Financial Planning | Managing Debt | Personal Finance | Article

Is It 100% Okay To Take a 100% Housing Loan? What You Need to Know Before Taking One

by Ooi May Sim | 14 Jul 2022 | 7 mins read

Owning a property is becoming increasingly difficult these days with rising property prices coupled with salaries that aren’t increasing at the same rate. Just take the average price of a house in Selangor for example. It cost RM204,105 in 2000 and rose to RM534,846 in 2021. That’s an increase of 4.8% in a year.

Throw in the high cost of living and inflation into the mix and it isn’t difficult to see why some of us may be struggling to purchase a home. Perhaps this is also why an increasing number of schemes and financial institutions are offering 100% financing for housing these days. With 100% financing, those who are looking to buy a house don’t need to place a down payment as the bank will loan you the full cost of the house.

The Malaysian government also introduced a similar scheme in 2011, the My First Home Scheme, or Skim Rumah Pertamaku (SRP) as it is more commonly known, to help the rakyat with home ownership. Here, 110% loans are on the table. It covers the down payment of the house as well as other payments such as the sales and purchase agreement and legal fees, so buyers don’t have to fork out anything when making a house purchase.

But just because you can take a 100% loan, does it really mean you should? Here are some of the pros and cons to consider before you take one.

Benefits

1. Lets you own a home even if you don’t have enough savings

With 100% loans, nearly anyone can be a homeowner as a large sum of savings is not needed to make a down payment. And owning a home gives you added financial security and stability in the future as you won’t have to worry about paying for rent after you retire (as your house would probably be paid off by then).

Home ownership also helps you build equity as property prices tend to go up over time, and you will have an asset that appreciates in value.

2. Don’t have to spend on rental

As you no longer need to foot the down payment, you won’t have to spend years paying for rent while saving up to purchase a home. The process of saving up for a down payment while renting is generally long as a huge chunk of your money usually goes towards paying rent.

With 100% financing, you can buy a house as soon as you start working, and the money you would allocate for rent can be used to pay off your housing loan, saving you money in the long run.

3. No hiked interest rates

Contrary to popular belief, 100% loans do not impose higher interest rates. Rather, it follows regular bank rates and calculate your interest and loan amount following the same formulas as any other housing loan such as by tabulating a borrower’s credit score and debt service ratio.

4. You can invest your down payment instead

If you have money for the down payment, you can choose to take a 100% loan and invest the down payment amount. This is a risky tactic, but it is one that could potentially bring you more returns.

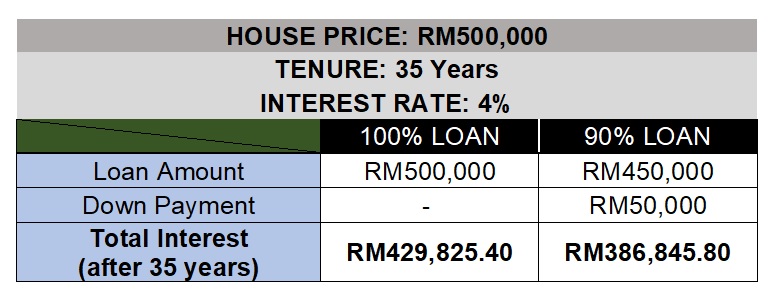

If you are buying a house for RM500,000, with a 35-year tenure and 4% interest rate, below are the calculations:

As the chart shows, the difference between the total interest of a 100% loan and a 90% loan is RM42,979.60 (RM429,825.40 – RM386,845.80).

If you were to invest your RM50,000 down payment in an investment that offers 7% returns, you would get RM3,500 a year, and RM122,500 after 35 years.

Hence, even though you pay RM42,979.60 more in total interest over your 35-year tenure with a 100% loan, your potential investment return is RM122,500, which is three times the additional amount you would pay in interest.

However, it is important to note that there are no guaranteed returns when it comes to investing and there is a chance of losing all the money you invest, and end up spending RM92,979.60 (RM50,000 + RM42,979.60) more than if you took a 90% loan. Higher debt equates to higher risk.

Alternatively, you can use the RM50,000 down payment to purchase a second property, for investment purposes, and furnish the loan using rental income.

But do note that the above is a simplified comparison of the different possible scenarios. In reality, there are often a lot of terms and conditions that come with applying and getting approved for a loan, such as credit rating and your debt service ratio.

Related

Disadvantages

1. You pay more overall for your property as you are borrowing more

As you would be borrowing more money from the bank, the amount of interest you would have to repay in the long run would be higher as well, even though the interest rates are similar. This increases the total cost that you will be paying for your property.

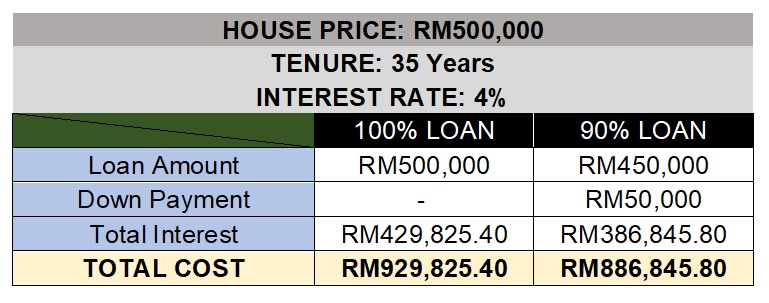

From the chart above, you can see that by taking a 100% loan, you pay RM42,979.60 (RM929,825.40 – RM886,845.80) more than if you take a 90% loan.

As the loan amount is bigger, your monthly repayments would be higher too. For instance, the monthly repayment for a 100% loan is RM2,213.87, compared to RM1,992.49 if you take a 90% loan.

This higher monthly repayment may affect your day-to-day spending and savings, so calculate your expenses and come up with a realistic plan before taking on any loan.

2. You may not qualify for a 100% loan as there are more eligibility requirements

Requirements differ between the various banks and schemes, but generally, to qualify for a 100% loan, you would need to:

- Be a first-time homeowner.

- Purchase a property that cost less than RM500,000.

- Be the one staying at the property (this means no renting it out).

Here is an example of how these eligibility requirements may effect you: You are living with your parents, and they put your name under their house deed because they would like you to inherit the house, eventually. If you want to move out and buy a house of your own under the SRP scheme, you would not be eligible for it because you are no longer a first-time homeowner.

Or, if you found your dream home, but it cost RM510,000, you wouldn’t be able to apply for a 100% loan under the SRP scheme.

3. Increases debt and risk

Taking a 100% loan means taking on more debt, and having higher debt increases the risk of defaulting on a loan. This is amplified by the fact that many who take 100% loans simply do so because they do not have the savings to pay the down payment for a house.

If you take a 100% loan without having any savings, any small financial emergency could derail you from making your monthly loan payments.

Financial consultants also point out that there is also an emotional aspect towards debt – people tend to feel better when they have less debt and own more home due to the insecurity of owing.

Related

Be 100% sure before taking the 100% loan plunge

While 100% loans encourage home ownership, it is essential to have a fool-proof budget before taking on any debt. So, map out your monthly budget and do ample research on the property market so you are not caught off guard.

And while you do not need a down payment to apply for a 100% loan, you should always have emergency savings stashed away, to pull you through unexpected events should they happen so you don’t go into even more debt.