Financial Planning | Personal Finance | Article

How Credit Card Interest Rates Work and Why You Should Be Afraid of It

by Ooi May Sim | 25 Aug 2022

Despite the influx of e-wallets and Buy Now, Pay Later schemes, credit cards remain a popular form of payment among Malaysian consumers. In fact, principal credit cards in circulation have gone up by 26% from 7.2 million credit cards to 9.1 million between January 2015 and January 2020, according to Bank Negara Malaysia.

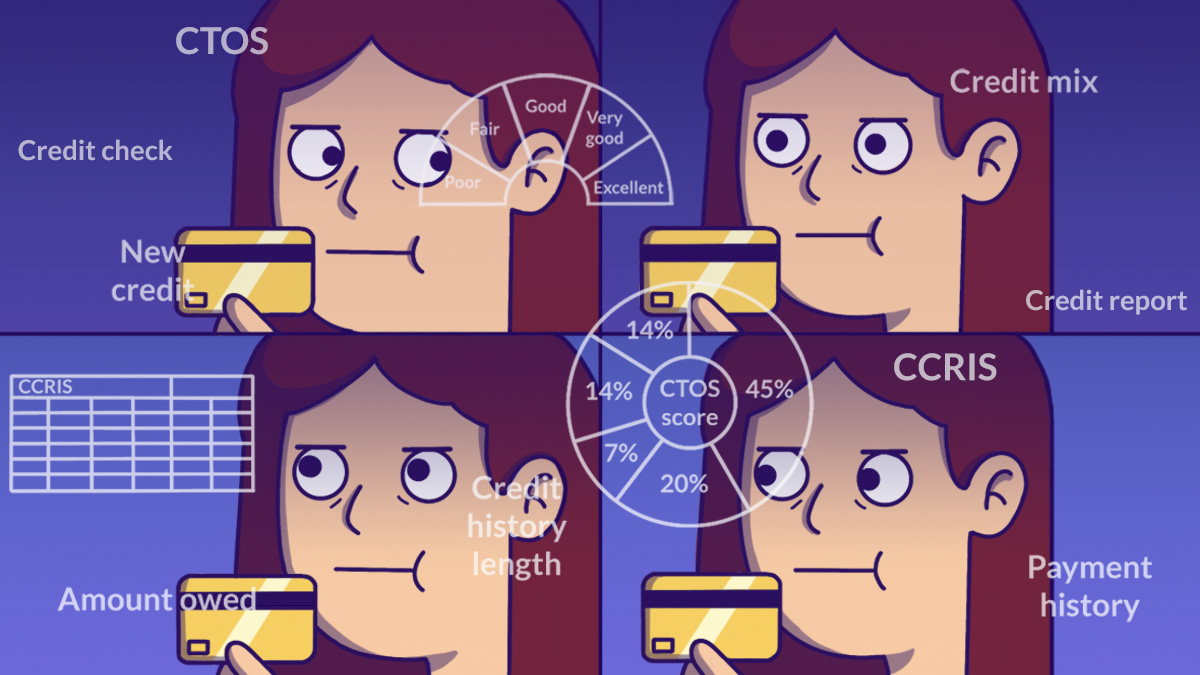

The popularity of credit cards isn’t waning largely because it’s an easy form of credit that gives its user the ability to pay for things even when they don’t have the money for it. It also comes with other perks – it’s a convenient way to pay your expenses and track them, it allows you to get discounts, cashback, and earn reward points on every dollar spent on your card, and it helps you build a credit score that may aid you in getting a housing or car loan one day.

Credit cards are a great financial tool provided that you pay off your outstanding balance diligently every month. But what happens when you don’t pay off the full amount on your card every month? That’s when credit cards put you in very real danger of spiralling into debt and financial ruin. It sounds like we’re exaggerating but we’re not. With the high interest rates on these cards, you can find yourself in a debt trap very quickly, even if you’re still making the minimum payments on your card.

