Budgeting | Managing Debt | Personal Stories | Article

When My Good Intentions To Save Backfired And Led Me Into Debt

by The Simple Sum | 3 Feb 2025

It started pretty innocently. I had just moved into a new rented apartment and wanted to get new bedsheets as I didn’t trust the cleanliness of the ones that came with the unit. So, I went online to buy a new set.

As I was checking out, I scrolled through all the different payment and delivery options and saw that I would get the biggest discount if I paid using PayLater.

While I could afford to pay for the bedsheets upfront, the allure of such a great discount was too hard to resist. Without a second thought, I opted for the 3-month instalment plan as it came with 0% interest.

That was the first time I used PayLater.

However, every time I shopped, PayLater always seemed to offer the best discounts, so I kept opting for it. It quickly became my go-to payment method.

And if I’m being honest, I think I became a little hooked on it! With payments broken down into smaller, more manageable sums, everything suddenly felt affordable. It was like I could finally buy all the things I’d been dreaming of! I used PayLater to buy toiletries, groceries, a rug, a lamp, towels, and cooking utensils. I even bought plants by the dozen as I wanted to transform my home into a green oasis.

Regrettably, I didn’t track how much I was spending, and didn’t even notice that I was overspending… until it was too late!

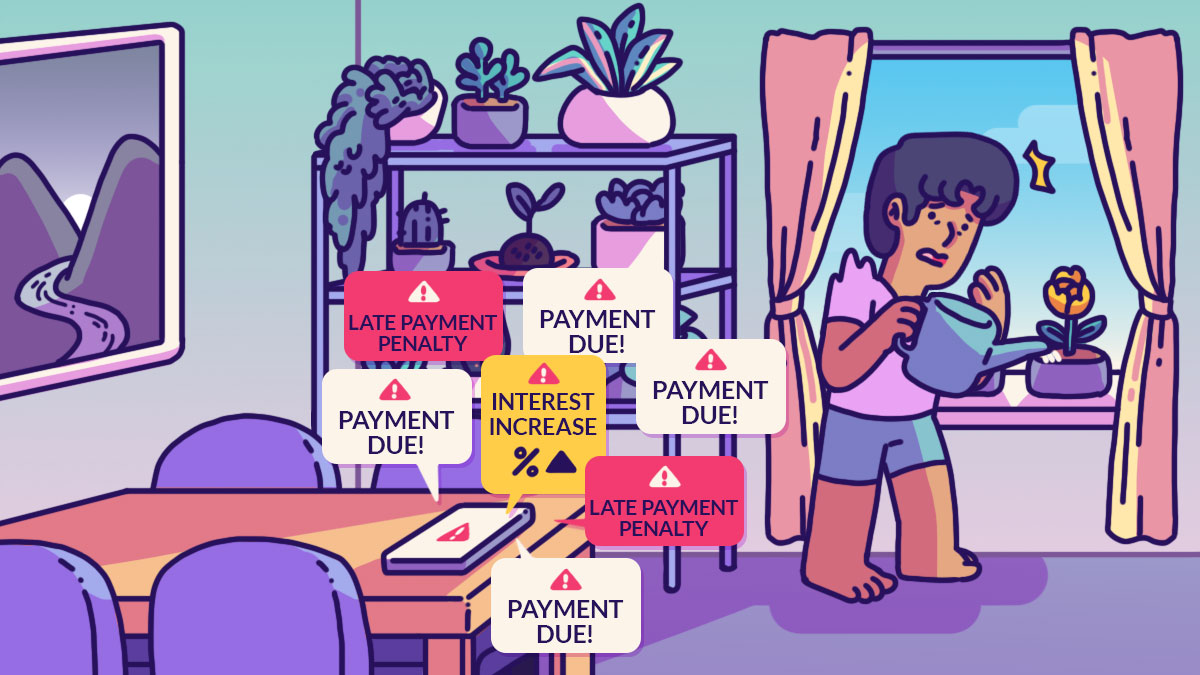

As my PayLater purchases grew, things started to feel overwhelming. I was constantly bombarded with notifications, and every time my phone pinged, I would be filled with anxiety as I knew that another payment was due.

After a few months, I could no longer keep up with the repayments anymore. Eventually, the notifications took a different tone. Instead of reminders, they became notices about added interest and late penalty fees. I felt completely helpless!

In a desperate attempt to stop all the interest and fees, I turned to my parents for help. And after enduring a very long lecture, they agreed to lend me the money to pay off my debt in full. Though I am grateful that the notifications have finally stopped, there’s a catch! My parents still bring up my traumatic experience from time to time and make a face every time they see me buying something. I guess that’s the price I have to pay for borrowing money from them.

Though this experience hasn’t stopped me from shopping online, I’m much more cautious with my spending now. After all, I am still feeling the effects of my lesson, as I’m still paying my parents back. But at least I can sleep easier now.

This article is part of TSS Confessions, a weekly column where we delve into personal finance topics that are unscripted and genuine real accounts from people.