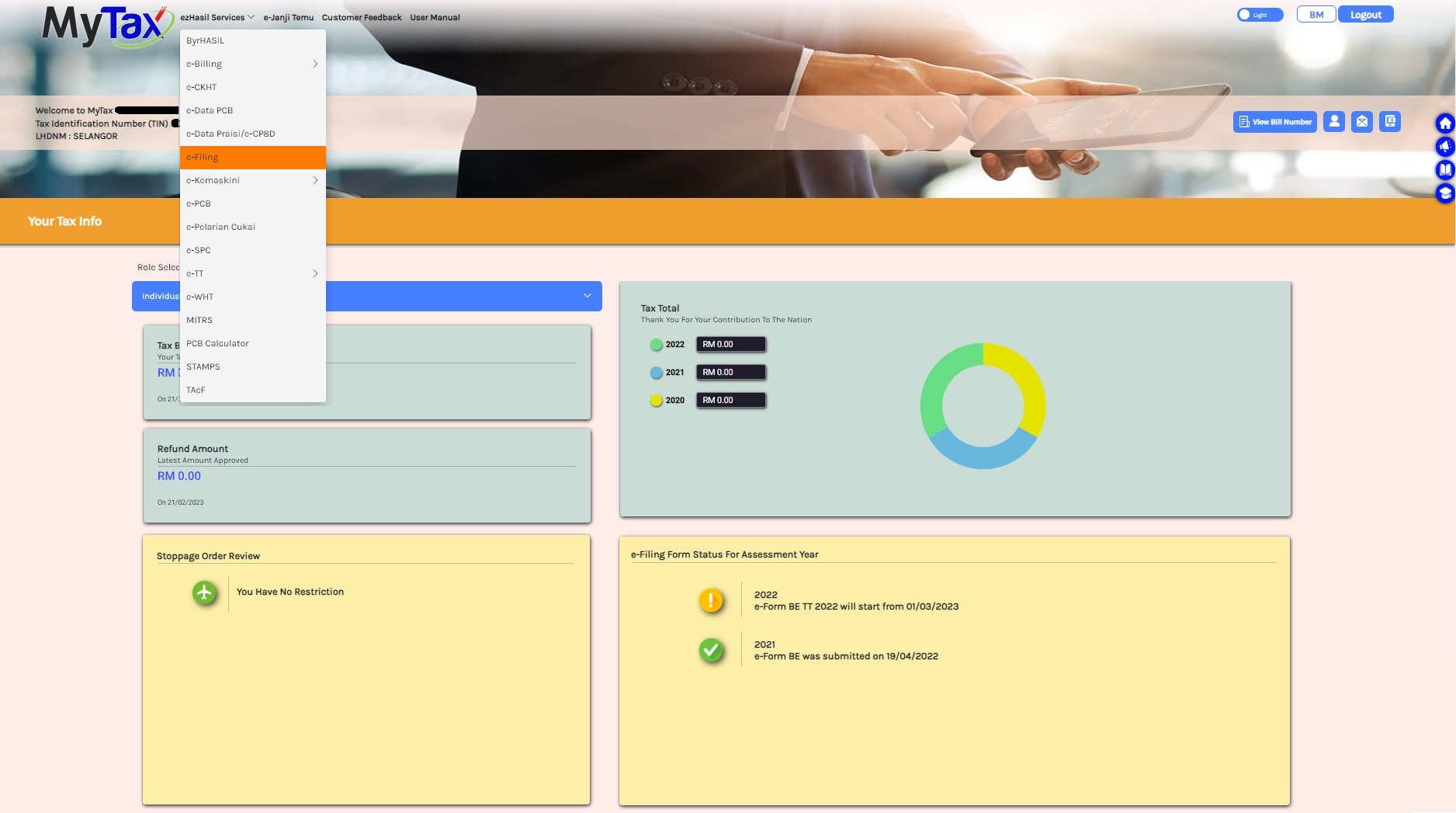

- Click on the ezHasil services button at the top left corner of the screen, then select the e-Filing function (see below).

