Investing | Personal Finance | Article

5 Things To Know About Exchange-Traded Funds (ETF) Investing

by The Simple Sum | 31 May 2024

One of the easiest ways to get started investing is by buying an exchange-traded fund (ETF). Here are 5 things you need to know about ETF investing:

1. ETFs are like baskets

ETFs are like baskets —imagine a single container holding a diverse assortment of companies you could invest in.

There are many forms of ETFs like Stock ETFs, Bond ETFs, Gold ETFs and a variety of other baskets for different asset classes.

When you invest in an ETF, you’re buying a slice of that basket—a small share of the diverse assets it contains.

2. ETFs provide instant diversification

Buying one stock is risky. If something bad happens to the company, you might be kissing goodbye to a significant portion of your invested capital for a long while.

Investing in multiple stocks or multiple asset classes, allows you to spread your money across different companies and instruments, thereby reducing the risk you lose it all if a single company or an entire market is impacted negatively.

ETFs are an easy way to achieve this diversification. Because ETFs pool together a diverse array of assets within a single fund, your investment is instantly diversified.

Imagine you’re really into tech and you want to invest in some tech companies. How would you know which tech companies would survive an event similar to the 2001 dot com bubble?

And major market events aside, which companies would have management changes, product failures and other company-specific developments that could affect their bottom line?

You could spend hundreds of hours researching and staying up to date with industry and market news. Unless you’re investing in stocks as a day job, you probably won’t have the time to do all this homework.

But you still love and believe in the tech sector’s growth. Rather than investing in a single tech company (or pick a bunch of companies with your best guess), you can opt to invest in a tech sector ETF.

This ETF typically comprises a portfolio of tech-related stocks, offering broad exposure to the sector while mitigating the risk associated with any individual company’s performance.

Ultimately, ETFs help you achieve a balanced portfolio that spreads your risk, which mitigates any negative impacts of a single sector or market, while allowing you to still capitalise on growth and diversification elsewhere.

Related

3. ETFs are low-cost

Okay so you know now that diversification is important, but there are only so many stocks you can buy if all you have is $100 right now. Plus, when you buy a stock, you might get charged a trading fee, clearing fee, custody fee, and other hidden fees you may not be aware of.

Multiply that across a variety of stocks, you’ll be paying a hefty amount in fees on top of the huge capital you have to fork out for each stock.

So how can you start investing if all you have is a mere $100? ETFs are your answer.

Because ETFs are baskets that contain a variety of assets, you can practically invest in thousands of companies by buying an ETF.

On top of that, because ETFs generally track an index passively, the fees (known as expense ratio) that are charged tend to be much lower than actively managed investment funds. So more money stays in your pocket, where it belongs.

4. You can trade ETFs anytime (within trading hours)

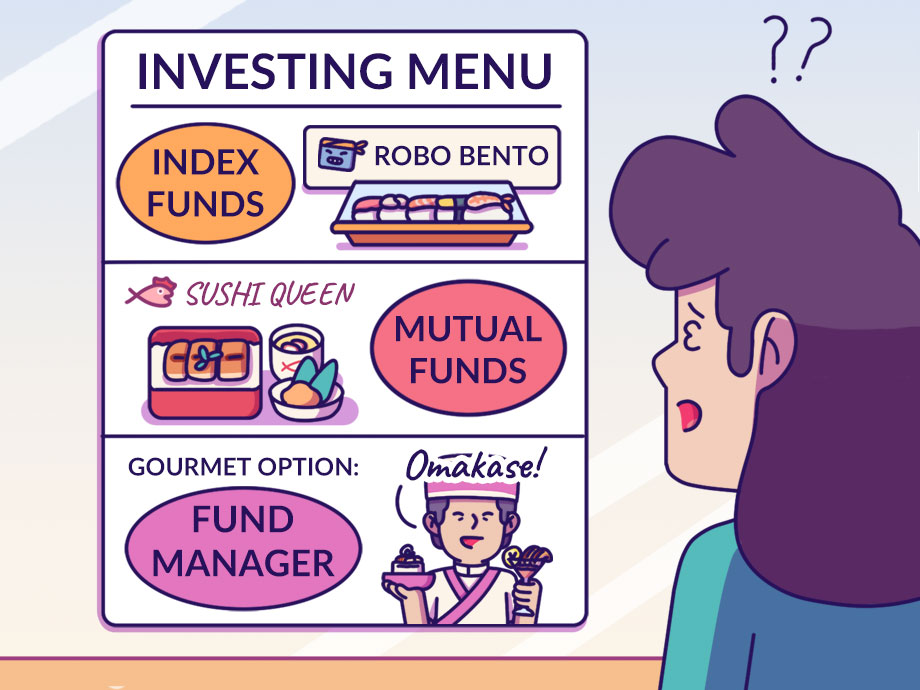

Mutual funds typically have a once-daily pricing mechanism, which means you can only buy or sell your units once a day.

ETFs, on the other hand, are the exchange-traded passive cousin of an actively-managed mutual fund, which means you can buy and sell your ETFs at any time during the trading day on an exchange much like an individual stock.

This means that ETFs are more liquid than mutual funds. You might ask, “What’s the big deal with liquidity anyway?”

Liquidity gives you the flexibility to make quick decisions based on when you need the money, or when you spot a golden opportunity to invest.

You can enter or exit a position whenever you please with an ETF. Want to take profits on a tech ETF before the market closes? Done. Spot a bargain in the energy sector and want to jump in? Easy peasy.

With ETFs, you’ve got the agility to react quickly or take advantage of short-term opportunities.

Related

5. You still need to do your research and due diligence with an ETF

ETFs almost seem like a no-brainer investment. The key word here being “seem”. The reality is, that with any investment, including an ETF, you still need to do your research and due diligence before putting your money in.

Here are some key things to look at when choosing an ETF:

- The ETF’s investment objective: An ETF can track any number of indexes and sectors so take a closer look at the fund’s investment objective to ensure it aligns with your financial goals and risk appetite.

- The underlying assets of the ETF: Translation, what’s in the basket? Remember that ETFs are baskets made up of various assets. Understanding the composition of the ETF’s portfolio is crucial to assessing its potential risks and returns.

- Expense ratio: When comparing two ETFs of a similar nature, take a look at their expense ratios to see how much it’s going to cost you to own the fund. Lower expense ratios generally mean more money stays in your pocket.

- Historical performance: Akin to a report card, reviewing the ETF’s past performance will give you a glimpse into how it’s fared in the past. While past performance doesn’t guarantee similar performance in the future, you can get a better sense of the fund’s track record from it.

- Tracking error: ETFs generally track a benchmark index, and the tracking error measures how closely the ETF follows its benchmark. A high tracking error could mean the ETF isn’t doing as good of a job tracking the index.