Here we’ll go into how credit card interest rates work and how your debt can snowball if you don’t pay the full balance on your card.

Credit card billing

There are two ways in which a credit card company makes money: the first is through the fees they charge retailers, restaurants and other sellers that use their services. The other is the interest and fees they charge you, the consumer.

At the end of each billing cycle (every month), you will receive a statement that shows all the purchases you made using your credit card. Most credit cards give you an interest-free period of 20 days to settle your bill. If you pay the amount in full and within the stipulated period, you will not be charged interest.

However, if you fail to make the full payment within this period, or, if you just pay the minimum amount that is due, the bank will charge you an interest on whatever balance is outstanding on your card.

The minimum monthly repayment is at least 5% of the total outstanding amount. So, if you swipe your card to buy a RM2,000 handphone, the minimum amount you would have to pay is just RM100.

If you pay the minimum RM100, you will still owe the bank RM1,900. Interest will then be calculated on the RM1,900 amount owed.

This is where the problem starts. Many people use their credit cards to buy items and only pay the minimum amount that is due. And since they have paid the minimum amount, they are allowed to continue using their credit cards to buy more items, all the while increasing their debt in the process.

How credit card interest works

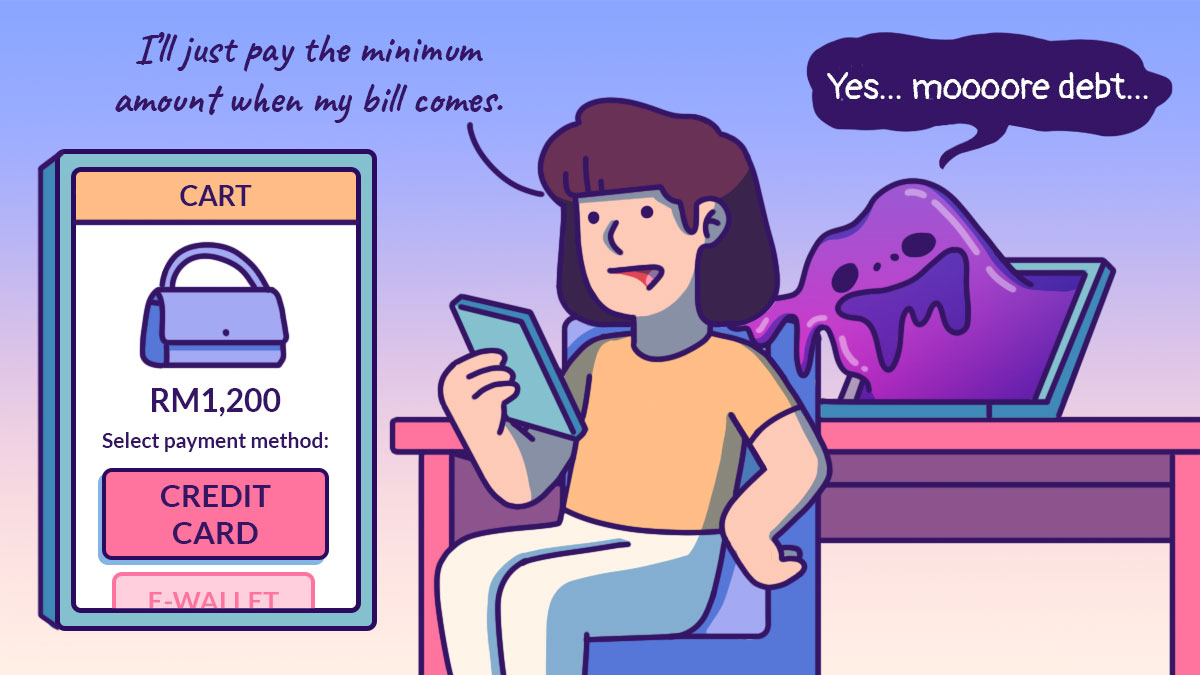

As mentioned above, credit card interest is only charged if you do not pay the full amount that is owed every month. When that happens, users will be slapped with an interest that is based on a tiered percentage set by Bank Negara Malaysia (BNM) in 2011.