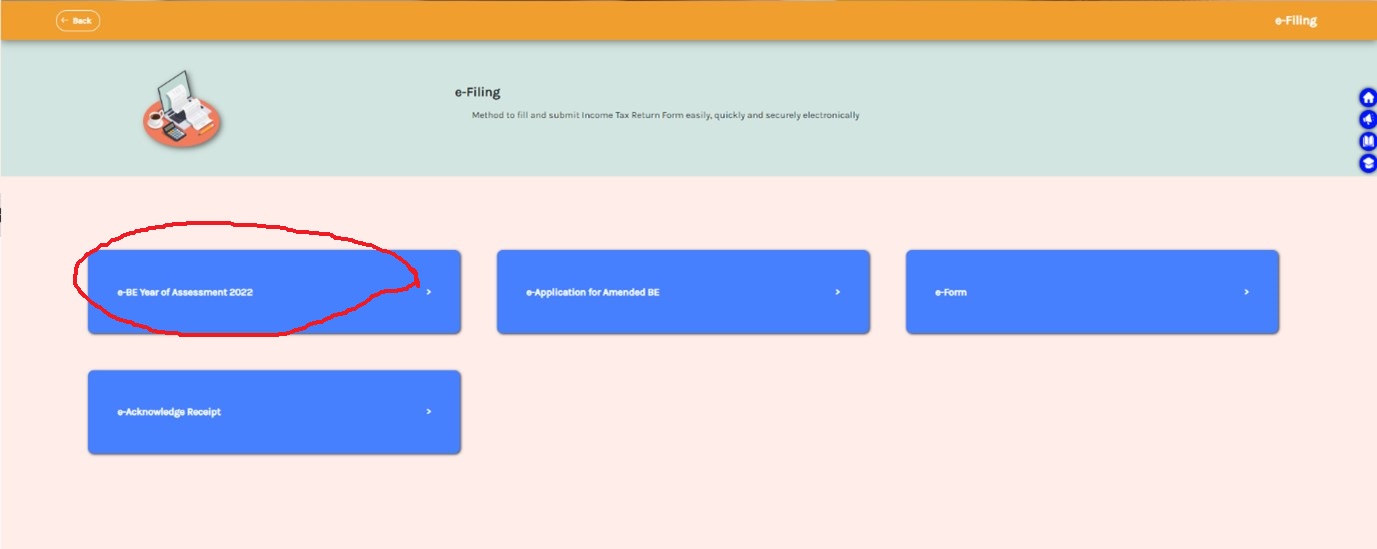

- Click on the e-BE Year of Assessment 2022

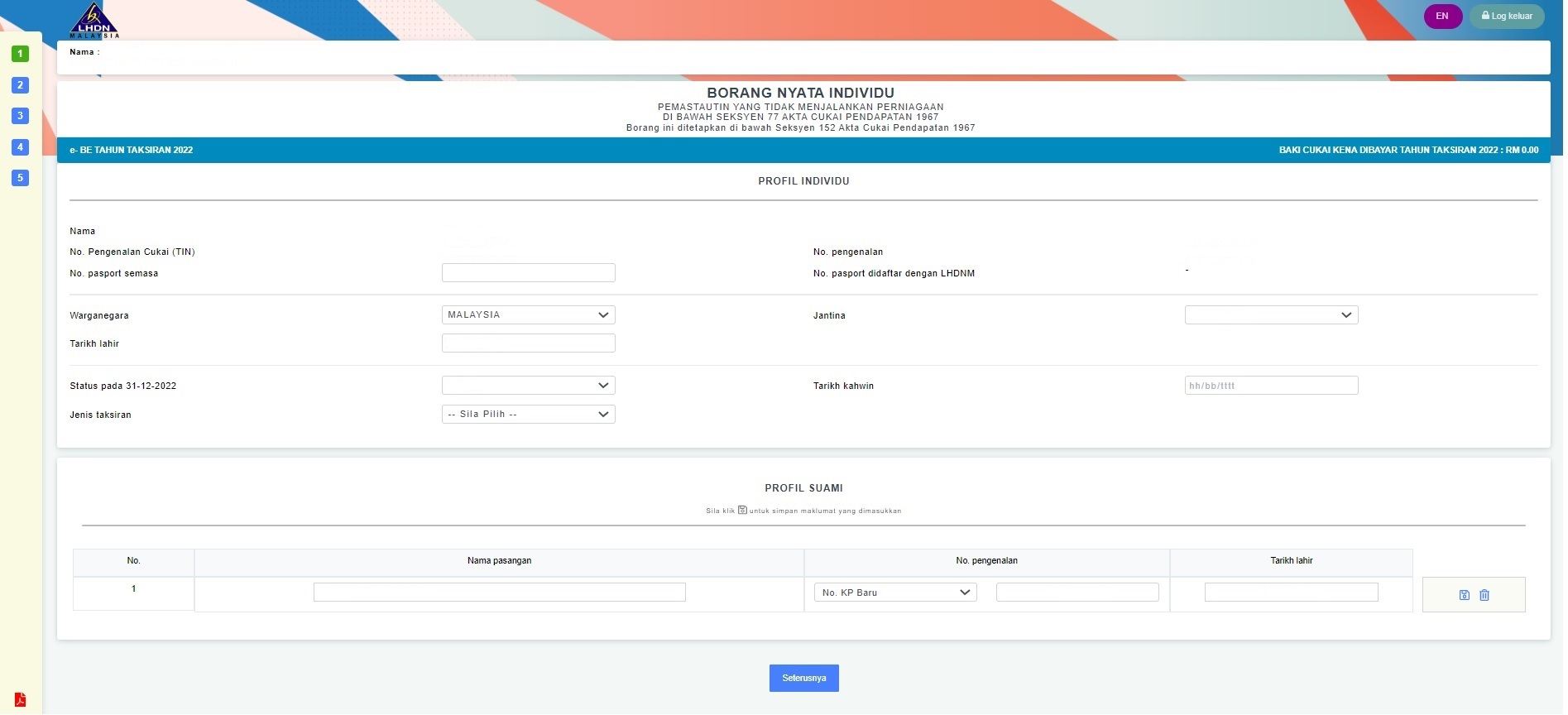

