Life | Personal Finance | Relationships & Family | Article

Don’t wait to instil good money habits in your children: Start them young

by Ooi May Sim | 9 Dec 2021

Have you ever noticed your child mimicking your facial expressions, or even repeating phrases you’ve used (sometimes, to our horror, even bad words!)? Well, we ‘inherit’ so much more than genes from our parents.

While many parents place importance on teaching their children reading, writing, and counting skills, not enough emphasis goes into financial literacy.

And if you feel that your two-year-old is too young to understand the value and concept of money, think again.

Research by Dr David Whitebread and Dr Sue Bingham from the University of Cambridge shows that money habits are set by age seven. Yes, you read correctly – seven!

By that age, many children would have developed habits, particularly financial ones, that are carried into adulthood. These include planning ahead, delayed gratification and budgeting, to simple habits such as returning borrowed items.

And there is some sense behind it. It is not possible for your teenage son to automatically know how to save, budget and invest when he hits 18. These are habits that must be ingrained from young to shape financially capable adults.

Related

Introducing the concept of money to children

Unsure of what exactly to teach your little ones about money and how to go about do it? Here are some simple and easily executable ideas.

Talking about money

The biggest mistake parents make is by not communicating with their children about money. As money affects almost every aspect of our life, talking about it is the first step to understanding how money works, and knowing what it can do for you.

You can start by having casual conversations about how you manage your finances and the struggles you face. Share how you fight temptation when you want to buy an unnecessary item you don’t need. Teach them the difference between needs and wants – just because we can afford the toy doesn’t necessarily mean we have to get it.

Saving and budgeting

Learning how to save is the building block to financial success. But getting a child on board is easier said than done, as your young one may not see the value in it. Explain why saving is important and motivate them to save by giving them incentives. For example, the reward for saving RM5 a week is to take them for a picnic. You can change the prize each week to keep it interesting.

Equally important is knowing how to create and maintain a budget. Start by giving your child three piggy banks to divide their money into: save, spend and share. Help them determine how much money they should allocate in each ‘bank’, for instance, 40% into saving, 10% into sharing and the remainder can be used to buy things they want.

The sharing portion is a good way to get children to give back to society and get involved in the community. Let them choose the charity or organisation they would like to donate to. As an added bonus, they learn how to care for others too.

Earning money

One great way to give your kid first-hand experience on how money works is to provide opportunities for them to earn money. They’ll learn the value of hard work and that money doesn’t come easy.

You can pay them for extra chores they complete or get them to sell handiwork like their drawings and crafts. Who knows, you might even spark the entrepreneur in them!