Interest rate charges are categorised in three tiers: 15%, 17% and 18% per annum, which is based on your outstanding balance and how promptly you’ve been paying your bills for the past 12 months.

If you have been paying your bills on time every month (in the last year), you fall into Tier 1 and will be charged a 15% interest on the outstanding amount that is owed. But if you’ve skip payments and have only paid your bills for less than nine months in the year, you will be imposed with an 18% interest. So, the more bills you fail to pay, the higher the interest.

New credit card users will often be placed in Tier 3 until they have completed their 12-month billing cycle.

While the fees from different financial institutions may vary, these percentages are the maximum rate a bank can charge its customers.

Related

Credit card interests can escalate quickly

The problem with credit card interests is that it can escalate quickly, making it increasingly difficult for you to pay off your outstanding balance.

And the longer you take to pay off your debt, the more interest you will end up paying.

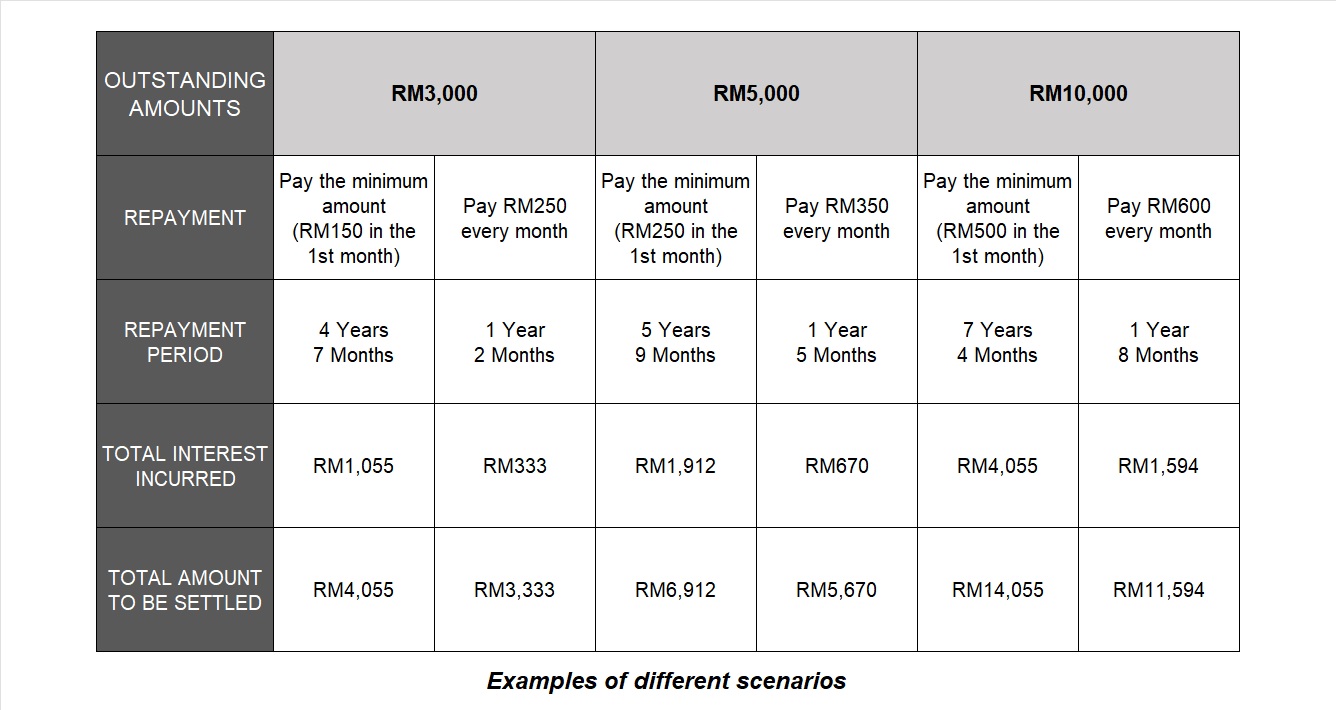

The chart above are examples of how long you will take to repay your credit card ‘loan’ if you pay the minimum amount every month, as opposed to if you were to pay a slightly higher fixed amount. It also shows you the total interest you would be charged, and the total overall amount you will pay to settle your credit card bill (outstanding amount + total interest).