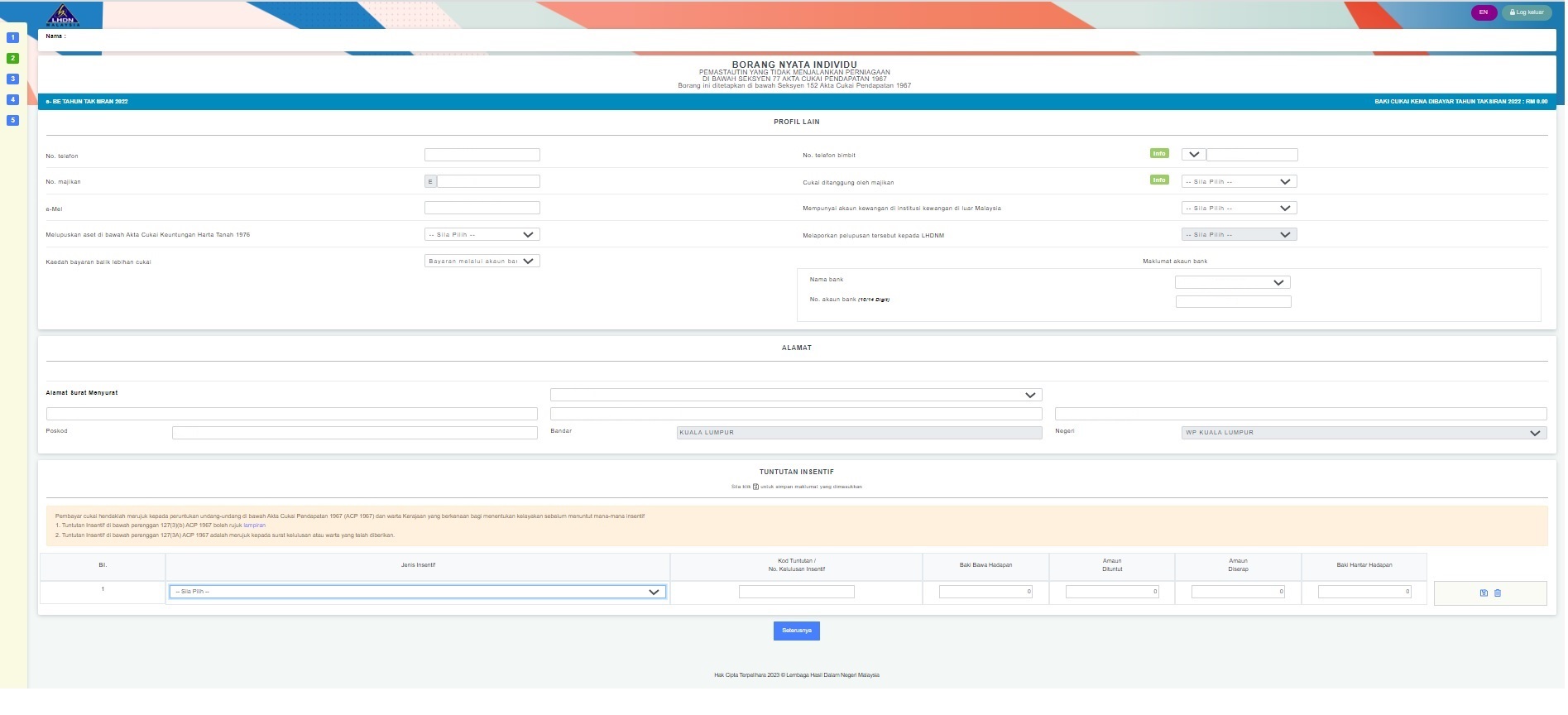

- Now it’s time to file your taxes. Review and update your particulars on the first page.

