Life | Personal Finance | Personal Stories | Article

I Had to Fork Out RM8,500 Even Though I Had Medical Insurance

by Ooi May Sim | 26 Oct 2023 | 5 mins read

Many of us get medical insurance thinking that we won’t need to pay from our own pocket later if we need medical attention. However, this isn’t always the case.

It depends on the specific coverage that your medical insurance policy includes – not all policies are the same, and you may be afflicted with a medical condition that is outside your policy’s coverage.

There are also times when additional outpatient treatment is required for you to get better, and your medical insurance may not cover that.

This is what happened to Alyssa Lee who found herself having to pay from her own pocket to fully recover from her injury, despite having medical insurance. She shares her story below.

Don’t worry – I have medical insurance!

When I bought insurance, I thought it would be enough to cover all my medical expenses and I wouldn’t have to worry about medical bills anymore. I was wrong.

In April, my knee, which has been giving me problems for years decided to give way when I was overseas. Not wanting to go to a foreign hospital, I hobbled on it throughout my holiday, which in hindsight probably made it worse.

When I got back to Malaysia, my doctor informed me that I had a tear on my meniscus, and anterior cruciate ligament (ACL). Surgery was the only way to fix it.

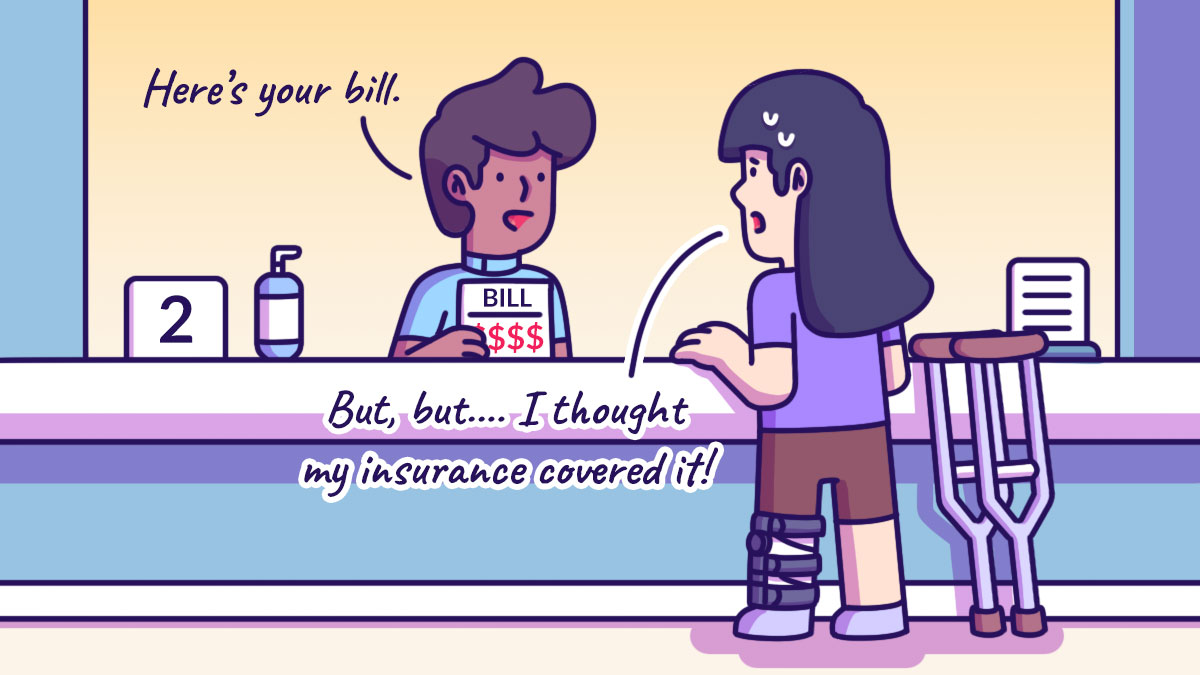

The surgical bill came up to a whopping RM38,000, but thankfully, my insurance paid for it. Little did I know that this was just the beginning of many more bills to come, ones that my medical insurance would not pay for.

Related

The costly journey towards recovery

Unfortunately, I was not able to fully recover just from surgery alone and the doctor advised that I undergo physiotherapy twice a week to improve my mobility. From here on, I had to pay for everything myself, as my policy did not cover outpatient treatments.

Each physiotherapy session cost RM127, and after getting treated for four months, I paid a total of RM4,064.

I also had to meet my doctor for follow-up consultations for two months to ensure my knee was recovering well. This took place once every two weeks and cost RM440 in total (RM110/per session). On one occasion, my doctor prescribed me more pain medication and I had to fork out an additional RM220.

As if that wasn’t enough, I developed an allergic reaction from the knee brace I was supposed to wear as part of my recovery. It started with the appearance of tiny bumps that caused my whole left leg to become red and itchy. It eventually spread to my right leg and left arm too.

I was referred to a dermatologist who prescribed pills, and a medicated lotion and body wash. Consultation and medication there cost RM500.

The additional expenses aren’t just medical related

Aside from these outpatient expenses, I also found myself spending more than I normally would on everyday living expenses such as food and transport because I live alone and couldn’t cook or drive.

After my surgery, I was on a lot of pain medication. This made me drowsy throughout the day, which made going grocery shopping or preparing food close to impossible for two months. Food delivery was my only option for all my meals, and I would spend about RM45 every day, just on meals alone.

And while I didn’t have to go to work whilst I was recovering, my stiff leg brace prevented me from driving to and from my doctor’s appointments, so I had to rely on e-hailing services that cost RM12 each trip.

Related

Mistakes, I’ve made a few

Since I have medical insurance, I didn’t think twice about going to a private hospital because I thought all my expenses would be covered by my insurance.

Looking back, I wish I had read through my insurance policy thoroughly as I was unaware that it does not cover outpatient treatment. If I had known, I would have gone to a government hospital instead, as everything would have cost less, including the physiotherapy sessions and the follow-up doctor’s appointments that I paid for.

I also shouldn’t have delayed seeing the doctor for my knee. I could have saved myself all this trouble and maybe even avoided surgery if I had gotten it checked earlier. That would have saved me a ton of money!

All in, I spent about RM8,501 on medical bills and necessities during my recovery period after surgery.

Luckily, I had an emergency fund that I could turn to, but I was constantly stressed that I wouldn’t have enough money, or that I was using too much of my emergency fund.

Learning from the experience

Moving forward, I plan to review my policy with my insurance agent with the intention to upgrade it to cover outpatient and hospital bills.

I will also make it a point to review my policy regularly as different milestones of my life require different coverage.

And although I had to spend over RM8,500 on recovery, I’m very thankful that my insurance paid for my surgery. Otherwise, the bills I would have to pay would be staggering.

This experience has opened my eyes to the importance of having insurance and has spurred me to look at other insurance coverages such as personal accident and critical illness insurance. Because the last thing I – or my finances – need is another medical emergency.