Budgeting | Financial Planning | Personal Finance | Article

5 Payments People Often Forget to Budget for When Buying a House in Malaysia

by Ooi May Sim | 17 Feb 2022

Buying a property is one of the biggest financial goals for many of us. It gives us a crib of our own and an asset to our name. Not to mention, a sense of security as we needn’t worry about landlords taking back their house and giving us a month’s notice to move out.

But buying a house is perhaps one of the most tedious financial processes we will ever face in our lifetime.

Aside from the paperwork, there are a ton of payments that need to be made. Unfortunately, we only tend to save up and set aside money for the 10% down payment and think that everything else can be paid up later.

However, there are other upfront charges people often forget to budget for when purchasing a home. Things like SPA, stamp duty and MRTA. Do you know what are they for, and more importantly, how much they cost?

Not planning for these may not only throw you off guard, it may also ruin your budget and affect your savings and monthly expenses. So, before you sign on the bottom line, here are a few major payments outside of your down payment you should account for:

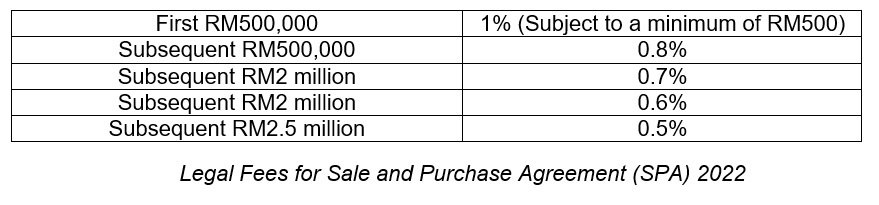

1. Legal fees for sales and purchase (SPA) agreement

A SPA is a legal contract that is signed by the seller and buyer after they mutually agree on the price and conditions of a real estate transaction. It binds both parties to a property deed.

Once signed, it cannot be further negotiated or amended. Cancelling it would result in a 10% penalty of the purchase price.

The SPA fee increases in accordance to the price of a property, as it is calculated based on a percentage:

Calculation example: If you are looking at purchasing a RM500,000 property, the SPA fees you’ll need to have is RM5,000.

2. Legal fees for loan agreement

A loan agreement is an understanding that is signed by the buyer and the bank that is providing the loan. However, some developers do absorb this fee so remember to check with the developer or agent (you might be lucky and need not pay this fee).

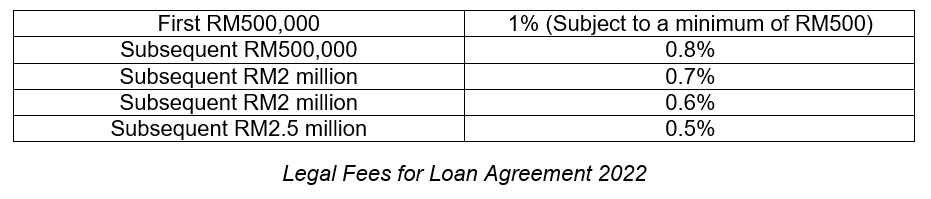

The fees are based on a percentage of the loan amount:

Calculation example: If you are taking a 450,000 loan when buying a property, you’ll have to pay RM4,500 for legal fees for the loan agreement.

Related

3. Stamp duty

Stamp duty is the tax on documents required while purchasing property and has to be paid twice – once during the transfer of a property, and the second time for the loan agreement.

a. Transfer of property

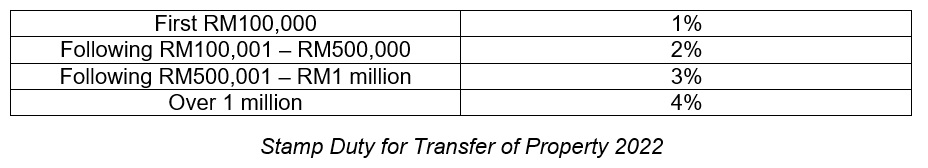

Below is the stamp duty breakdown for the transfer of property:

Calculation example: If you purchase a RM500,000 property, you would need to pay the following in property transfer stamp duty:

1% of RM100,000 = RM1,000

+ 2% of RM400,000 = RM8,000

Total = RM9,000

b. Loan agreement

The stamp duty for a loan agreement is capped at a maximum of 0.5% of the total loan amount.

Calculation example:

If you are purchasing a RM500,000 property with a 90% loan, your loan amount is RM450,000.

Stamp duty for loan agreement = 0.5% x RM450,000 = RM2,250

4. Valuation fees

A property valuation, or real estate appraisal, is an estimation of how much a house is worth. This charge is incurred when a buyer buys property from another owner, which is also known as a subsale unit.

It evaluates factors such as location, latest property transactions in that area, general economic trends, demographics, property market conditions and recent renovations.

If you are purchasing a house with a loan, you must first get the property valuated by an authorised firm, as banks need to know a property’s value before approving a loan. And of course, these services come at a price.

The charges vary, depending on the property’s price, and it uses this formula:

For the first RM100,000 = 0.25%

Next residue up to RM2 million = 0.2%

Calculation example: If you are buying a RM500,000 house, you would need to pay:

For the first RM100,000 = RM100,000 X 0.25% = RM250

Remaining RM400,000 = RM400,000 X 0,2% = RM 800

Total = RM250 + RM800 = RM1,050

Related

5. Agent fees

If you plan to engage a property agent, be prepared to fork out 3% of the property price as payment. That is the maximum commission fee a property agent is allowed to charge. The minimum is RM1,000 per property.

As the amount can differ greatly, do negotiate and fix your agent fees before you engage them to represent you.

Of course, you can do away with property agents, but then you will be presented with another headache – research and paperwork! So, weigh the pros and cons of having a property agent. The money spent might be worth it if you’ll rather have someone else find a property for you.

Calculation example: If you are buying a RM500,000 house and are charged the maximum 3% in agent fees, you would need to have RM15,000 to pay your agent.

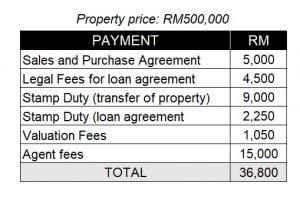

The numbers are in

Okay, so we’ve been throwing quite a lot of numbers around and perhaps the amount doesn’t seem very significant when viewed separately. But here is what it all adds up to for someone who is buying a RM500,000 property:

Aside from the 10% down payment, as a home buyer, you would need to have approximately the same amount set aside for other upfront payments required.

There still are other costs to factor in

Sorry to burst your bubble, but that is not the end of it. Aside from the upfront payments listed above, there are other smaller fees such as government tax and bank processing fees that costs a few hundred ringgit each.

You also need to set aside money for renovation, fittings and furnishing. With the rising cost of furnishing and services, renovations usually cost at least 10% of the price of the house for something minimal and simple. An amount equivalent to 30% of your house price is typically what people spend on renovations.

The costs also don’t end once you move — there are the running costs of home ownership. Aside from financing your monthly instalment (bank loan), you need to pay utility bills, housing insurance, property tax, and maintenance fee and sinking fund charges if you bought a strata property.

I bet your head is spinning from thinking of all that money. I know ours is just from writing this article. But as with many things in life, the key to home ownership is just planning and being prepared. So don’t forget to factor all these costs in when planning for your home purchase!