- On the second page, review more details about yourself. You will also need to declare if you sold any taxable assets that fall under the Real Property Gains Tax Act (properties). Also, if you have any tax incentives, this page is where you can declare these.

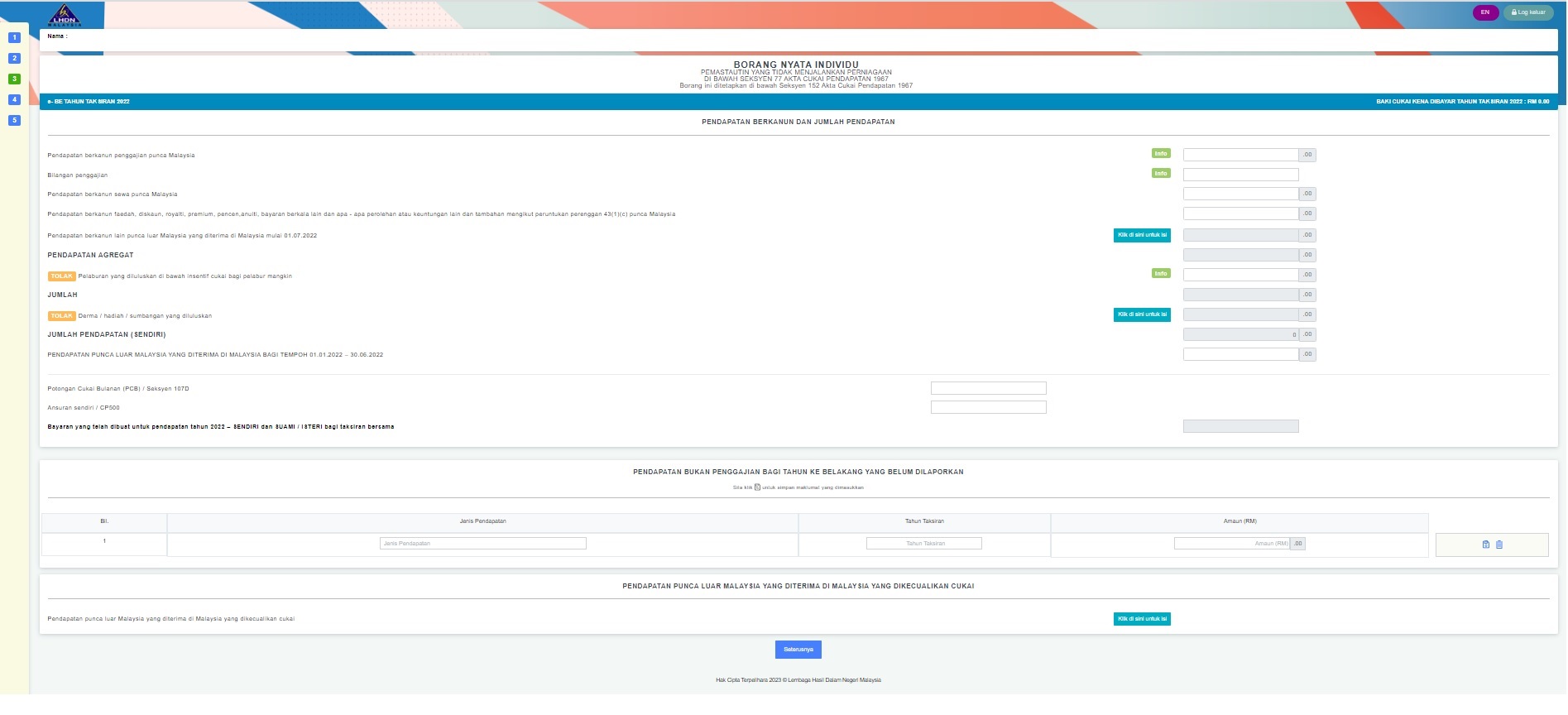

- On the third page, fill in your income information according to the relevant categories.

