Financial Planning | Personal Finance | Article

How To Create A Payday Routine That Is Useful

by The Simple Sum | 19 Jun 2024

Ah, payday. There’s nothing quite like the sweet notification of money hitting your bank account.

For a moment, you feel like the king or queen of the world—or at least, of KL Sentral.

But then, reality checks in faster than your kiasu colleague hogging the office coffee machine at 9 am.

Bills, rent, and that slightly impulsive bubble tea spree start calling your name, and suddenly, your royal treasury isn’t looking so royal anymore.

Why you need a payday routine more than a kopi break

Setting up a payday routine isn’t just about making sure you can afford your kaya toast every morning; it’s about taking charge of your financial future. Here’s why it’s a game changer.

Say goodbye to late fees

Keeping track of due dates for bills like your credit card bill or phone bill is as tedious as commuting on the train during peak hours.

Automate them, and you’ll never have to pay another late fee or have your phone line barred again.

Imagine never having to rush a payment while in the middle of a dinner date or a meeting.

Budget like a pro

Ever feel like your money just… disappears? A payday routine helps you tell your dollars exactly where to go. Yes, even that lonely dollar looking for a kopi at the hawker centre.

When you get your pay, you can use a zero-based budget to designate your income to your savings, bills, subscriptions, and yes, even your weekend treats.

Related

Build your wealth, automatically

By directing part of your paycheck straight into savings or investments right when you get your pay, you’re building your wealth and taking the inertia out of saving and investing.

Even better, just set up the transfer to automatically deduct your account for the amount you’re setting aside for your various savings funds and investments the moment your paycheck comes in.

Reduce the stress of money management

Financial worries can be a real mood killer. Knowing your financial ducks are in a row can give you peace of mind to enjoy life’s little pleasures.

Instead of sticking your head in the sand and not knowing what your bank balance looks like, set aside some time every month when your pay comes in to review your spending and plan for the month ahead.

That little pain and time sacrifice will set you up for a smooth sailing month ahead.

Once it’s a habit, it’s easy peasy

With a solid routine, you’ll get better at managing your money and you could almost do it in your sleep. Almost.

It’s just like riding a bicycle, with more practice you’ll be able to do it with speed and ease so you’ll eventually spend less time fretting over finances.

Related

How to set up a payday routine that sticks

Follow these steps to create a payday routine that’s as reliable as clockwork:

| Block your calendar

Just like you’d mark a date for an important meeting or a catch-up with friends, set a specific time each payday to manage your finances. Choose a quiet hour where you can focus, perhaps a Sunday morning or right after dinner. Make this a recurring event in your calendar so it becomes a habit. This dedicated time helps ensure you never rush through your financial planning.

|

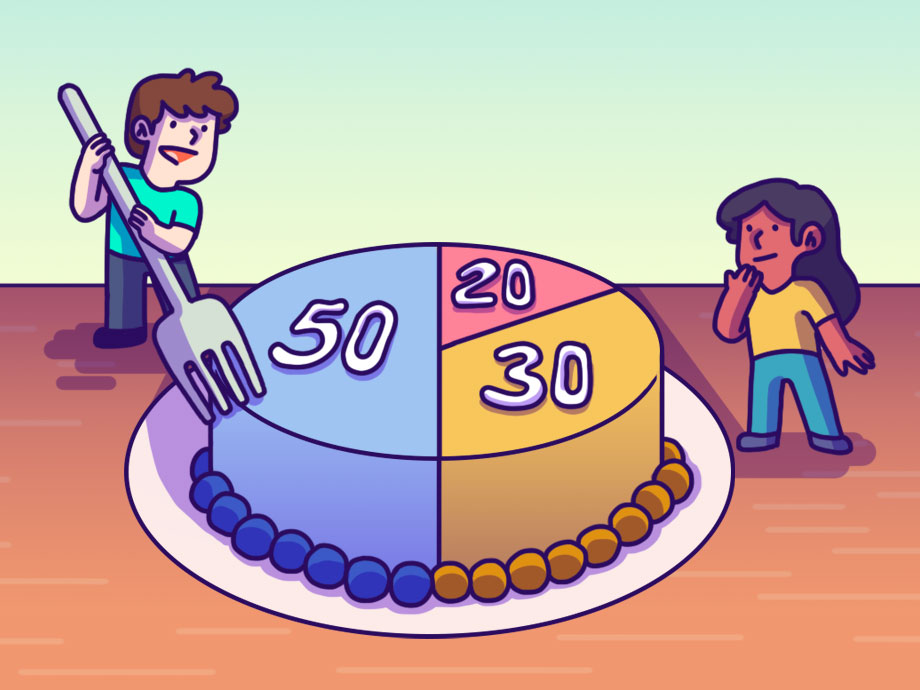

| Automate the essentials

Set up automatic payments or GIRO transfers for your fixed expenses like rent, utilities, and loan payments. Automating these payments means you’ll never have to worry about incurring late fees or damaging your credit score. For instance, if your payday is on the 28th, schedule your payments for the 1st of each month, giving you peace of mind that your most important obligations are covered. This also extends to your savings and investment – automating them ensures you’re always contributing to your financial goals and not making excuses for splurging your paycheck on vacays and bubble tea.

|

| Make it fun

Turn the routine task of budgeting into a more enjoyable activity by coupling it with something you love. You could watch your favourite K-drama in the background, or make it a monthly budgeting date with your partner or a friend. Sharing the task not only makes it more enjoyable but can also offer you fresh perspectives on managing money.

|

| Budget for your wants

Don’t you ever get that feeling that work is more enjoyable when you’ve got a trip coming up soon? The same goes for the tedious task of budgeting. It’s important to allocate funds for not just your needs but also your wants. Set aside a portion of your paycheck for the things that bring you joy, like dining out, hobbies, or shopping. Make planning for these expenditures a fun event by envisioning what you’ll do with this “fun money” in the coming month. Perhaps plan a dinner date, a weekend outing, or a small trip. This approach not only ensures you have the money for these activities, but it also enhances your anticipation and enjoyment.

|