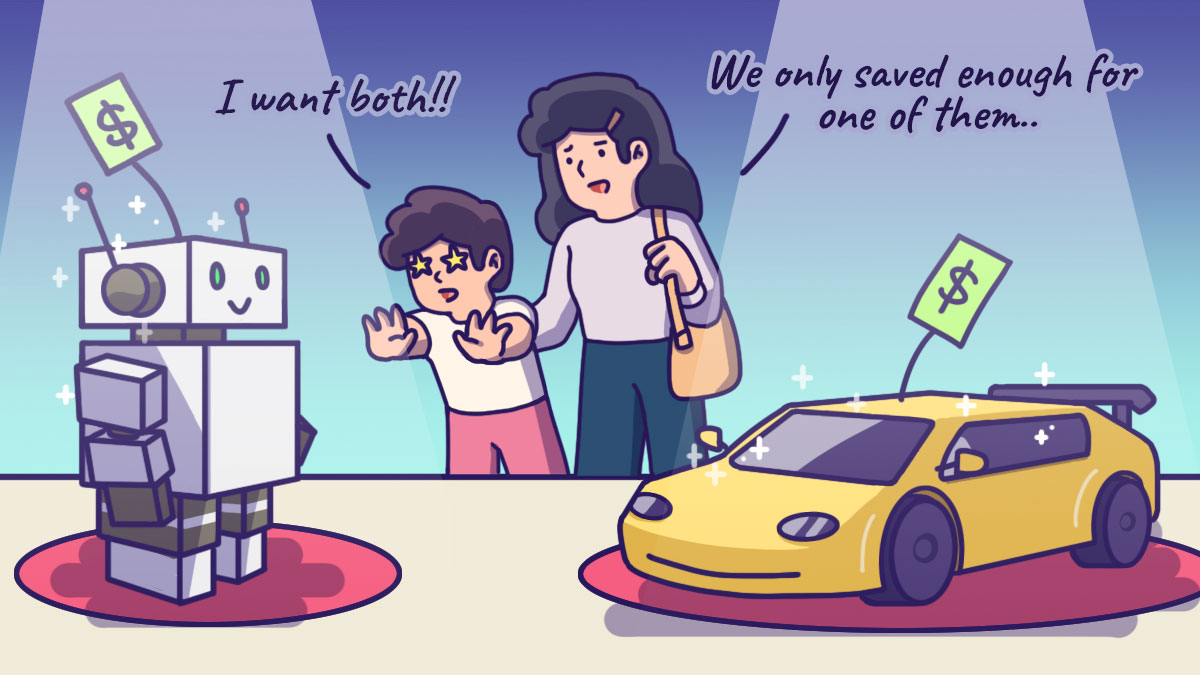

Purchasing items through goal setting

This might sound strange, but if you want to teach your child how to save, you must first allow them to spend their money. This is because if you tell a four-year-old that the money they save today will be used to pay for their college education down the road, they will not be able to see the relevance.

Instead, if you let them buy toys or books that they want (instead of buying it for them), it allows them to see the correlation between the two. They’ll learn that if they don’t save enough, they won’t be able to buy the toy.

Let them decide what they would like to buy then research and shop around for the best deals together. Once you’ve identified the price of the item, map out a savings plan equipped with a timeline on how long it will take before they will be able to make the purchase.

This teaches them discipline and delayed gratification. Along the way, ask them reflective questions to make them think about what they are saving for and how it makes them feel. While many of us feel happy when we buy a nice item, we should disassociate happiness to owning material things.

And if they have a problem with their spending, impose a waiting period to avoid impulse purchases. If they are still pining for the item after a week, let them buy it (with their own money, of course!).

They will also learn that once money is spent, it is gone. It will not return, and they will have to work to get more money.

Growing money

Once they grasp the concept of saving, learning simple ways that can make their money grow should be the next step. The most common and easiest way to grow your money is through a bank.

Once your child’s saving jar is full, bring them to the bank and deposit their money into a high-interest savings account or a fixed deposit.

Conduct an experiment to help them grasp this concept: Place the same amount of money in a piggy bank, and in a six-month fixed deposit. At the end of six months, compare the two – they’ll see that their money has grown in the latter.

Related

Involve them in family money decisions

When planning the family budget, get your kid involved. Narrate what you are doing and where the money is going. For example: “We have three commitments: house instalment, car loan and insurance, so we have to set aside RM1,800, RM800 and RM500 to pay for these every month”.

Include your child in discussions about big purchases such as a car or a house. Tell them how much these purchases cost and how you plan to pay for it. As they get older, explain how interest and loans work so they understand that they will need to budget for more than the actual amount, should they want to take a loan later on.

Get them involved in the family’s finances by brainstorming ways to save together. If they are unsure of where to start, get them thinking by asking them specific areas which the family can save in, such as, “How can we save on our electric and water bill?”

Children learn by example. So, watching how you handle your finances will rub off on them.

Lessons that last a lifetime

Once your child has understood all the individual components, show them how everything is connected – if you overspend, you will not have any money left for savings, and if you don’t work to earn money, you won’t have any.

Teach them how to live within their means and most importantly, allow them to make mistakes. Part of giving kids control of their money is to get them to take responsibility and ownership of their finances. Be encouraging and create opportunities for them to practice and learn, even if that means making errors. How else will they learn?