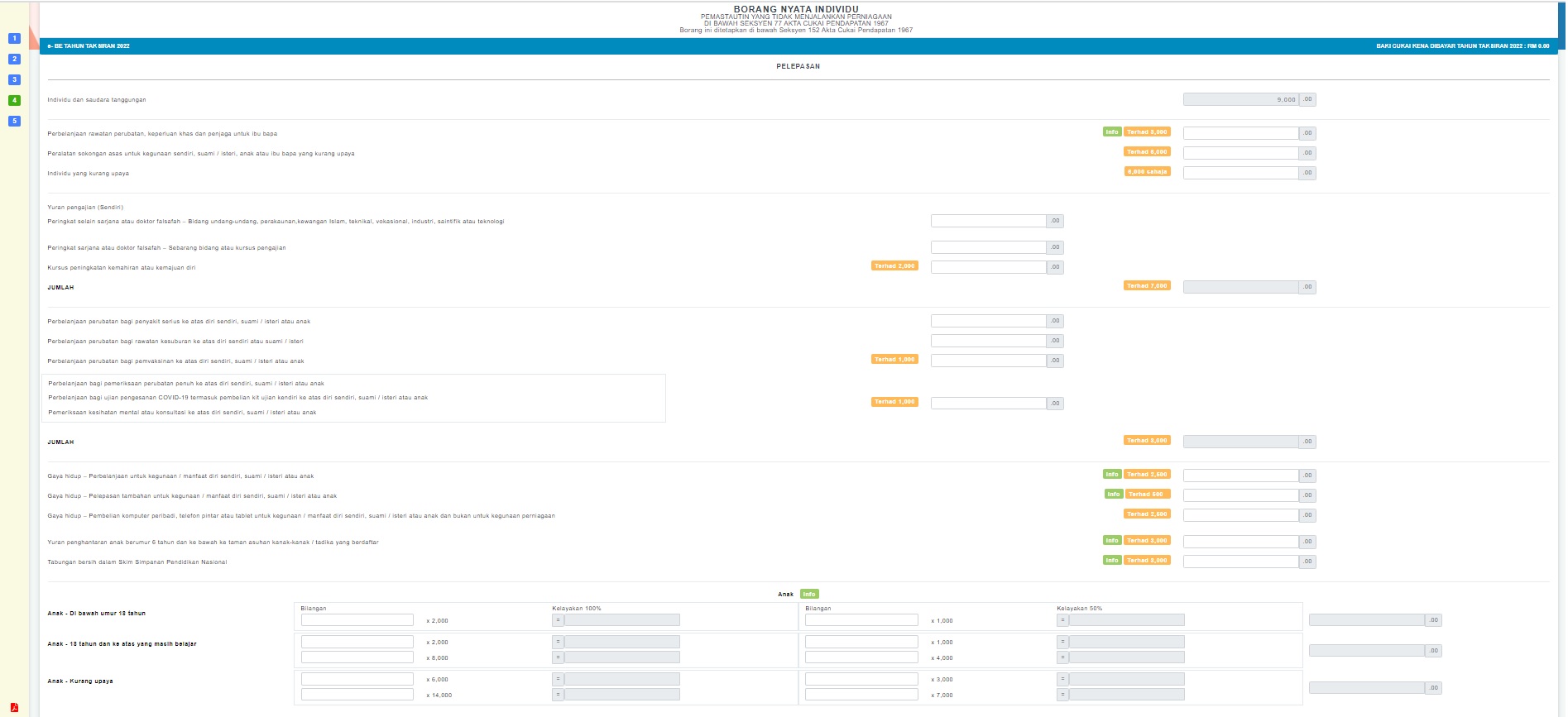

- On the fourth page is where you declare your purchases from last year for tax relief purposes. If you are unsure of what this entails, you can hover your curser over the green info button and additional information about the relief will appear. The maximum amount of relief that is claimable for each category is also listed in an orange box for easy reference. (Remember to save the receipts for everything you have claimed for, for at least seven years).

- LHDN will automatically calculate your taxes and inform you if you need to make an additional payment, or if you have paid an excess of taxes. If you have overpaid in taxes, LHDN will reimburse your money into your bank account (that you registered with).

- The final step is to declare whether all the information provided is true, before signing and submitting the form.

And just like that, you have successfully filed your income tax form for the year. Congrats! … Until next year comes around again!