If you spent RM3,000 on your credit card and pay the minimum 5% every month, it would take you 4 years and 7 months to fully pay off your credit card bill. But if you pay a fixed monthly rate of RM250, you would reduce your repayment period to only 1 year and 2 months. The total interest would also be less, at RM333 compared to RM1,055.

The same goes for the other two examples where you have an outstanding amount of RM5,000 and RM10,000.

Do note that these examples show the outstanding amounts as being fixed and does not include additional spending on your credit card. If you continue swiping your card, these outstanding amounts will increase, along with all the other numbers on the chart.

Interest charges will be imposed on your entire outstanding balance every month until the balance you owe is fully paid off. The longer you take to pay off your loan, the more interest you will incur. For example, if you spend RM10,000 on your credit card and only pay the minimum amount every month, you will pay RM4,055 in interest compared to RM1,594 in interest if you were to repay RM600 monthly.

Related

The consequences of failing to make payment on time

If you fail to even make the minimum payment, you will be slapped with a late payment charge, which is often 1% of the outstanding balance, or RM10, whichever is higher (charges vary between banks).

And if you still don’t pay up, you will start receiving letters or calls from your credit card issuer to remind you of payment. Repeated late payments can also land you on BNM’s Central Credit Reference Information System (CCRIS) blacklist.

You can also be declared bankrupt if you owe the bank RM100,000 and above, and are unable to repay your debt. If that happens, you’ll face a lot of consequences and restrictions such as having all your assets seized and managed by the Director General of Insolvency (DGI), not being able to travel abroad, own a business, and have multiple bank accounts. Your spending and employment status will also be monitored by the DGI and you are required to submit a report on all your income and expenses to the DGI every six months.

Withdrawing cash from an ATM using a credit card

You can also use your credit card to withdraw cash from an ATM machine, which is known as a cash advance. This short-term loan may help tide you over in an emergency when you would need cash urgently.

But the service is not free. Banks charge a service fee that is either based on a set percentage (often 5%) of the amount that is withdrawn, or a fixed minimum fee (whichever is higher).

If the service charge is 5% or a minimum fee of RM15, below are the example calculations:

If you take a RM100 cash advance, you will be charged the minimum fee of RM15. However, if you take a RM1,000 cash advance, your service fee will be based on the 5% charges, and you would have to pay RM50 for the service.

On top of that, banks charge an additional 17% to 18% per annum interest for every day that the amount is not repaid in full.

If you take a RM1,000 cash advance that charges 18% interest and 5% service fee, and take a month to repay the loan, here is how much your cash advance will cost you:

Cash advance: RM1,000

Interest: 18% = RM180/12 months = RM15 per month

Service fee: 5% = RM50

TOTAL= RM65 (RM50 + RM15)

You will have to pay RM1,065 after a month of borrowing.

As these charges are notoriously high, you should always evaluate your reason for taking a cash advance. If you’re in dire need of emergency cash, try to find other ways to shore up money quickly – you can ask your employer for an advance in your salary, for instance. Alternatively, you can consider taking a personal loan instead as the interest rate is lower and the repayments will be a lot more manageable.

With great borrowing comes great responsibility

One of the biggest problems when using a credit card is that it is easy to get carried away with your spending (as you do not see your money going out). So, you should set a credit limit and always be up to date with your spending.

It is also important to know the terms and agreements of your card to know when your billing cycle is, the fees involved and the interest charges.

Remember – you can avoid credit card interest by making payments on time and in full. Credit cards can offer a wealth of benefits when used responsibly.